⚡ZurzAI.com⚡

AI Start Ups Your Should Know

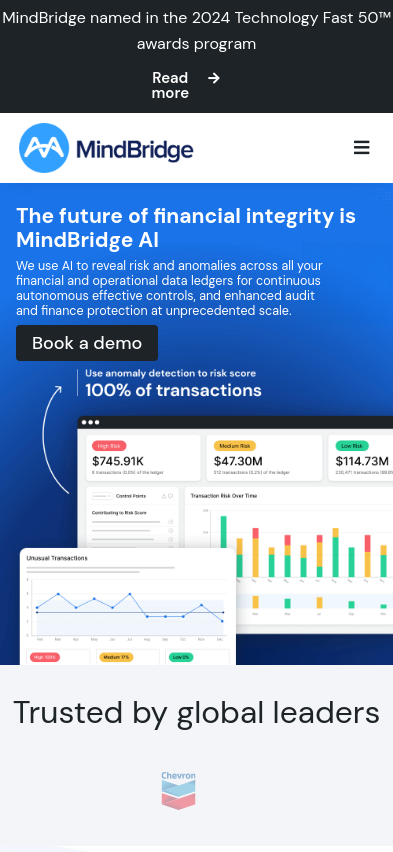

MindBridge

MindBridge is a technology company that provides an AI-powered platform for continuous oversight across financial transaction risks, helping organizations identify anomalies and unusual patterns in financial data.

MindBridge AI is a comprehensive platform designed to enhance oversight across financial transactions by leveraging artificial intelligence. The platform consists of several modules that focus on different aspects of financial data analysis:

Platform and Products:

-

General Ledger Analysis: This module identifies anomalies and patterns that require attention, providing a holistic view of financial data. It analyzes all transactions, ensuring accuracy in financial reporting.

-

Customer Analysis: It assesses revenue recognition risks and identifies unexpected activities by analyzing customer data and revenue segmentation.

-

Payroll Analysis: It aims to minimize financial losses arising from inaccurate or fraudulent payroll allocations by scrutinizing payroll data.

-

Travel & Expense Analysis: This module uncovers anomalies in travel and expense data, helping safeguard company transactions.

-

Vendor Analysis: Designed to mitigate losses from incomplete or inaccurate invoices, this module ensures timely and accurate vendor payments.

Key Features:

-

Continuous Monitoring: The MindBridge AI platform provides ongoing analysis of financial and operational data, supporting continuous oversight and reducing the risk of fraud and errors.

-

Advanced Algorithms: The platform uses more than 250 machine learning control points, statistical methods, and business rules to identify financial risks and anomalies across various ledgers.

-

Automation: It automates the transaction analysis process, helping to streamline workflows and focus resources on areas that need attention.

-

Risk Analysis: The platform enables risk scoring, segmentation, and anomaly detection to highlight areas that need further investigation or risk management.

-

Data-Driven Insights: MindBridge AI provides extensive insights across all transactional data that empower finance professionals to make informed decisions and improve resource allocation.

Impact and Recognition:

MindBridge has been recognized in the 2024 Technology Fast 50 awards program due to its growth and innovation in the financial risk intelligence sector. This acknowledgment highlights MindBridge's impact on transforming financial risk management practices, especially amidst complex and evolving regulatory demands.

Audience and Utilization:

The platform serves a wide range of users, including global leaders like Chevron, KPMG, and Polaris, helping these organizations address the increased volume and speed of financial data changes. Its broad applicability across finance, auditing, and enterprise risk management makes it a valuable tool for detecting and mitigating financial irregularities.

Conclusion:

MindBridge AI offers a versatile suite of solutions for financial anomaly detection and risk management, enabling continuous oversight and efficient handling of vast amounts of data. By automating and refining the financial analysis process, it aims to equip finance professionals with enhanced tools to detect, manage, and mitigate potential financial risks and fraud.