⚡ZurzAI.com⚡

AI Start Ups Your Should Know

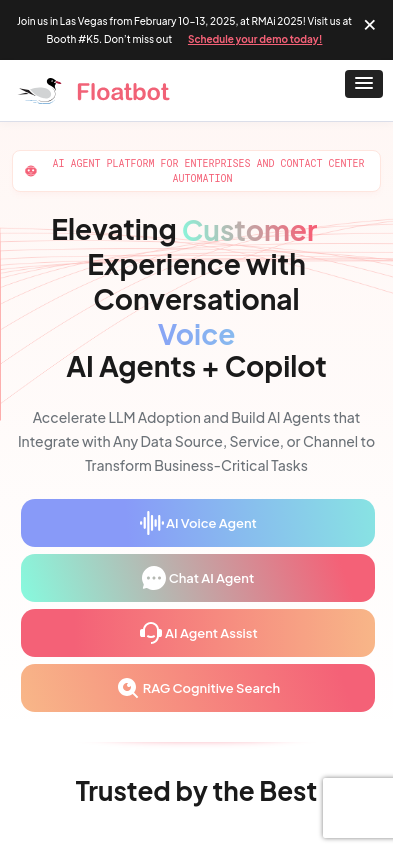

Floatbot

Floatbot is a conversational AI platform offering solutions like self-service AI agents, voice and chat AI agents, speech AI services, real-time agent assist, live chat, and LLM-based AI solutions. It provides a no-code/low-code, GenAI-powered conversational AI platform called Floatbot UNO.

Floatbot specializes in providing AI-driven solutions to enhance customer interactions, focusing primarily on voice and chatbot technologies to automate, streamline, and optimize business processes. The core of their value proposition is the deployment of AI agents to accelerate operational efficiency, reducing cost and improving customer satisfaction for industries like insurance, banking, and business process outsourcing (BPO).

1) Key Focus Area:

- Conversational AI: Floatbot focuses on developing voice AI and chatbot solutions to automate customer interactions across various channels.

- Contact Center Automation: They aim to improve the efficiency of contact centers by implementing AI technologies that assist human agents and automate routine tasks.

2) Unique Value Proposition and Strategic Advantage:

- Generative AI Platform: Utilizing a no-code/low-code platform, Floatbot empowers businesses to deploy conversational AI solutions swiftly, addressing complex interactions without extensive manual intervention.

- Omni-channel Integration: Floatbot's solutions are pre-integrated with a wide array of digital channels and platforms, facilitating consistent customer experiences irrespective of the communication medium.

- Customizable AI Scale: With their proprietary AI solutions like VoiceGPT and Agent M, Floatbot claims to offer customizable and scalable conversational AI, tailored to meet specific industry needs.

3) Delivery on Value Proposition:

- Universal Application: By employing tools like VoiceGPT for real-time interactions, Floatbot purports to handle various scenarios—from customer service to sales—effectively across omnichannel platforms.

- Cost Reduction and Efficiency: Through extensive automation and self-service solutions, they claim to lower operational costs drastically (e.g., reducing costs per claims submission significantly in the insurance sector).

- Integration and Accessibility: Floatbot's platform supports integration with popular industry software and provides a multilingual interface, catering to global markets with diverse language needs.

- Automated Business Processes: From processing insurance claims to enabling self-serve banking transactions, Floatbot endeavors to automate and streamline end-user interactions at scale, reducing dependency on human operators.

Additionally, they highlight measurable ROIs achieved by clients, such as increased sales, higher efficiency in query resolution, and improvements in customer satisfaction scores, to validate their claims of transforming digital sales and support operations.

By positioning their AI solutions as both comprehensive and adaptable, Floatbot aims to provide a robust conversational AI experience that meets the dynamic needs of modern enterprises, especially in complex regulatory and transactional landscapes like insurance and banking.