⚡ZurzAI.com⚡

AI Start Ups Your Should Know

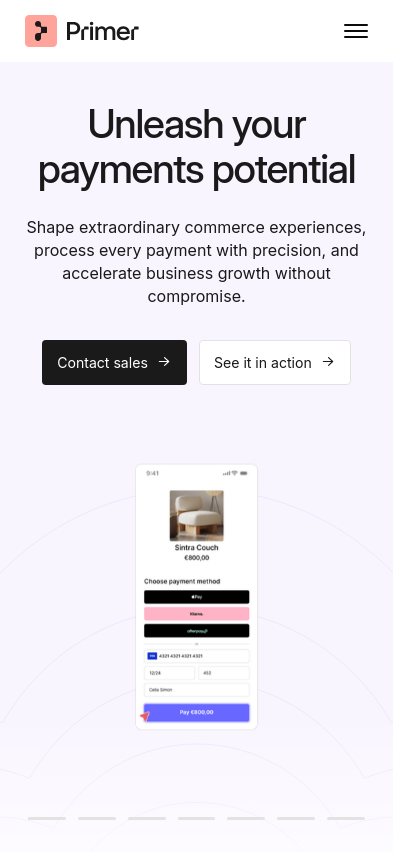

Primer

Primer develops machines that automate large dataset analysis using natural language processing to extract insights from open source intelligence.

Primer focuses on revolutionizing the payment infrastructure by providing a seamless, unified, and customizable payment experience for businesses. This platform integrates various payment methods, services, and processors to enable businesses to manage their entire payment lifecycle within a single interface, facilitating enhanced customer experiences and operational efficiencies.

Unique Value Proposition and Strategic Advantage: Primer’s unique value proposition is its ability to transform complex payment systems into a streamlined, easy-to-manage interface without the need for extensive coding or technical expertise. This positions Primer as a strategic partner for businesses looking to optimize their payment strategies by leveraging:

-

Unified Payment Infrastructure: Offers an open and adaptable framework that allows for seamless integration and management of multiple payment services and methods. This unification facilitates new service deployment, expands into new markets, and enhances overall payment efficiency without the complexities tied to traditional payment infrastructures.

-

No-Code Platform: Businesses can activate and configure payment services simply by utilizing Primer's no-code platform. This saves engineering resources and accelerates time-to-market for new product offerings, allowing companies to focus on strategic initiatives rather than technical integrations.

-

Comprehensive Payment API: Provides a single point of integration for businesses, reducing the overhead associated with managing multiple payment services through one API. This enables unified control over the entire payment process, from authorization to dispute management.

Delivery on Value Proposition: Primer delivers on its value proposition through several key strategies and features:

-

Apps and Integrations: With over 100 global integrations, businesses can easily customize their payment stack using a marketplace of processors and fraud providers. This flexible integration approach allows for easy adjustments and enhancements to the payment system as business needs evolve.

-

Optimization Features: Primer offers optimization tools such as network tokenization to increase authorization rates and reduce fraud, alongside fallback mechanisms that route payments to a secondary processor if the primary one fails. These features are designed to enhance payment success and operational efficiency.

-

Observability and Data Insights: By providing real-time visibility into the payment stack, Primer enables businesses to monitor performance, conduct A/B testing, and quickly address payment issues. Advanced data visualization tools aid in understanding payment flows, enhancing decision-making, and uncovering optimization opportunities.

-

Localized and Personalized Checkout Experiences: Through Universal Checkout and customizable checkout solutions, Primer allows businesses to create localized experiences that align with customer preferences, improving conversion rates across different geographies and currencies.

-

Robust Security and Compliance: Primer maintains PCI-DSS Level 1 compliance and offers agnostic 3D Secure (3DS) solutions, ensuring secure and compliant payment transactions without increasing the user burden during the payment process.

By providing a flexible, innovative payment framework, Primer empowers its clients to enhance customer experiences, optimize payment operations, and strategically position themselves within the competitive landscape of global commerce.