⚡ZurzAI.com⚡

Companies Similar to ZBrain

DataRobot

DataRobot offers AI applications and platforms that enhance business impact and reduce risk, helping companies innovate and optimize operations with proven success stories.

DataRobot Summary

-

Key Focus Area: DataRobot specializes in delivering AI applications and platforms tailored for enterprise environments. Its focus is on enabling businesses across various industries such as energy, financial services, healthcare, manufacturing, and the public sector to develop, deliver, and govern generative and predictive AI at scale. It aims to integrate AI into core business processes, enhancing efficiency and innovation.

-

Unique Value Proposition and Strategic Advantage: DataRobot's unique value proposition lies in its comprehensive integrated solutions within the AI ecosystem:

- Integrated AI Suite: Combines generative and predictive AI frameworks with a focus on AI governance and observability.

- Enterprise-Grade Features: Its platform offers tools for building custom AI solutions that integrate smoothly with existing business processes.

- Automation and Efficiency: Clearly emphasizes a reduction in time-to-value for AI deployment by providing pre-built tools to automate AI application delivery.

-

How They Deliver on Their Value Proposition: DataRobot delivers its value proposition through a series of strategic implementations:

- Modular Yet Unified Platform: The AI platform includes a suite of applications and tools like Enterprise AI Suite, AI Apps, and AI Foundation for integrating and managing AI efficiently.

- Comprehensive Governance Framework: Ensures compliance and risk management by automating documentation and providing built-in guardrails for models, supporting various AI regulations.

- Customer Focused Solutions: The platform is industry-agnostic and supports adaptability across energy, healthcare, financial services, etc., with custom deployments tailored to client needs.

- Edge Deployment and Real-Time Monitoring: DataRobot allows for deploying AI models on the edge, delivering real-time anomaly detection and operational monitoring.

- Support Services: Offers services including quick-start programs and AI development workshops to facilitate the adoption and integration of AI capabilities within business frameworks.

In summary, DataRobot focuses on empowering businesses with scalable and secure AI solutions. Its strategic advantage is its integrated platform that simplifies AI application development and governance, allowing organizations to harness AI’s potential while managing risks and compliance efficiently. Using a mix of generative and predictive AI, it addresses diverse business needs, offering tools to optimize processes from operational efficiencies to enhancing customer experiences.

C3.ai

C3 AI offers over 100 enterprise AI applications across various sectors, enhancing business efficiency through innovative solutions like Generative AI and data analytics.

About | About | About | About | Management | About | About | About | About | About | Management | About | About | About | About | About | About | About | About | About | About

C3 AI Overview and Key Insights

-

Key Focus Area: C3 AI is primarily focused on providing enterprise artificial intelligence (AI) software to high-value industries. They develop AI applications aimed at improving a wide range of business operations such as anti-money laundering, cash management, logistics, customer relationship management (CRM), demand forecasting, energy management, and many more. Their solutions target industries like manufacturing, financial services, healthcare, oil and gas, and telecommunications, among others.

-

Unique Value Proposition and Strategic Advantage: C3 AI’s value proposition lies in their comprehensive suite of pre-built AI applications designed to address specific enterprise needs across various sectors. Their strategic advantage is rooted in:

- A robust AI platform that integrates with major enterprise systems such as SAP, Oracle, Salesforce, and Microsoft, providing a seamless integration experience.

- An extensive library of over 100 pre-configured applications tailored to specific use cases, allowing rapid deployment.

- The use of generative AI to surface and act on insights, enabling predictive analytics, entity and sentiment analysis, and more, offering organizations a unified view across disparate data sources.

- Partnerships with leading tech companies, like Microsoft, to enhance AI adoption and capability across enterprise landscapes.

-

Delivering on Their Value Proposition: C3 AI delivers on their value proposition through several mechanisms:

- Turnkey Solutions: Enterprises can quickly implement C3 AI’s applications within a timeline of six months, thanks to their pre-configured nature and ease of integration.

- Scalable Platform: Their platform supports data unification from various sources, applying predictive AI models that scale across operations, from manufacturing facilities to financial institutions.

- Proven Results: They provide detailed case studies showing significant return on investment, such as enhanced demand forecasting accuracy, inventory reductions, and improved predictive maintenance outcomes.

- User-friendly Development Tools: C3 AI offers integrated development tools including deep code, low code, and no code environments, facilitating custom development to suit unique organizational needs.

- Generative AI Capabilities: Utilizing AI to automate and streamline business processes, C3 AI’s solutions mitigate operational risks and enhance decision-making efficiencies with real-time data insights.

In conclusion, C3 AI’s strategic emphasis on enterprise AI, coupled with an extensive suite of applications and integrations with major systems, positions them as a formidable player in the AI software landscape. Their solutions address complex business challenges by leveraging AI-driven insights to optimize operational efficiencies and transform business outcomes.

Boost.ai

Boost.ai specializes in providing conversational AI solutions, including chat automation and voice bots, aimed at enhancing customer interaction and experience across various industries.

Boost.ai offers a versatile conversational AI platform designed to optimize and automate customer interactions across various industries, including financial services, insurance, telecommunications, and the public sector. Here's a summary of the key offerings and activities outlined by the company:

Product Offerings

-

Conversational AI Platform: This platform includes features like chat automation, voice call automation, and integrations with existing systems. It is designed to improve customer service, increase efficiency, and ensure security.

-

Generative AI Integration: By incorporating large language models (LLMs) such as GPT-4, the company aims to deliver more personalized and automated customer experiences. This approach combines traditional AI with generative capabilities to manage customer interactions across high-traffic and complex scenarios.

-

Enterprise Solutions: Specific solutions cater to different sectors:

- Financial Services: Automate banking queries, enabling self-service for customers to manage account information and transactions.

- Insurance: Simplify claims processing and customer interactions while enhancing efficiency.

- Telecom: Offers automated customer service 24/7, turning customer interactions into opportunities for upselling and service enhancement.

- Municipal Services: Facilitates citizen engagement with localized virtual agents.

Key Features

-

Omnichannel Experience: The platform ensures consistent service across multiple customer touchpoints, supporting channels like chat, voice, and social media.

-

Scalable and Secure: Designed for enterprise use, it integrates seamlessly into existing systems while ensuring security and compliance with standards like GDPR, FSQS, ISO 27001, and 27701.

-

Generative AI and Hybrid AI Approach: Blends generative models with traditional AI to offer robust and controlled interactions. Features include knowledge guardrails, API and action hooks, and knowledge integration to personalize interactions.

Recent Developments

-

Boost Camp 2025: An upcoming event focused on the impacts of AI on customer service. It will showcase AI advancements, particularly Boost.ai's hybrid AI technologies.

-

New Partnerships and Tools: Recent alliances and toolkit launches aim to enhance management capabilities and customer service through AI innovations.

Learning Resources and Support

-

Academy and Community: Offers a range of learning materials, webinars, guides, and reports for users to understand and maximize the use of the AI platform.

-

Case Studies: The company shares insights from various sectors, illustrating successful deployments of conversational AI that have led to measurable improvements in customer service and efficiency.

-

Customer and Internal Support: Virtual agents can assist with customer inquiries and internal support functions like IT assistance and HR queries, increasing autonomy and efficiency within organizations.

Market Position

-

Customer Feedback: Boost.ai reports high satisfaction and recommendation rates from users, with a track record of deploying over 600 virtual agents.

-

Awards and Recognition: The platform has been recognized in categories such as Best Chatbots and Consumer Chatbot of the Year.

Boost.ai is positioning itself as a key player in the conversational AI market, focused on delivering scalable, reliable, and innovative AI solutions that enhance customer and employee interactions across a wide range of applications.

Peak

Peak develops AI solutions for businesses, offering products like inventory management and pricing optimization to enhance operations and boost confidence in AI performance.

Peak is a company focused on delivering AI-driven solutions to optimize inventory and pricing for businesses across sectors. Here's a breakdown of the offerings and key initiatives detailed in the company-authored content.

Main Offerings:

-

Inventory AI: A suite of tools designed to manage inventory effectively. Features include:

- Dynamic Inventory: Optimizes inventory levels across a network.

- Production Planning: Helps to optimize the production process holistically.

- Rebuy and Reorder: AI-powered recommendations to manage purchase orders and supplier engagement, ensuring optimal stock levels.

- Replenishment: Maintains optimal stock coverage to avoid shortages and overstock.

-

Pricing AI: Assists businesses in setting and adjusting prices optimally. Key features include:

- Markdown Optimization: Manages and automates pricing adjustments.

- Promotion Optimization: Tailors promotions and offers to optimal times and prices.

- List Price Optimizer: Consolidates and streamlines pricing across lists to maximize revenue.

AI Platform:

- Peak Platform: A cloud-based platform that offers diverse applications of AI across industries. It's built for integration, flexibility, and ease of use, enabling organizations to adopt and leverage AI quickly.

AI Services and Guarantees:

- AI Performance Guarantee: Assures businesses of hitting agreed service levels with their AI applications. If the service falls short, Peak promises reimbursement, emphasizing its commitment to reducing perceived risks in AI adoption.

- Co:Driver: A generative AI product that provides actionable recommendations through natural language interaction, aimed at driving business growth.

Company Initiatives:

- Partnerships: Collaborates with numerous organizations across sectors to enhance business processes using AI.

- Upcoming Events: Peak organizes AltitudeX, a summit focusing on AI trends and innovations, aiming to bolster AI knowledge among business leaders.

- AI Adoption: Promotes AI usage without requiring businesses to develop extensive in-house tech teams, making AI more accessible and less complicated.

Business Outcomes:

- Quick Deployment: Solutions are designed to be quickly adopted, delivering tangible results faster by connecting different parts of the business infrastructure on a single platform.

- Customizable AI: Tailored to fit specific business processes and strategic objectives, providing personalized and strategic insights and recommendations.

Additional Insights:

- Company Culture: Emphasizes a diverse and inclusive workplace where innovation is cultivated.

- Recognition: Noted for being highly regarded as a workplace in the technology sector.

Resources and Learning:

- Content Hub: Offers blogs, events, guides, and podcasts designed to educate and inform about AI and its applications.

Peak’s approach underscores the importance of integrating advanced technology into business functions for modernization and efficiency, while offering assurances to mitigate the risks associated with adopting new AI technologies. The provision of customizable and quickly deployable solutions highlights the company's focus on strategic, data-driven decision-making to drive business outcomes.

Compliance.ai

Compliance.ai is a Regulatory Change Management Platform that streamlines compliance through monitoring, analysis, and management of regulatory updates, utilizing machine learning for efficiency.

Compliance.ai offers a comprehensive regulatory compliance and risk management platform designed to streamline the monitoring of regulatory updates and align them with a company's internal policies and controls. The platform utilizes specialized machine learning models to ensure organizations remain compliant with impactful regulations and requirements. Here’s a breakdown of the key elements covered in the company-authored content:

Features and Capabilities:

-

Regulatory Change Management Platform: This solution aims to mitigate risks, reduce costs, and improve compliance status management.

-

RegTech Technology Overview: The content explains RegTech, an emerging class of applications that enable more flexible and automated approaches to understanding and complying with regulatory requirements.

-

Highlighted Features: The platform includes configurable dashboards, automated monitoring of regulatory updates, and expert guidance to identify regulatory obligations and their impact.

-

Compliance Management Tools: Tools such as a Savings Calculator and templates help organizations assess their needs and implement the solution effectively.

Who They Serve:

-

Industry Focus: Compliance.ai targets sectors like banks, financial services, insurance, fintech, and energy and commodity trading.

-

Role-Specific Benefits: The solution caters to compliance officers, general counsels, risk officers, and regulatory offices ensuring efficiency and compliance accuracy.

Expert-In-The-Loop (EITL):

- This initiative is emphasized as the industry's unique event focused on Regulatory Change Management for financial services. The forum discusses trends such as cryptocurrency, ESG, compliance, and cybercrime, featuring global experts in various domains.

Emerging Compliance Technology:

-

The platform addresses the historical limitations of traditional Governance Risk and Compliance (GRC) software, which weren't designed for proactive regulatory monitoring and content analysis.

-

The integration of cloud computing, AI, and analytical capabilities extends compliance teams’ capacities, improving accuracy and productivity while reducing compliance gaps.

Benefits:

-

Increased Confidence: Establishes a command center for managing compliance and risk, offering transparent compliance status across the enterprise.

-

Risk Mitigation: Ensures a smooth transition in compliance processes, reducing executives' risk and enabling near-real-time monitoring of enforcement actions.

-

Cost Reduction: Enhances productivity and audit processes, helping organizations meet regulatory requirements timely and cost-effectively.

Testimonials:

- Users from Bremer Bank, Bank of the West, and Quantcast highlight the platform's ease of use, comprehensive regulatory coverage, and enhanced operational efficiency.

Educational and Support Resources:

- The platform provides access to activity reports, a blog on regulatory trends, and a training center for platform-specific learning and best practices.

Compliance.ai presents itself as a versatile and automated platform designed to help organizations in heavily regulated industries manage and align their internal processes with ever-evolving external regulatory requirements. The focus is on delivering timely, relevant compliance insights, fostering efficiency, and reducing regulatory risks through innovative technological solutions and expert guidance.

ZBrain

ZBrain is a leading Generative AI platform for logistics, providing innovative solutions for optimized production processes and supply chain management. Established in 2007, ZBrain has completed over 5000 projects globally and employs over 250 AI experts. Their platform offers a suite of tools that cater to various logistical needs, from AI for fleet management to AI-powered predictive maintenance.

Management | Management | Management | Management | Management | Management | Management | About | About | About | About | About | About | About | Management

The document provides comprehensive insights into ZBrain AI's offerings and applications, focusing specifically on logistics operations but also touching on other industry applications and products such as the AI Copilot for sales and regulatory monitoring tools. It highlights various tools and solutions that utilize AI to enhance business processes across multiple sectors.

Key Products and Features:

-

AI-based Regulatory Monitoring Tool: Offers real-time insights into regulatory changes to help businesses mitigate compliance risks effectively.

-

AI Copilot for Sales: Aids sales teams by generating executive summaries, identifying issues, suggesting next actions, and integrating efficiently with CRM systems to optimize sales processes.

-

AI Research Solution for Due Diligence: Enhances due diligence processes by providing data-driven insights, focusing on financial, operational, and risk assessments to aid decision-making.

-

AI Customer Support Agent: Automates and streamlines customer support processes, offering accurate, multilingual assistance across channels, reducing ticket volume.

Specific Applications in Logistics:

-

Inventory Management: ZBrain apps can optimize inventory by analyzing demand patterns and stock levels, offering insights to maintain optimal inventory levels.

-

Customer Service: Incorporates 24/7 chatbots to manage customer inquiries and enhance user satisfaction by providing personalized communication based on user preferences.

-

Operational Efficiency: Technologies are implemented to automate tasks, streamline workflows, reduce manual work, and offer comprehensive data analysis for increased efficiency.

AI Agents and Solutions:

-

ZBrain AI agents offer various functionalities to improve logistics and supply chain operations, such as automating order entry, monitoring supplier deliveries, ensuring compliance, and analyzing procurement spending.

-

Supported by Various LLMs (Large Language Models): Integration with advanced AI models such as GPT-4, Llama, PaLM-2, and others to provide intelligent data processing and decision support.

Integration and Usability:

-

ZBrain integrates through APIs, Slack, and Microsoft Teams, allowing seamless incorporation into existing workflows, enhancing collaboration and productivity with AI capabilities.

-

Provides a comprehensive AI Readiness Assessment to help enterprises identify opportunities for AI integration effectively.

Benefits:

-

Enhanced Decision-Making: By offering real-time insights and automating data collection and analysis, ZBrain solutions empower businesses to make informed decisions.

-

Proactive Compliance and Risk Management: Helps businesses manage compliance proactively, saving time and resources by reducing manual effort in tracking regulatory updates.

-

Cost and Time Efficiency: Automation enables cost reduction and frees up resources for core business activities.

Industries Served:

- Products and solutions are applicable across a range of industries including manufacturing, logistics, real estate, retail, finance, healthcare, hospitality, and automotive.

This summary illustrates ZBrain AI's expansive functionality in harnessing AI technology to automate, streamline, and optimize various business processes, enabling organizations to enhance efficiency, reduce errors, and drive greater strategic value in their operations.

CommerceIQ

CommerceIQ offers a unified, AI-driven platform for managing ecommerce operations. It helps consumer brands optimize marketing, supply chain, and sales operations to drive market share and profitability.

CommerceIQ offers AI-powered ecommerce management solutions designed to aid consumer brands in navigating and optimizing their digital presence across a wide range of channels and retailers. Below is a summary of their solution offerings:

Products:

-

Digital Shelf Analytics:

- Optimize sales through content improvement, compelling brand messaging, and compliance checks.

- Enhance organic and paid search rankings with Share of Search tools.

- Monitor retail media to optimize advertising efficiency and drive category growth.

-

Ecommerce Sales Management:

- Automate processes to prevent out-of-stock (OOS) situations and revenue loss.

- Protect brand equity by controlling unauthorized third-party (3P) sellers.

-

Retail Media Management:

- Facilitate comparisons of customer reviews to enhance the customer experience.

- Drive advertising outcomes with comprehensive, full-funnel solutions.

-

Profit Recovery Automation:

- Implement systems for automated revenue recovery, addressing shortages through enhanced order reconciliation processes.

-

Market Share Analysis:

- Utilize machine learning for daily sales data correlation, enhancing best seller rank and review count analyses.

-

Nexis AI Teammate:

- Augment CommerceIQ solutions with AI that offers commerce-centric assistance.

Target Users:

- Consumer Brands: Industry-specific solutions for consumer-packaged goods, electronics, home goods, and groceries.

- Agencies: CommerceIQ offers partnership opportunities for agencies to leverage its data and tools to enhance client ecommerce strategies.

Use Cases:

- Purchase Order Reconciliation: Address discrepancies in orders to retain profitability.

- Out of Stock Reduction: Tools to minimize OOS instances and maintain stock levels.

- Share of Voice Monitoring: Tools designed to amplify brand presence in the digital space.

- 3P Variants Control: Protect brand equity by minimizing unauthorized seller impact.

Platform Features:

- Scalability and Integration: Real-time analytics are integrated into various ecommerce systems, providing unlimited user access and reliable service uptime.

- User-Centric Design: Interfaces are tailored for different roles within an organization, offering intuitive navigation and personalized workspace settings.

- Technology Robustness: The platform is supported by advanced cloud infrastructure, complying with global security standards.

- Extensive Coverage: Its digital shelf capabilities span over 850 retailers across 45+ countries, with real-time updates to ensure competitiveness in diverse markets.

Client Testimonials:

Companies like PepsiCo and Molson Coors highlight the value of digital shelf analytics for granular insights, strategic support, and training, enhancing market position and operational capacity.

Additional Resources:

CommerceIQ offers ebooks, webinars, podcasts, case studies, and whitepapers for deeper insights into ecommerce strategies and case-specific applications.

Overall, CommerceIQ positions itself as a comprehensive solution for ecommerce brands seeking to harmonize their marketing, sales, and supply chain operations with AI-driven insights and seamless digital integrations. It aims to provide transparency and actionable intelligence to drive profits and market share in a rapidly evolving digital landscape.

Zest AI

Zest AI enhances underwriting by utilizing AI to assess borrowers with limited credit history, providing data-driven insights to improve lender risk management and decision-making.

Zest AI is a technology company specializing in AI-powered lending solutions aimed at improving the efficiency, transparency, and accessibility of credit decision-making. It provides a range of AI-driven products and services tailored for different types of lending institutions, including credit unions, banks, and specialty lenders. Here's a summary of the key offerings and recent updates from Zest AI:

Key Offerings:

-

AI-Automated Underwriting: Zest AI offers AI-automated underwriting solutions designed to improve lending decisions by considering a wider array of data points than traditional models. This helps institutions make more accurate predictions about an applicant's credit risk and ensures consistency in decision-making.

-

Fraud Detection: The company's fraud detection solutions use advanced AI to protect against various types of application fraud. These systems leverage a wide range of data to detect both first-party and third-party fraud and enable lenders to make confident lending decisions.

-

Lending Intelligence: Zest AI's lending intelligence tools provide actionable insights and metrics to help institutions optimize their lending strategies. This includes performance data across all lending stages from marketing to portfolio management, aiding lenders in making more informed decisions.

Industry Impacts:

-

Zest AI is notable for its commitment to fair lending practices. Its technology aims to increase access to credit for underserved groups, effectively removing biases present in traditional credit scoring systems.

-

The company has developed various strategic partnerships to enhance its service delivery, including integrations that aid in seamless implementation within financial institutions' existing systems.

Recent Developments:

-

Funding: Zest AI recently secured a $200 million growth investment from Insight Partners, which will be used to advance product innovation, particularly in fraud protection and generative AI, as well as pursue M&A opportunities.

-

Awards and Recognition: The firm has been recognized as one of North America's fastest-growing tech companies by Deloitte Technology Fast 500 for 2024, underscoring its significant market impact and growth trajectory.

-

Product Innovation: Zest AI unveiled the first generative AI lending intelligence companion named LuLu, enhancing financial institutions' ability to glean insights via intuitive, natural language prompts.

-

Compliance and Risk Management: The company emphasizes compliance, with technology aligning with legal standards such as the Fair Credit Reporting Act and the Equal Credit Opportunity Act. Zest AI's solutions are crafted to meet and exceed these regulatory expectations, offering robust documentation and reporting for model risk management.

Customer and Market Engagement:

-

Zest AI supports over 500 active AI models in the lending ecosystem, covering a broad spectrum of credit union members and financial assets.

-

Customer feedback from entities like credit unions and banks highlight the transformative impact of Zest AI’s technology in terms of reduced delinquency rates, increased automation, and expanded credit access.

Educational and Supportive Initiatives:

-

The company provides educational resources such as a "Lender's Guide to Implementing AI", aimed at assisting financial institutions to understand and integrate AI tools effectively.

-

Zest AI emphasizes continuous customer support, offering dedicated expert teams to assist clients in optimizing their lending processes.

Overall, Zest AI is positioning itself as a catalyst in the lending industry, advocating for equitable lending practices and leveraging the power of AI to transform traditional underwriting and fraud detection methodologies for better economic equity.

NeuroPixel.ai

NeuroPixel.ai is a deep-tech B2B SaaS startup that enables fashion brands to create high-resolution marketing images of apparel without models, by generating images with real or synthetic models after uploading apparel photos to their platform.

Neuropixel provides software solutions that harness advanced machine learning and AI technologies to help businesses automate processes and extract insights from visual data. Here's a summary of their offerings and the value they propose:

Main Offerings

- AI and Machine Learning: Neuropixel specializes in developing models that can automate complex visual tasks, providing solutions tailored to specific industry needs.

- Computer Vision: The company focuses on extracting meaningful information from images and videos, improving the efficiency and accuracy of data processing.

Sectors

- Neuropixel's solutions cater to a wide range of industries, aiming to enhance operational efficiencies and improve decision-making through automated visual data analysis.

Key Features

- Customization and Scalability: The software is designed to be adaptable, scaling to meet the varying demands of different business sizes and sectors.

- Real-time Analysis: Provides tools for live monitoring and analysis, allowing businesses to respond quickly to changes in their visual data.

Implementation and Support

- Offers comprehensive support for integration, ensuring that businesses can smoothly incorporate Neuropixel’s solutions into their existing workflows.

Privacy and Compliance

- Emphasizes a commitment to data privacy and compliance, aligning its practices with relevant regulations to protect user data.

Neuropixel positions itself as a provider of sophisticated AI-driven solutions aimed at making visual data analysis more accessible and actionable for businesses.

Zeuron.ai

Zeuron.ai is an AI startup from Karnataka, participating in the TechXpedite accelerator program organized by Games24x7.

Zeuron.ai is a company focused on innovating neurotechnology solutions for health and wellness. Their platform offers various integrated products and services that combine gaming, digital health, and biomarker analysis to provide personalized healthcare experiences.

Key Offerings:

-

MiMo (MindMotion) Gaming Console:

- A wellness-centric gaming console designed to enhance brain function and support rehabilitation.

- Features a mix of cognitive, biomechanical, and wellness games that merge entertainment with health benefits.

- Offers applications for rehabilitation by providing scientifically-backed interventions aimed at improving muscle strength and cognitive function.

-

Happiness Club:

- Wellness centers that integrate gaming with rehabilitation and developmental games for all ages, using advanced movement technology.

- Aimed at enhancing hospital and gym experiences through cognitive and biomechanical gaming, promoting fitness and cognitive enhancement.

-

ReLive:

- A holistic health platform that leverages biomarker-based analysis.

- Offers personalized health management programs using AI-driven insights.

- Includes ReLive MindBody for gamified health routines and ReLive Synergy for coach-led wellness experiences.

- Provides various plans catered to different health goals, including weight loss and chronic condition management.

-

Digital Twin - Z-Twin:

- It is a personalized health mapping tool that integrates users’ health data (like genetics and biometrics) to create a comprehensive digital health profile.

- Offers real-time health status insights and predictive analytics for proactive health management.

-

Neuro-Marketer:

- An innovative marketing tool that leverages cognitive function tracking and neuromarketing techniques to analyze and influence consumer behavior.

- Features tools like eye-tracking and facial coding for a deeper understanding of consumer engagement.

-

Customisation:

- A platform for creating personalized gaming experiences by turning images into game characters in simple steps.

-

Gift Cards:

- eGift Cards are available to offer access to Zeuron’s health and wellness platforms.

Technological Approach:

- Zeuron's technology strategy focuses on developing solutions that integrate AI, cognitive computing, and digital therapeutic techniques to foster holistic well-being.

- The company's Neuro-Computing platform aids in the swift creation of market-ready digital health applications.

Business and Vision:

- Founded in 2019, Zeuron aims to revolutionize telehealth and promote longevity and happiness through its digital health innovations.

- Partners play a critical role in the expansion and implementation of Zeuron's health platforms, particularly in rehabilitation settings.

- Their vision includes creating a future where digital neurotherapeutics are central to wellness and where longevity can be experienced by all.

Customer Policies:

- They have set terms around sales, returns, and cancellations, reflecting an understanding of customer needs while managing the digital nature of their products.

- The company provides tools and methods to handle transactions flexibly, yet with particular conditions, especially concerning digital goods.

Userbot.ai

Userbot.ai is an advanced chatbot system that learns from conversations to improve its response capabilities over time.

Userbot offers a comprehensive suite of AI-powered solutions designed to automate and optimize customer interactions across various industries, including healthcare, finance, public administration, retail, and energy utilities.

Key Offerings:

-

AI Conversational Platform: Userbot provides a unified platform for creating virtual assistants powered by AI, integrating with various communication channels such as web, social media, and business systems, available 24/7.

-

AI Voice & Digital Human: These solutions enable the creation of realistic digital human avatars and intelligent voice assistants, aimed at enhancing customer experiences with lifelike interactions.

-

Omnichannel Approach: Userbot's platform supports multichannel communication, allowing for seamless integration across platforms such as WhatsApp, Messenger, web, and mobile applications.

Industry Applications:

-

Healthcare:

- Patient Experience: Userbot assists in booking appointments, improving communication between patients and healthcare providers, and managing routine administrative tasks to free up medical professionals for more critical duties.

- Digital Human Avatars: These provide a realistic, empathetic touch to patient interactions, enhancing the overall healthcare experience.

-

Finance:

- Customer Assistance: The platform automates customer queries, reducing operational costs, and providing tailored financial advice and information to clients.

- Data Analysis: It collects and analyzes customer interaction data to improve service offerings.

-

Public Administration:

- Service Optimization: Userbot enhances citizen engagement by automating responses to public inquiries and improving access to services beyond typical office hours.

- Data Insights: Collecting feedback helps public offices refine their services for better transparency and efficiency.

-

Retail:

- Customer Support: The platform automates routine inquiries, manages customer relationships, and analyzes consumer behavior to improve service delivery.

- Human-like Interactions: Digital Assistants provide seamless customer experiences both online and in physical retail environments.

-

Energy & Utilities:

- Process Automation: Userbot automates routine operations like billing and emergency reporting, enhancing service delivery efficiency.

- Customer Engagement: The solution helps in maintaining effective communication with clients, providing quick solutions and detailed interaction summaries.

Technological Features:

- No-Code Interface: Userbot offers a user-friendly drag-and-drop interface allowing businesses to adjust bot training without technical expertise.

- Continuous Learning: The AI continually improves by interacting with users, enhancing its ability to engage authentically.

- Real-Time Translation: Facilitates communication in over 100 languages, ensuring inclusivity and global reach.

Customer Success Stories:

Userbot showcases several case studies where its solutions have successfully transformed customer service operations in sectors like healthcare and energy. Notable clients include Aboca in the pharmaceutical sector and the Policlinico A. Gemelli in healthcare, where AI bots support patient interactions and streamline processes.

Business Insights:

The content emphasizes AI's role in reducing operational costs, speeding up service delivery, and improving customer satisfaction by automating up to 90% of routine interactions without human intervention. Additionally, the ROI calculator tool provides insights into the financial and efficiency gains achievable through implementing Userbot's AI solutions.

Call to Action:

Userbot encourages potential users to request demos and discover firsthand how their AI solutions can benefit various sectors. They also highlight the availability of partnerships and employment opportunities for those interested in expanding Userbot's offerings.

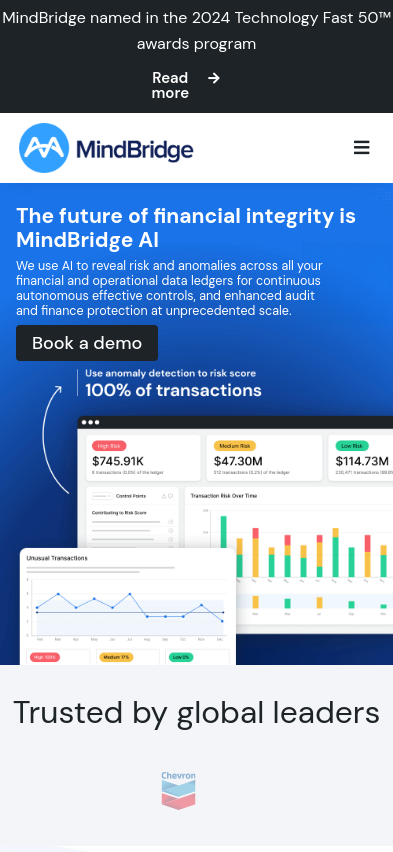

MindBridge

MindBridge is a technology company that provides an AI-powered platform for continuous oversight across financial transaction risks, helping organizations identify anomalies and unusual patterns in financial data.

MindBridge AI is a comprehensive platform designed to enhance oversight across financial transactions by leveraging artificial intelligence. The platform consists of several modules that focus on different aspects of financial data analysis:

Platform and Products:

-

General Ledger Analysis: This module identifies anomalies and patterns that require attention, providing a holistic view of financial data. It analyzes all transactions, ensuring accuracy in financial reporting.

-

Customer Analysis: It assesses revenue recognition risks and identifies unexpected activities by analyzing customer data and revenue segmentation.

-

Payroll Analysis: It aims to minimize financial losses arising from inaccurate or fraudulent payroll allocations by scrutinizing payroll data.

-

Travel & Expense Analysis: This module uncovers anomalies in travel and expense data, helping safeguard company transactions.

-

Vendor Analysis: Designed to mitigate losses from incomplete or inaccurate invoices, this module ensures timely and accurate vendor payments.

Key Features:

-

Continuous Monitoring: The MindBridge AI platform provides ongoing analysis of financial and operational data, supporting continuous oversight and reducing the risk of fraud and errors.

-

Advanced Algorithms: The platform uses more than 250 machine learning control points, statistical methods, and business rules to identify financial risks and anomalies across various ledgers.

-

Automation: It automates the transaction analysis process, helping to streamline workflows and focus resources on areas that need attention.

-

Risk Analysis: The platform enables risk scoring, segmentation, and anomaly detection to highlight areas that need further investigation or risk management.

-

Data-Driven Insights: MindBridge AI provides extensive insights across all transactional data that empower finance professionals to make informed decisions and improve resource allocation.

Impact and Recognition:

MindBridge has been recognized in the 2024 Technology Fast 50 awards program due to its growth and innovation in the financial risk intelligence sector. This acknowledgment highlights MindBridge's impact on transforming financial risk management practices, especially amidst complex and evolving regulatory demands.

Audience and Utilization:

The platform serves a wide range of users, including global leaders like Chevron, KPMG, and Polaris, helping these organizations address the increased volume and speed of financial data changes. Its broad applicability across finance, auditing, and enterprise risk management makes it a valuable tool for detecting and mitigating financial irregularities.

Conclusion:

MindBridge AI offers a versatile suite of solutions for financial anomaly detection and risk management, enabling continuous oversight and efficient handling of vast amounts of data. By automating and refining the financial analysis process, it aims to equip finance professionals with enhanced tools to detect, manage, and mitigate potential financial risks and fraud.

AMBIENT.AI

Uses computer vision intelligence to proactively prevent security incidents.

Ambient.ai focuses on transforming physical security using artificial intelligence (AI) and computer vision intelligence. It offers a comprehensive suite of software solutions designed to enhance security and response systems across various sectors.

Key Offerings:

-

Platform Overview: The core platform integrates several AI-driven security features with the prime objective of improving real-time threat detection and response.

-

Threat Detection & Response: This feature is pivotal in identifying and mitigating potential threats promptly. It includes an emphasis on signals intelligence, which provides warnings based on data analysis, and gun detection, enhancing security measures against armed threats.

-

Forensics and Investigation: AI-powered forensics helps in conducting swift and exhaustive investigations following security incidents, providing actionable insights and facilitating evidence gathering.

-

Occupancy Insights: Monitors and analyzes the movement and presence of people in a given space to provide insights that could preemptively mitigate potential security threats.

Featured Use Cases:

-

Customer Stories: The solutions cover diverse environments such as educational institutes, corporate campuses, and retail. For instance, the Harker School benefits from 24/7 proactive threat detection to safeguard K-12 settings, while notable enterprises like VMware and SentinelOne utilize the platform to enhance their operational security efficiency.

-

Case Studies: Clients such as Fortune 500 companies and e-commerce giants streamline their security operations, achieving milestones like a 100% alert resolution rate and drastically improving post-incident investigation speeds.

Resources and Learning:

Ambient.ai provides a resource hub that includes educational materials and customer stories to guide organizations in optimizing their security strategies. The offerings are rich with:

-

Webinars and Guides: These cover strategic themes in AI implementation, discussing topics ranging from active shooter incident management to the future of autonomous security operations.

-

Whitepapers and Videos: These resources delve into AI’s impact on physical security, providing analytical insights and industry-specific intelligence.

Professional Integration and Partnerships:

-

Collaborations and Partnerships: The company works closely with technology partners such as Brivo and Axis Communications to enhance its security solutions. It integrates seamlessly with existing security infrastructures to improve access control and incident response capabilities.

-

Achievements and Recognitions: Recognized for its innovative approach, the company has received certifications and accolades such as SOC 2 Type II certification and featuring on lists of noteworthy advancements in technology.

-

Investment and Growth: Recent financial investments demonstrate ongoing growth, aiding in the expansion of AI-powered security technologies globally, as seen with the strategic growth investment from Allegion Ventures.

Company Infrastructure:

Ambient.ai operates from multiple locations, including offices in San Jose, California, and Bengaluru, India, reflecting its global operational reach. It maintains a user-friendly online platform to engage with clients and offer demonstrations of its technologies.

Privacy and Legal:

The company provides clear policies on privacy and terms of use, ensuring transparency and regulatory compliance in its operations.

In summary, Ambient.ai aims to enhance physical security through sophisticated AI and computer vision technologies, offering tailored solutions that cater to diverse sectoral needs and empowering customers with actionable intelligence to preempt and respond to security challenges effectively.

HRbrain

HRbrain offers an AI-powered Career Coach that creates personalized career plans and matches employees to growth opportunities. HRbrain is a SaaS provider for human resources that offers capabilities like data integration, advanced analytics, and machine learning algorithms to enable prescriptive analytics in HR.

HRbrain.ai Executive Summary

Key Focus Area: HRbrain.ai is primarily focused on enhancing human capital management via AI-powered solutions. The company aims to help organizations optimize talent acquisition, employee satisfaction, and retention strategies that align with advanced technologies such as AI and machine learning. Their tools address various facets of human resource management including career development, employee turnover prediction, pay equity, culture assessment, and managing diversity, equity, and inclusion.

Unique Value Proposition and Strategic Advantage:

-

AI Integration: HRbrain.ai positions its AI-driven platform as a strategic advantage for HR departments struggling to keep pace with technological advances and evolving workforce needs. They offer a comprehensive set of tools that not only address operational aspects of HR but also aim to integrate AI to transform how organizations manage their human resources.

-

Comprehensive Suite of AI Tools: The platform’s suite includes features for pay equity evaluation, employee churn prediction, DE&I bias detection, culture assessment, and employee preference optimization. Each tool is designed to address specific challenges in human capital management, such as reducing turnover costs, ensuring equitable pay practices, and enhancing corporate culture.

-

Strategic Insights: Its offering extends to detailed strategic insights and thought leadership through publications and workshops, enabling organizations to make informed decisions about workforce management.

Delivering on the Value Proposition:

-

MentorZone and JobMatch Pro: These platforms target career development for both businesses (B2B) and individual consumers (B2C). MentorZone focuses on employee growth within organizations, promoting retention and leadership development. JobMatch Pro aids individuals with job seeking, aligning their skills with optimal roles.

-

Predictive Analytics for Employee Churn: The Employee Churn Predictor uses machine learning to identify potential turnover risks, allowing organizations to mitigate such risks proactively and preserve team cohesion.

-

Cultural and DE&I Management: The Culture Assessment and DE&I Bias Detection tools are specifically designed to identify and rectify cultural misalignments and biases within organizations. This proactive approach is intended to safeguard against reputational damage and promote an inclusive brand culture.

-

Pay Equity and Compensation Optimization: They provide tools to evaluate and ensure pay equity, not only to mitigate legal risks but also to enhance workforce loyalty and motivation.

-

Employee Preference Optimization: This service addresses benefits customization, helping companies optimize their rewards packages to reflect actual employee preferences, thereby improving satisfaction and reducing unnecessary expenditures.

Conclusion: HRbrain.ai presents itself as a transformative partner in the field of human capital management, combining AI and strategic insights to improve workforce management. By leveraging their diverse suite of AI tools, they propose robust solutions to critical HR challenges, positioning themselves as facilitators of a future-ready organizational culture.

Holistic AI

Holistic AI empowers enterprises to adopt and scale AI with confidence. Holistic AI helps enterprises adopt and scale AI with confidence.

Holistic AI: AI Governance Platform Overview

Key Focus Area: Holistic AI centers its business model on providing a comprehensive AI Governance Platform. The company underscores the importance of governance, risk management, and compliance in AI deployments. They aim to enable enterprises to adopt and scale AI confidently by managing the risks associated with AI systems' use, ensuring compliance, and optimizing AI investments across industries such as financial services, consumer goods, technology, insurance, and human capital management.

Unique Value Proposition and Strategic Advantage: Holistic AI's value proposition lies in its positioning as a 360-degree solution for AI management. They claim to offer complete oversight and command over AI systems from risk management to compliance readiness. The platform is designed to safeguard enterprises against risks like data breaches, bias, and operational inefficiencies, providing a holistic approach to AI governance that integrates legal and ethical considerations. Their strategic advantage includes the ability to continuously audit AI systems, assess conformity with evolving global regulations, and provide comprehensive reporting, which can foster trust with stakeholders and ensure ethical AI practices.

How They Deliver on Their Value Proposition:

-

AI Governance Platform: The platform provides a detailed oversight of AI systems, mapping risks, managing compliance requirements, and optimizing AI investments. It enables organizations to register AI usage, set internal policies, and audit systems regularly.

-

AI Safeguard and Tracker: These tools are designed to monitor AI developments and security measures. The AI Safeguard module specifically addresses risks associated with generative AI, ensuring safe and productive utilization without compromising security. Meanwhile, the AI Tracker helps companies navigate global regulatory landscapes, giving insights into legislative changes and compliance obligations.

-

AI Audits and Risk Management: The auditing tools within the Holistic AI suite enable organizations to showcase the trustworthiness of their AI systems by evaluating bias, privacy, efficacy, robustness, and explainability. These audits help in producing tailored insights and risk mitigation strategies, thus maintaining AI systems' efficacy and compliance with legal frameworks.

Additional Services:

-

Use Case-Specific Solutions: Holistic AI formulates solutions tailored for specific roles within a company, such as the Chief Information Officer or Chief Data Officer, ensuring strategic alignment with business-level AI decisions.

-

Industry-specific Analyses: There are focused solutions that cater to diverse sectors, each with specific regulatory demands and challenges—emphasizing their adaptability in meeting industry-specific needs.

-

Continuous Expert Support: The company emphasizes ongoing customer support and expert consultancy, which aims to guide stakeholders in adapting to and adopting responsible AI practices.

Conclusion: While Holistic AI presents itself as a comprehensive provider of AI governance solutions, potential users should approach with an understanding of this distinct value proposition. The emphasis on strategic AI governance aims to position Holistic AI as a pivotal tool for organizations looking to harness AI responsibly, yet verify claims through due diligence due to the self-promotional nature of the content.

zypl.ai

zypl.ai provides GenAI SaaS to optimize risk management with macro-resilient zGAN for the financial sector.

Executive Summary of Zypl.ai

-

Key Focus Area: Zypl.ai is concentrated on pioneering innovations in synthetic data generation and artificial intelligence to optimize credit scoring. Their mission encompasses the advancement of AI technologies within the financial sector, particularly concerning credit scoring and lending models. The firm targets regions with emerging economies, focusing on improving credit availability and financial inclusivity through smarter, AI-driven solutions.

-

Unique Value Proposition and Strategic Advantage: The company offers a unique value proposition through its proprietary AI tools that leverage synthetic data to complement traditional credit scoring models. This approach allows financial institutions to account for outlier conditions, often not captured in typical lending evaluations. The strategic advantage lies in their ability to provide adaptive and convincing credit scoring solutions that can be customized to varying levels of risk appetite. By utilizing machine learning techniques to handle ‘black swan’ events, they enhance the stability and resilience of financial institutions’ credit portfolios.

-

Delivery on Value Proposition:

-

Generative AI Software (Zypl.score): The flagship product is ‘zypl.score,’ a software offering AI-as-a-service capabilities that support banks and financial institutions in adopting a macro-resilient decision-making framework. By using synthetic data-driven AI algorithms, zypl.score helps in providing a more robust credit evaluation process that is privacy-secure and customizable.

-

Partnerships: Zypl.ai collaborates with over 35 banks across 12 markets, which includes leading financial institutions in Eurasia, MENA, and Southeast Asia, effectively demonstrating the product's applicability and scalability across different geographies.

-

Strategic Collaborations: They maintain significant partnerships with global entities and leverage influential networks which enable the firm to access cutting-edge resources and insights. The collaboration with institutions like Commercial Bank International further solidifies its credibility in fintech innovation.

-

Market Expansion: Beyond its origins, zypl.ai has embraced a broad geographical expansion strategy, often highlighted by their move from a Tajik startup to establishing headquarters in Dubai’s International Financial Center and participating in international accelerators such as Hub71 and the Silkway Accelerator.

-

Technological and Market Innovation: Besides credit scoring, the company is venturing into underwriting insurance models and exploring other finance-related AI applications, thus broadening its impact and adaptation of its AI tools.

Zypl.ai’s strategic focus and technological advancements align with their ambition to be the first unicorn from Central Asia and their commitment to transforming the regional financial landscape. This is supported by their continual drive for innovation in AI-driven financial services.

Feedzai

Feedzai is the market leader in fighting fraud and financial crime with today’s most advanced cloud-based risk management platform, powered by machine learning and artificial intelligence.

Feedzai: An Overview for Executives

Key Focus Area:

Feedzai specializes in providing comprehensive solutions for fraud prevention and risk management. Their operations are tailored to protect financial institutions, encompassing a broad spectrum of products designed to mitigate financial crime such as transaction fraud, account takeover, and anti-money laundering (AML) concerns.

Unique Value Proposition and Strategic Advantage:

-

Comprehensive RiskOps Platform: Feedzai delivers a singular, cohesive platform that integrates a variety of fraud management functionalities, streamlining processes and data into a unified system. This platform leverages artificial intelligence to enhance detection capabilities and offers solutions across multiple financial crime types and channels.

-

Behavioral Biometrics Technology: Feedzai emphasizes the use of behavioral biometrics, providing a non-intrusive authentication layer that identifies potential fraud through the assessment of digital interactions such as typing patterns. This technology enhances the ability to detect subtle fraud patterns that could be missed by traditional methods.

-

Real-time Risk Analysis: Their strategic advantage lies in employing advanced AI models that continuously learn and adapt to emerging threats, ensuring proactive fraud detection. This real-time capability is pivotal in securing transactions while minimizing disruptions for genuine customers.

Delivery on Value Proposition:

Feedzai executes its value proposition by deploying a multi-faceted approach that encompasses:

-

AI and Machine Learning: Feedzai’s AI system supports advanced fraud detection by analyzing transactional and behavioral data to create individual risk profiles. This intelligence not only helps in reducing false positives but also enhances fraud detection rates.

-

Omnichannel Capabilities: The company’s solutions monitor customer activities across various payment channels, providing a comprehensive view and allowing for more accurate risk assessments. This approach mitigates risks associated with new and diverse payment methods, crucial for adapting to the rapidly evolving financial sector.

-

Scalable and Adaptable Solutions: With their platform’s scalability, Feedzai is capable of processing upwards of 59 billion events per year and securing around $6 trillion in payments, signifying readiness to tackle the current volume and diversity of threats that face global financial institutions.

-

User-friendly Interfaces and Dynamics: The platform offers user-centric designs and self-service capabilities that allow financial institutions to manage risk directly. It provides features for model deployment and rule customization without extensive IT involvement, promoting efficiency and agility.

-

Strong Industry Partnerships and Insights: Collaborations with financial leaders and firms such as Form3 help Feedzai to continually refine their approach to fraud detection, ensuring their technology remains at the forefront of industry standards.

Feedzai positions itself as a central player in the fight against financial crime, integrating innovative technology and strategic insight to deliver targeted, effective risk management solutions. This alignment with evolving industry and regulatory needs provides their clients with tools needed to maintain robust, adaptable security measures in an increasingly digitalized financial landscape.

Cranium

Cranium offers governance solutions helping organizations manage AI services, assess risks, and ensure AI models are used safely and securely within enterprises.

Cranium focuses on AI governance, offering solutions to secure and ensure compliance across AI systems and supply chains. Their key proposition is providing a comprehensive platform for AI exposure management, underpinned by AI-driven threat intelligence, compliance tracking, and proprietary tools like the AI Card and Detect AI. This platform facilitates both internal and third-party AI oversight, highlighting security, compliance, and trust as their primary focal points.

Key Focus Area:

- Cranium specializes in AI governance and compliance, aiming to protect organizations from security risks associated with AI systems. They emphasize maintaining security and regulatory compliance while fostering trust in enterprise AI and generative AI systems.

Unique Value Proposition and Strategic Advantage:

- Cranium's unique value proposition lies in its comprehensive end-to-end AI governance platform. This platform provides detailed security measures, compliance frameworks, and insight into both internal and third-party AI systems.

- Their strategic advantage is their integration capabilities, facilitating seamless incorporation into existing organizational workflows. This offers uninterrupted threat detection and compliance maintenance, providing organizations with the ability to manage AI systems effectively without disrupting development or deployment.

Delivery on Their Value Proposition:

- Platform Features: Cranium’s platform includes tools for continuous monitoring and detailed risk assessment of AI systems. The AI Card helps in documenting and demonstrating compliance and security postures, both internally and with third-party partners.

- Exposure Management: Through AI-augmented workflows, Cranium offers assessments of potential vulnerabilities by characterizing attack surfaces and utilizing threat intelligence to keep abreast of new threats, thus maintaining a strong security posture.

- Compliance Tools: They provide mechanisms to ensure AI systems align with major regulatory frameworks, like the NIST AI RFM and the EU AI Act, through automated checks and comprehensive compliance scoring.

- Industry-Specific Solutions: Cranium tailors its governance solutions to specific industry needs like financial services and life sciences, addressing unique regulatory and compliance challenges faced by these sectors.

- Partnerships and Collaborative Hubs: Initiatives like the EU AI Hub, in collaboration with KPMG and Microsoft, exemplify their commitment to advancing AI governance practices by providing platforms for ideation, innovative solution crafting, and regulatory navigation support.

Overall, Cranium is positioned to assist organizations in managing the complexities of AI implementation by enhancing their security measures, regulatory compliance, and establishing trust both internally and across networks involving third-party AI systems. The platform supports continuous development and deployment processes with a focus on refining compliance and security endeavors.

Huma.AI

Huma.AI is a leading generative AI platform for life sciences, providing advanced insights and data-driven solutions to accelerate drug development and improve healthcare outcomes.

Huma.AI Overview: Key Insights for Executive Audience

1. Company's Key Focus Area: Huma.AI is centered on empowering the healthcare and life sciences sectors by accelerating decision-making processes. They achieve this through their generative AI platform, designed to extract, synthesize, and process data and insights from a wide range of complex data sources. Their primary goal is to streamline the analysis of clinical evidence, market trends, and internal research to aid in strategic business decision-making.

2. Unique Value Proposition and Strategic Advantage:

-

Generative AI Application: Huma.AI differentiates itself by harnessing generative AI technology to simplify the extraction and synthesis of insights from large volumes of data. This capability enables users to construct a comprehensive and tailored view of their data landscape, optimizing the decision-making process.

-

Single-Tenant Environment: Each client is provided a dedicated environment for their data, ensuring confidentiality and protection, which can be critical in sectors handling sensitive health data.

-

Automated Insight Generation: The platform’s automation reduces the time required for insight generation from days or weeks to minutes. This enhances agility and responsiveness to evolving market and scientific landscapes.

3. How They Deliver Their Value Proposition:

-

Diverse Functional Modules: Huma.AI provides various modules such as literature review, congress materials analysis, CRM data consolidation, market research, research study ingestion, and ad board feedback tracking. These tools are designed to tackle different aspects of data analysis and insight generation, specific to the needs of healthcare and life sciences.

-

User-Friendly Interface: Through an interface that supports everyday language queries, the platform facilitates rapid access to information, allowing users to ask questions and receive fast, relevant answers.

-

Robust Security Measures: The company maintains stringent security protocols, adhering to SOC 2 Trust Service principles, utilizing AWS infrastructure for encrypted data storage and transmission, and routine security reviews to uphold data integrity and confidentiality.

-

Comprehensive Data Handling: Capabilities include the ingestion of public and private data, advanced real-time data analysis, and seamless data export, fostering collaborative insights within teams.

Huma.AI positions itself as a strategic partner in enhancing efficiency and productivity in decision-making processes for its clients in healthcare and life sciences, leveraging cutting-edge AI technology to transform data into actionable insights.

Viz.ai

Viz.ai uses AI to enhance emergency care by rapidly diagnosing strokes through CT image analysis and streamlining workflows for healthcare professionals.

Viz.ai is a company that focuses on leveraging artificial intelligence (AI) to transform patient care and improve outcomes in healthcare. It offers a comprehensive suite of AI-powered solutions that are designed to assist healthcare providers in various specialties, including neurology, cardiology, radiology, and vascular medicine. Here are the main elements of Viz.ai as per their company-authored content:

Core Offerings

- Viz.ai One: A flagship solution that enhances care coordination with real-time data analysis and efficiency improvements across hospitals and healthcare systems.

- Neuro Suite: Specifically designed to accelerate the detection and treatment of neurovascular diseases, including large vessel occlusion (LVO), hemorrhages, and cerebral aneurysms.

- Cardio Suite: Aimed at meeting cardiovascular needs with AI-powered solutions to enhance disease treatment and management.

- Vascular and Trauma Solutions: Offer capabilities tailored for vascular medicine and trauma centers to streamline patient responses and outcomes.

- Radiology Suite: Helps accelerate diagnosis and treatment for radiologists, maximizing their efficiency and decision-making capacity.

Collaborative Efforts

- Microsoft Partnership: Viz.ai has partnered with Microsoft to deliver its AI models via Microsoft's Precision Imaging Network, integrating over 48 AI models into clinical workflows. This collaboration aims to offer advanced diagnostics and streamlined care coordination across different areas including oncology, cardiovascular, and neurosciences.

Key Features

- AI-Powered Detection and Analysis: Capable of auto-detecting diseases, providing automated assessments and real-time insights to healthcare providers, potentially speeding up diagnosis and treatment timelines.

- Data-Driven Approach: Supports healthcare organizations in optimizing workflows and enhancing patient care through data-driven insights and real-world evidence.

- Seamless Integration: The solutions are designed for easy integration into existing healthcare workflows, enhancing communication and data sharing across different device platforms.

Educational Resources and Support

- Viz Academy and Clinical Resources: Provides resources, clinical research publications, and user guides to educate and support healthcare professionals using their solutions.

- Customer Support: Offers expert support and on-call specialists available 24/7 to assist healthcare teams in effectively utilizing Viz.ai’s technology.

Impact and Validation

- Time Efficiency: Clinical studies such as VALIDATE have demonstrated significant time savings in stroke treatment workflows when using Viz.ai solutions, which led to improved patient outcomes.

- Clinical Partnership: Collaborations with life sciences partners and healthcare facilities aim to enhance patient care innovation and reduce clinical gaps.

AI and Security

- ISO Certifications: Viz.ai underscores its commitment to data security and patient privacy with certifications like ISO-27001:2022, SOC 2 Type 2, which provide assurance of robust information security measures.

In summary, Viz.ai positions itself as a pioneer in utilizing artificial intelligence to enhance clinical workflows and patient outcomes in healthcare. Through partnerships and real-time data analysis, it offers diverse solutions aimed at reducing diagnosis and treatment times across multiple healthcare disciplines.