⚡ZurzAI.com⚡

Companies Similar to Finom

Onfido

Onfido provides AI-powered digital identity solutions for onboarding, compliance, and fraud prevention, helping businesses enhance customer trust and reduce operational costs.

About | About | About | About | About | News | Careers | News | About | Leadership | About | About | About | About | About

Onfido's Key Focus Area

Onfido specializes in digital identity verification. The company provides a comprehensive platform aimed at businesses needing to verify user identities online and ensure compliance with regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering). Their key focus is to create trust in digital interactions and onboarding processes through their suite of identity verification solutions.

Unique Value Proposition and Strategic Advantage

Onfido's proposition lies in its "Real Identity Platform," designed to perform identity verification in a seamless, efficient, and automated manner. Their strategic advantage hinges on the use of AI-powered technology, particularly their in-house developed Atlas AI, which is claimed to provide fast and fair biometric and document verification. This capability not only enhances the speed of onboarding but also reduces the risk of fraud, offering businesses a scalable solution to navigate complex compliance landscapes and manage costs effectively.

Delivering on Their Value Proposition

Onfido delivers its value proposition through a combination of product offerings and technological infrastructure:

-

The Real Identity Platform: This platform integrates document verification, biometric verification, data verification, and fraud detection into a single, cohesive service. It aims to streamline the identity verification process by providing fast and accurate results through automated systems.

-

Atlas AI: At the core of Onfido's offerings is the Atlas AI, which claims to deliver swift verification results, processing 95% of biometric verifications in under 10 seconds. Atlas AI is developed using global datasets to ensure that its algorithms are fair and unbiased, addressing potential issues such as racial or gender bias in its technology.

-

Smart Capture SDK: Onfido offers a software development kit (SDK) that enables businesses to incorporate identity verification functionalities into their mobile apps and websites. This is intended to enhance user experience by providing real-time feedback and optimizing the verification process to reduce friction during sign-up.

-

Compliance and Fraud Prevention: Onfido emphasizes its robust compliance framework designed to meet regional regulatory requirements, such as KYC and AML. This is coupled with comprehensive fraud detection, intended to safeguard businesses by accurately identifying fraudulent activities using machine learning-driven analytics.

-

Onfido Studio: A no-code orchestration tool that allows businesses to tailor verification workflows to meet specific needs and risk profiles, adapting swiftly to changes in market conditions without requiring specialized coding knowledge.

-

Global Coverage and Scale: Their suite supports identity document verification from over 2,500 document types across 195 countries, which provides businesses with global scalability and a consistent user experience worldwide.

Overall, Onfido positions its offerings as a pivotal enabler for businesses aiming to streamline user onboarding while ensuring compliance and fraud protection, all facilitated by advanced AI-driven technology. The company caters to industries like financial services, gaming, healthcare, and telecommunications, where digital identity verification is critical.

Paro

Paro provides professional services focused on tax and finance compliance, accounting, bookkeeping, financial planning, fractional CFO services, tax advisory, and more. They offer flexible models for businesses to augment their teams and utilize AI-matching technology to connect firms with experts quickly.

Paro.ai is a company that specializes in providing finance and accounting solutions across various sectors, with a primary focus on outsourced financial services. It operates at the intersection of business needs and skilled financial expertise, catering to both corporate clients and accounting firms.

Key Focus Area: Paro concentrates on offering a wide range of financial services including accounting and bookkeeping, financial analysis, fractional CFO services, growth strategy consulting, and tax services. Its core value revolves around providing skilled finance experts to help businesses and accounting firms enhance their financial operations, drive growth, and efficiently manage financial tasks.

Unique Value Proposition and Strategic Advantage: Paro’s unique value proposition lies in its ability to match businesses with top-tier finance professionals through a data-driven, AI-powered talent platform. This strategic advantage allows for:

-

Quick and precise matching: The company uses AI algorithms to swiftly pair businesses with the top 2% of finance experts, making it 20 times faster to find the appropriate skill set among over 250 competencies.

-

Diverse expertise: With a vast network of professionals from 60+ industries, they promise a breadth of expertise that can cater to niche and complex needs without burdening internal teams.

-

Seamless integration: Paro professionals are equipped to integrate swiftly into clients' existing systems, minimizing disruptions and maximizing project efficiency.

Execution of Value Proposition: Paro delivers on its value proposition through several methods:

-

Flexible Talent Pool: The platform provides on-demand access to finance professionals, enabling businesses to tackle both short-term staffing gaps and long-term strategic challenges without the need for extensive hiring processes.

-

Comprehensive Services: Paro offers an extensive array of services from transaction manage ment and reconciliation to full-charge bookkeeping and software implementation, tailored to meet the precise needs of clients.

-

Tech-Driven Efficiency: Utilizing AI and data analytics, the company enhances decision-making, forecasting, and financial analysis processes to provide insightful, strategic guidance that scales with the business.

-

Outsourcing Solutions: Businesses can leverage outsourced services to improve operational flexibility and cost efficiency, benefiting from high-level financial insights and compliance assistance without incurring the expenses associated with full-time employment.

Paro also supports businesses by providing resources on financial strategy and industry insights, aiming to deepen clients’ understanding of their financial operations and strategic opportunities.

In summary, Paro.ai focuses on leveraging AI-driven expertise to provide flexible and efficient finance solutions, thereby aiding businesses in optimizing their financial performance and strategic growth without cumbersome internal efforts.

Mondu

Mondu offers B2B "buy now, pay later" solutions, allowing businesses to offer installment payments while Mondu assumes the financial risk, paying vendors upfront.

Mondu is a financial services provider focusing on various B2B payment solutions, primarily aimed at enhancing the payment processes for businesses. These solutions include deferred payment options like Buy Now, Pay Later (BNPL), designed to align B2B transactions with the flexible payment terms familiar in the B2C space. Here's a detailed overview of Mondu's offerings and operational structure:

Key Highlights:

- Mondu has secured an Electronic Money Institution (EMI) license from the Dutch National Bank (DNB), enabling it to operate across the EU with enhanced financial service solutions.

- The company addresses various business sectors, including webshops, marketplaces, and multichannel sales in industries like automotive, construction, electronics, and hospitality.

Products:

- Online Payments and Multichannel Support: Mondu facilitates popular B2B payment methods across diverse sales channels. It offers an embedded payment system, allowing deferred payments directly within platforms, enhancing customer convenience.

- Payment Terms and Installments:

- Businesses can offer their buyers flexible payment terms extending up to 90 days.

- It enables splitting purchases into 3, 6, or 12 monthly installments, providing substantial upfront payment while spreading buyer costs over time.

- Digital Trade Account: This feature supports buyers to consolidate multiple purchases into one account, thereby increasing purchase frequency and user engagement.

Use Cases and Integrations:

- Mondu is tailored for various business models, particularly enhancing B2B webshops and marketplaces. By incorporating Mondu's payment solutions, these platforms can offer deferred payment solutions, attracting more buyers with flexible purchase options.

- Integration with existing systems is supported through APIs, including compatibility with platforms like Stripe to ensure seamless implementation into existing workflows.

Benefits for Businesses:

- Risk Management: Mondu handles credit checks, fraud prevention, and manages the risk of invoice defaults. This allows businesses to focus on core operations without worry.

- Cash Flow Improvement: By offering upfront payments to businesses while allowing their customers flexible payment options, Mondu helps maintain healthy cash flow.

- Operational Efficiency: Automated processes established by Mondu reduce the administrative burden and streamline financial operations.

Additional Services:

- Invoice Factoring and Payables Extension: Mondu provides upfront payments for invoices at creation, optimizing workflows and enhancing cash liquidity for businesses. This service is especially beneficial for platforms and marketplaces looking to manage incoming invoices and outgoing supplier payments efficiently.

Customer and Market Insights:

- Mondu focuses on fostering strong customer relationships while facilitating seamless transactions. This is marketed as providing a B2C-like buying experience in the B2B sector, enhancing user satisfaction and driving sales growth.

- Their service portfolio aims to address the challenges of traditional invoicing by offering a modern, digital-first payment approach.

Through its comprehensive suite of B2B payment solutions, Mondu positions itself as a facilitator of business growth, offering financial services that streamline operations, reduce risk, and enhance customer experiences.

WorkFusion

Digitize operations with intelligent automation for your business processes, with solutions that use RPA (Robotic process automation), artificial intelligence, chatbots, and the crowd. WorkFusion digitizes operations through intelligent automation, utilizing RPA, AI, and chatbots to automate business processes.

About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About

Executive Summary of WorkFusion

1. Company's Key Focus Area: WorkFusion concentrates on providing AI-driven solutions designed to streamline financial crime compliance processes. The company particularly emphasizes Anti-Money Laundering (AML), sanctions screening, transaction monitoring, and adverse media monitoring. Their target is financial institutions looking to automate and enhance compliance operations, improve efficiency, and mitigate associated risks.

2. Unique Value Proposition and Strategic Advantage: WorkFusion differentiates itself through its AI Agents, which are AI-enabled digital workers that replicate the roles of skilled analysts in specific compliance areas. These agents are pre-trained and can be quickly deployed to automate complex compliance tasks, thereby reducing the need for extensive human resources. This pre-built, easily scalable AI workforce aligns closely with the regulated banking sector's needs, addressing common issues such as alert surges and staffing challenges. They claim an improvement in return on investment by ensuring compliance while cutting operational costs significantly.

3. Delivery on Their Value Proposition:

-

Customized AI Agents: WorkFusion offers AI Agents tailored to handle various compliance roles, such as sanctions and adverse media screening and transaction monitoring. These agents can sift through extensive data to identify potential compliance risks, freeing human employees for more strategic initiatives.

-

Automated Processes: By utilizing machine learning and artificial intelligence, WorkFusion's solutions automate the repetitive, error-prone tasks associated with compliance, enhancing speed, accuracy, and overall efficiency of operations without replacing existing compliance infrastructure.

-

Client Success: WorkFusion has demonstrated the effectiveness of their solutions through client success stories where significant reductions in false positives and manual effort have been reported. This includes partnerships with some of the largest financial institutions globally, showcasing credibility in the industry.

-

Partnership and Support: The company facilitates partnerships and offers robust support through its services and Automation Academy, ensuring that clients can implement and adapt AI Agents smoothly into their existing systems.

In summation, WorkFusion provides AI-driven tools essential for financial institutions aiming to streamline compliance tasks, manage regulatory risks, and enhance operational efficiency. Its strategic advantage lies in ready-to-deploy AI solutions that not only reduce manual workloads but also improve compliance processes' speed and accuracy.

Z.Ai

Provides AI-powered personalization solutions for conversions.

Key Focus Area:

The primary focus of DN.com is the facilitation and execution of domain name transactions. They specialize in both buying and selling domain names, catering to a global audience eager to secure, invest in, or liquidate web domain assets. The company emphasizes the importance of domain name investment and keeps clients informed about industry trends.

Unique Value Proposition and Strategic Advantage:

-

Secure Transactions: DN.com provides a platform that ensures security and reliability in domain transactions. They claim to guarantee a 100% secure transaction process by withholding the release of funds to sellers until buyers receive full ownership of the domain, promising a money-back guarantee should any issues arise during the process.

-

Efficiency and Speed: A significant strategic advantage is the speed of transaction completion. The platform boasts an over 95% success rate in delivering domain ownership within 24 hours after payment, facilitating fast transitions for customers eager to acquire their domains quickly.

-

Comprehensive Support: The company offers free support for transaction processes and domain ownership transfer, extending help through a designated service team to assist clients from start to finish.

Delivery on Value Proposition:

To deliver on its promise of secure, efficient, and reliable domain transactions, DN.com utilizes a multi-step strategic process:

-

Secure Payments: By leveraging a platform that holds funds in escrow until completion of a transaction, DN.com minimizes risk and builds trust with buyers and sellers, ensuring both parties adhere to the agreed terms before the transfer of funds or domain occurs.

-

Fast Processing: They facilitate rapid domain transfer by verifying transactions quickly once a buyer has made the payment. This operational efficiency plays a crucial role in their value delivery, especially for clients who prioritize time-sensitive acquisitions.

-

Support Infrastructure: The company’s support infrastructure is multifaceted, providing guidance and facilitation through a Help Center aimed at educating customers about using products and completing transactions. They also offer direct support options, such as email and WeChat for more personalized assistance.

In conclusion, DN.com concentrates on making domain transactions straightforward, secure, and swift. Their strategic use of escrow payment methods, rapid transaction processing, and comprehensive support services distinguish them in the domain market, appealing to a clientele seeking confidence and efficiency in domain investment and transfer activities. However, it's important to view these claims critically, given they are presented in the context of advertising the company's offerings.

Airwallex

Airwallex is an Australian-born fintech unicorn that provides financial services to support innovators, entrepreneurs, and startups. They offer solutions for managing international transactions and business expenses.

Key Focus Area

Airwallex's central focus is providing a comprehensive fintech platform for conducting global financial operations. Their suite of products and services is directed towards businesses looking to scale globally by simplifying international payments, managing multi-currency accounts, and offering integrated financial solutions. Their service portfolio includes business accounts, payment processing, foreign exchange, treasury management, and embedded finance solutions, all facilitated through advanced APIs that cater to a broad range of finance-related functions.

Unique Value Proposition and Strategic Advantage

Airwallex presents itself as an all-encompassing financial platform that enables businesses to operate without borders by integrating various financial services into a single interface. The strategic advantage lies in their:

- Proprietary Payments Network: This offers businesses faster and more cost-effective cross-border transactions compared to traditional banking services. Their ability to open accounts in local currency across numerous markets reduces the friction of forced currency conversions.

- Integrated Financial Infrastructure: They allow businesses to not only process payments and manage multiple currency transactions but also integrate these processes within existing business ecosystems, thereby streamlining operations and reducing administrative burdens.

- Embedded Finance Capabilities: Clients can leverage Airwallex's infrastructure to create custom financial products tailored to their specific business needs, adding another layer of utility for businesses seeking to deploy unique financial solutions.

Delivering on Their Value Proposition

Airwallex executes its value proposition through a robust combination of products and technological solutions aimed at streamlining and enhancing financial operations globally. The primary methods include:

- Business Accounts: These accounts allow businesses to manage funds globally, accepting and holding money in various currencies without fees on conversions, thus removing a significant pain point in international transactions.

- Core API: Businesses can integrate Airwallex's APIs into their platforms, offering flexibility and control over their financial operations at scale.

- Payments and FX Management: Their platform supports online payment acceptance, managing currency risk with interbank rates, and the issuance of multi-currency payment cards to streamline expense management.

- Treasury Services: The platform enables efficient global fund collection, storage, and distribution, helping businesses manage their liquidity across multiple regions.

- Partnership and Integration: By integrating with popular business tools (like accounting software and e-commerce platforms), Airwallex ensures that businesses can seamlessly incorporate its financial services into their existing workflows.

- Comprehensive Support Networks: They offer dedicated support teams that focus on compliance and security, ensuring that funds and data are safeguarded in line with local and international regulations.

Overall, Airwallex positions itself as a utility provider for businesses with global aspirations, offering a wide array of solutions aimed at reducing financial overheads and operational complexities associated with international commerce. Through continuous service enhancement and integration capabilities, they aim to empower companies by focusing on innovation and tailored financial services.

Terzo

Terzo is a company that specializes in AI-powered contract analysis software. They leverage artificial intelligence and machine learning to enhance data quality and risk monitoring for both business and legal teams.

Terzo Technologies focuses on leveraging artificial intelligence (AI) to transform financial intelligence and contract management for enterprise-scale organizations. Their primary aim is to help businesses uncover insights hidden in their contracts and other financial documents, providing greater visibility and operational efficiency.

Key Focus Area:

- Terzo places a strong emphasis on AI-powered financial intelligence and contract analytics. Their solutions are tailored to optimize financial results by centralizing contracts, aggregating financial data, and automatically extracting critical data.

Unique Value Proposition and Strategic Advantage:

- Terzo's differentiation lies in their AI-as-a-Service model which combines proprietary AI extraction with human quality assurance. This approach ensures high data accuracy, exceptional precision, and actionable insights.

- With an AI-driven platform recognized by Gartner as a Cool Vendor, Terzo presents itself as a cutting-edge choice for finance and procurement teams. The platform is designed to facilitate smart, quick decisions that contribute to significant cost savings and improved spend management.

- The robust integration capabilities with existing systems such as ERP, CRM, and more, support seamless data flow, enhancing collaboration and unifying processes across departments.

How They Deliver on Their Value Proposition:

- Data Extraction and Analysis: Utilizing AI, Terzo automates the extraction of financial and contractual data from documents. This process is further refined with human oversight to ensure data quality and accuracy, allowing enterprises to efficiently manage contracts, invoices, and supplier spend.

- Contract Analytics and Supplier Management: The platform offers comprehensive visibility into contract hierarchy, renewal tracking, and supplier relationships. It allows businesses to negotiate effectively, manage spend, and ensure compliance through advanced contract analytics and a centralized data hub.

- Operational Efficiency and Cost Reduction: Terzo’s solutions automate workflows and manual tasks, significantly reducing time and costs associated with data retrieval and contract management. They report a 70% reduction in cycle time and a 10% savings in costs due to their integrated view of contract and spend data.

- Proactive Risk Management: By providing real-time insights and automated alerts for contract terms and renewals, Terzo ensures that enterprises remain compliant and minimize risks related to contract oversight.

- Comprehensive Integration Capabilities: Terzo supports a wide range of integrations with leading enterprise systems to ensure seamless data exchange and operational continuity. This ensures that data is readily accessible and insights are aligned with business strategies.

In conclusion, Terzo Technologies positions itself as a strategic partner for enterprises looking to harness AI for enhanced financial and contract management. They prioritize addressing the challenges of data inaccessibility and operational inefficiencies, thereby enabling organizations to optimize spending and drive informed decision-making.

Feedzai

Feedzai is the market leader in fighting fraud and financial crime with today’s most advanced cloud-based risk management platform, powered by machine learning and artificial intelligence.

Feedzai: An Overview for Executives

Key Focus Area:

Feedzai specializes in providing comprehensive solutions for fraud prevention and risk management. Their operations are tailored to protect financial institutions, encompassing a broad spectrum of products designed to mitigate financial crime such as transaction fraud, account takeover, and anti-money laundering (AML) concerns.

Unique Value Proposition and Strategic Advantage:

-

Comprehensive RiskOps Platform: Feedzai delivers a singular, cohesive platform that integrates a variety of fraud management functionalities, streamlining processes and data into a unified system. This platform leverages artificial intelligence to enhance detection capabilities and offers solutions across multiple financial crime types and channels.

-

Behavioral Biometrics Technology: Feedzai emphasizes the use of behavioral biometrics, providing a non-intrusive authentication layer that identifies potential fraud through the assessment of digital interactions such as typing patterns. This technology enhances the ability to detect subtle fraud patterns that could be missed by traditional methods.

-

Real-time Risk Analysis: Their strategic advantage lies in employing advanced AI models that continuously learn and adapt to emerging threats, ensuring proactive fraud detection. This real-time capability is pivotal in securing transactions while minimizing disruptions for genuine customers.

Delivery on Value Proposition:

Feedzai executes its value proposition by deploying a multi-faceted approach that encompasses:

-

AI and Machine Learning: Feedzai’s AI system supports advanced fraud detection by analyzing transactional and behavioral data to create individual risk profiles. This intelligence not only helps in reducing false positives but also enhances fraud detection rates.

-

Omnichannel Capabilities: The company’s solutions monitor customer activities across various payment channels, providing a comprehensive view and allowing for more accurate risk assessments. This approach mitigates risks associated with new and diverse payment methods, crucial for adapting to the rapidly evolving financial sector.

-

Scalable and Adaptable Solutions: With their platform’s scalability, Feedzai is capable of processing upwards of 59 billion events per year and securing around $6 trillion in payments, signifying readiness to tackle the current volume and diversity of threats that face global financial institutions.

-

User-friendly Interfaces and Dynamics: The platform offers user-centric designs and self-service capabilities that allow financial institutions to manage risk directly. It provides features for model deployment and rule customization without extensive IT involvement, promoting efficiency and agility.

-

Strong Industry Partnerships and Insights: Collaborations with financial leaders and firms such as Form3 help Feedzai to continually refine their approach to fraud detection, ensuring their technology remains at the forefront of industry standards.

Feedzai positions itself as a central player in the fight against financial crime, integrating innovative technology and strategic insight to deliver targeted, effective risk management solutions. This alignment with evolving industry and regulatory needs provides their clients with tools needed to maintain robust, adaptable security measures in an increasingly digitalized financial landscape.

Inscribe

Inscribe helps finance organizations manage risks by enabling them to detect fraud, automate processes, and understand creditworthiness.

Inscribe's Key Focus Area:

The primary focus of Inscribe is on automating risk management and fraud detection tasks for financial services. Their technology serves fintech companies, banks, and lending institutions by streamlining processes related to onboarding, underwriting, and compliance. Their suite of AI-powered tools aims to enhance the efficiency and effectiveness of risk detection, thereby reducing fraud-related losses and operational burdens on teams.

Unique Value Proposition and Strategic Advantage:

-

AI Risk Agents: Inscribe offers pre-trained AI Risk Agents that perform onboarding and underwriting tasks. These AI Agents can read, write, and reason similarly to human counterparts but operate continuously without error, enhancing productivity and scalability.

-

Proprietary Machine Learning Models: Unlike competitors who might use generalized AI models, Inscribe utilizes proprietary, state-of-the-art models specifically designed for fraud detection in financial transactions and document verification, which have been trained with a diverse dataset since 2017.

-

Comprehensive Risk Features: Inscribe provides a set of core features such as document parsing, fraud detection, transaction enrichment, document classification, cashflow analysis, and document verification, all purposed for reducing risk and improving the processes for financial health assessment.

Delivery on Value Proposition:

-

Automation and Efficiency: Inscribe’s AI systems automate complex, time-consuming manual tasks, reducing manual review times by up to 99%. By offering real-time processing—such as comprehensive fraud reviews in as little as 90 seconds—organizations can make faster and more accurate decisions.

-

Fraud and Compliance Expertise: Designed by data scientists and engineers with practical experience in risk operations, Inscribe facilitates fraud detection beyond traditional human capacity, using advanced analytics to recognize subtle fraud signals.

-

Client Testimonials and Results: The utility of Inscribe is highlighted through customer experiences that demonstrate significant reductions in fraud review duration and improved operational efficiency. For example, clients like Airbase and Plaid have reported substantial savings and enhanced decision-making confidence since implementing Inscribe technologies.

-

Continuous Support and Adaptation: Inscribe also commits to adapting its services to evolving fraud tactics. Their support includes consultation and training to integrate these solutions effectively within client workflows, maximizing the return on investment and operational effectiveness.

Through these mechanisms, Inscribe positions itself as a meaningful ally for financial institutions focused on minimizing risk and maximizing process efficiency, with an adaptable, comprehensive AI-based approach to risk management.

Ravelin

Ravelin is a smart fraud detection and prevention platform that helps companies stop online payment fraud.

-

Key Focus Area: Ravelin focuses on providing fraud prevention and payments optimization solutions for merchants that conduct business online. Their primary aim is to enhance the safety of online transactions by mitigating fraudulent activities like payment fraud, account takeovers, refund abuse, promo abuse, and marketplace fraud. Ravelin supports businesses in minimizing financial losses due to fraud while maximizing transaction efficiency and customer satisfaction.

-

Unique Value Proposition and Strategic Advantage: Ravelin's value proposition centers around its integration of machine learning with human insights to preemptively address fraud issues. This combination allows them to offer highly adaptive and scalable fraud detection solutions tailored to individual business needs, risk appetites, and market-specific threats. Their key strategic advantage is the utilization of advanced machine learning models and graph network analysis, which provide detailed insights into fraud patterns and enable rapid detection and prevention of fraud attempts. This capability is augmented by their customizable rule engines that allow businesses to specify and refine fraud detection parameters according to their needs.

-

How They Deliver on Their Value Proposition: Ravelin delivers its value proposition through a multi-faceted approach:

-

Machine Learning and Graph Networks: They employ sophisticated models that analyze billions of data points from transactions to identify and predict fraudulent activities. Their graph network tools help visualize connections between data points, making it easier for users to detect fraud rings and suspicious activity patterns.

-

Customizable Rule Engines: Ravelin offers flexible rule crafting solutions allowing businesses to set and adjust rules dynamically based on their evolving fraud patterns. This adaptability ensures customized fraud prevention strategies can be rapidly deployed with predictive insights into potential outcomes.

-

End-to-End Support: Ravelin provides comprehensive support services, including dedicated teams for integrations, product support, and data science to assist clients in optimizing their fraud solutions and ensuring effective use.

-

Visualization and Analytics Tools: Clients have access to dashboards and visualization tools that provide actionable insights and allow for in-depth analysis of transaction data. This helps businesses understand fraud patterns and adjust strategies proactively.

-

3D Secure Optimization: Ravelin helps businesses comply with payment regulations and optimize transaction authentication processes using their 3D Secure services. Their approach focuses on reducing transaction friction and churn while maintaining security.

In summary, Ravelin capitalizes on advanced technologies and collaborative client interactions to deliver tailored fraud prevention solutions that aid in securing online transactions while promoting business growth.

Hawk AI

Hawk AI’s mission is to help financial institutions detect financial crime more effectively and efficiently using AI to enhance rules and find anomalies.

-

Key Focus Area: Hawk specializes in providing anti-money laundering (AML) and fraud detection solutions to financial institutions, including banks, payment service providers, neobanks, and cryptocurrency firms. The company employs advanced artificial intelligence (AI) to meet the growing demand for more accurate financial crime detection and operational efficiency.

-

Unique Value Proposition and Strategic Advantage: Hawk's strategic advantage lies in its integration of AI, machine learning, and cloud-based technology within its compliance solutions. The company claims a significant reduction in false positives, around 70%, ensuring more efficient processing and prioritization of genuine threats. This capability allows financial institutions to better allocate resources and focus on actual risks, effectively reducing the noise in alert systems that complicates compliance tasks.

- Explainable AI: Hawk offers an explainable AI system, providing transparency in decision-making processes that enhance trust among stakeholders, regulators, and auditors.

- Modular and Customizable Framework: Its flexible platform can be tailored to specific organizational needs, supporting scalable deployments that align with customer growth and regulatory demands.

-

Delivery on Value Proposition: Hawk delivers on its value proposition through a comprehensive technology stack and suite of products designed to tackle various aspects of financial crime:

- Product Suite: It includes Payment Screening, Transaction Monitoring, Customer Screening, Customer Risk Rating, and Entity Risk Detection, all designed to increase risk coverage and operational efficiency.

- Integration and Scalability: The platform supports seamless integration with existing systems, allowing institutions to leverage AI tools over legacy systems without extensive disruptions. The modular nature facilitates scalability and flexibility.

- Real-Time Processing: Hawk emphasizes real-time surveillance capabilities, ensuring timely detection and prevention of suspicious activities across diverse transaction types and geographies.

- Compliance and Security: The solutions are designed in compliance with strict regulatory standards, e.g., GDPR, meant to proactively manage data protection and reduce regulatory burdens.

Overall, Hawk positions itself as a flexible and robust provider of AI-driven financial crime compliance tools requiring minimal manual oversight while bolstering operational transparency and security protocols within financial institutions.

LYNK Capital

Specializes in commercial real estate loan fraud prevention.

LYNK Capital - Business Overview for Executives

1. Company’s Key Focus Area

LYNK Capital primarily targets the real estate investment sector, focusing on providing a range of financing solutions nationwide. The firm offers various types of loans explicitly catering to real estate investors engaging in fix-and-flip projects, construction, rental property investment, and bridging finance needs. Their services encompass short-term and long-term loan products tailored to different investment strategies within the market.

2. Unique Value Proposition and Strategic Advantage

LYNK Capital distinguishes itself through flexibility and speed in lending processes. Their strategic advantage lies in a deep understanding of construction lending, backed by decades of experience, allowing them to adeptly serve real estate investors. Their loan products are structured to be competitively priced and adaptable to the fluctuating demands of real estate investments. As a direct lender, they promise rapid loan approvals and closings, addressing market needs for expedited access to funds without the typical bureaucratic delays seen in traditional banking.

3. How They Deliver on Their Value Proposition

LYNK Capital emphasizes a comprehensive service delivery framework:

-

Diverse Loan Options: They provide housing investors with fix-and-flip, construction, bridge, and DSCR rental loans, each product tailored to specific project requirements.

-

Streamlined Pre-Approval Process: With an efficient online application process, potential borrowers can receive pre-approvals quickly, often in just minutes, ensuring they can act swiftly in competitive markets.

-

No Requirement for Traditional Credit Checks or Documentation: LYNK Capital's loan approvals often avoid cumbersome personal financial assessments, such as tax returns, focusing instead on the potential profitability of projects.

-

Investor-Centric Approach: With significant experience in real estate investment financing―having funded over $1 billion in loans―LYNK Capital uses this insight to offer contractual terms that align more closely with the investor’s project timelines and financial needs than traditional banks.

-

Quick Draw Process for Construction Loans: For construction or renovation loans, LYNK Capital facilitates a staged disbursement of funds, matched against project milestones to maintain fund control aligned with budget use and verification.

-

Customizable Loan Structures: Through competitive LTV (Loan-to-Value) and LTC (Loan-to-Cost) ratios, alongside flexible term lengths and interest structures, they provide options that can be fine-tuned to align investor business models with project goals.

-

Dedicated Support: They promise focused customer service to navigate the complexities of loan management, ensuring that borrowers have access to knowledgeable teams that can provide assistance throughout the loan lifecycle.

-

Efficient Use of Technology: Utilizing an online platform for applications and information dissemination offers a user-friendly experience designed to keep investors promptly and effectively connected to their lending solutions.

LYNK Capital’s strategic focus is on serving not as a general financial institution, but as an invested partner understanding the unique challenges and fluidity of the real estate market. They aim to empower investors with the financial tools necessary to capitalize on market opportunities swiftly and confidently.

FOCAL

FOCAL provides fraud prevention and AML compliance software solutions, focusing on KYC operations, machine learning, and AI to detect and prevent fraudulent activities across various sectors. FOCAL provides fraud risk & AML compliance software solutions for KYC businesses. They offer tools for identity verification, income verification, customer screening, transaction monitoring, and more, aimed at protecting businesses from various types of ecommerce fraud.

Focal – Business Summary

Key Focus Area: Focal is primarily concentrated on the production and innovation of high-fidelity audio equipment. Their product range includes loudspeakers, headphones, integrated systems, and car audio solutions. They aim to enhance the listening experience across various environments, including homes, personal travels, commercial venues, and marine settings.

Unique Value Proposition and Strategic Advantage: Focal distinguishes itself through high-quality craftsmanship combined with cutting-edge acoustic technology. Their strategic advantage lies in their emphasis on:

- Innovative Technologies: They incorporate proprietary technologies into their products, such as the Slatefiber and Flax sandwich cones for speaker membranes, aimed at delivering precise sound.

- French Manufacturing and Craftsmanship: Focal capitalizes on its French roots to craft products that blend tradition and technological innovation, which contributes to its prestigious image on the international stage.

- Strategic Partnerships: Collaborations with brands like Naim Audio and partnerships within the automotive industry, such as with Opel, help integrate their audio solutions into diverse contexts, extending their brand reach and application scope.

Delivery on Their Value Proposition: Focal delivers its value proposition through several avenues:

-

Comprehensive Product Range: Catering to various audio needs, Focal's offerings vary from high-fidelity speakers and headphones to professional audio systems and car audio solutions. This range targets individual users as well as professional environments.

-

Focal Powered by Naim Boutique Network: These boutiques provide a physical space where customers can experience the unique sound quality of Focal products, tailored by the complementary technology of Naim.

-

Customization and Integration Services: Focal offers tailored solutions that adapt to specific user and environment needs, whether it's custom car installations or integrated systems for personal and commercial use.

-

Expert Guidance and Support: Through their extensive support system, Focal ensures customer satisfaction and product optimization, accompanied by thorough product documentation and customer service.

-

Innovation and Passion for Sound Excellence: Their manufacturing process integrates both innovation and aesthetic appeal, which enhances the emotional connection with their users.

Conclusion: Focal aims to offer pure, emotional audio experiences through their technologically advanced and aesthetically appealing products. By leveraging French craftsmanship and strategic collaborations, Focal seeks to maintain a foothold in the premium audio market globally. Their targeted product development and customer support systems are structured to uphold high standards and adapt to diverse environments and applications.

Payoneer

High-volume merchant onboarding automation service.

Summary of Payoneer's Offerings and Market Proposition

-

Key Focus Area: Payoneer is a financial services company that focuses primarily on facilitating seamless global business payments. Their platform is designed to streamline cross-border transactions, helping businesses and freelancers get paid and pay others in multiple currencies, efficiently and compliantly.

-

Unique Value Proposition and Strategic Advantage:

- Global Reach: Payoneer supports payments in 70 currencies across 190+ countries, providing businesses access to international markets as seamlessly as if they were local.

- Access to Major Marketplaces: They have established connections with leading marketplaces such as Amazon, eBay, and digital platforms like Upwork and Fiverr, facilitating businesses to extend their market reach.

- Compliance and Security: The company emphasizes secure transactions with a strong compliance and fraud prevention infrastructure, essential for managing risk in cross-border transactions.

- Multi-Currency Accounts: They offer multi-currency accounts that simplify the management of payments in different currencies.

-

Delivering on the Value Proposition:

- Comprehensive Payment Solutions: Payoneer's platform offers a plethora of services including receiving payments, withdrawing funds to local bank accounts, sending payments, and managing multi-currency operations, suitable for both freelancers and businesses.

- Ease of Use: The platform is user-friendly with functionalities to request payments, connect to global platforms, and send invoices.

- Partnerships and Integrations: They provide exclusive offers from partners and have integration capabilities with various business software, enhancing their utility for businesses of all sizes.

- Resource Hub and Support: Payoneer maintains a resource hub with videos, articles, and guides to assist users, alongside multilingual global support teams to cater to diverse client needs.

Payoneer's services are tailored for a vast array of industries including e-commerce, marketing agencies, IT outsourcing, and freelance professionals. They highlight cost-effectiveness by eliminating the steep fees typically associated with international wire transfers. Additionally, the platform supports mass payouts, making it particularly useful for marketplaces requiring bulk transaction capabilities. Their effort to breakdown barriers of international payments aims to make global transactions as convenient as domestic operations for their users.

Habito

Provides online mortgage brokering with confident decision-making capabilities.

Habito positions itself primarily in the mortgage brokerage and home-buying space, with a key focus on simplifying the process of acquiring a home and handling associated financial aspects, such as mortgages and legal proceedings.

Key Focus Area:

- Habito concentrates on easing the pains associated with obtaining a mortgage and buying a home. This involves providing services to both first-time buyers and those looking to remortgage or switch existing mortgage deals.

Unique Value Proposition and Strategic Advantage:

- The company offers an all-encompassing home-buying service, which stands out by integrating mortgage brokerage, legal work, and property surveys into one comprehensive service.

- Habito's strategic advantage lies in their digital-first approach, offering expert mortgage advice and application services online, which aims to minimize traditional paperwork and streamline the process.

- They emphasize impartiality by ensuring advice remains unbiased since they explore an expansive market of over 90 lenders.

Delivery on Value Proposition:

- Free Mortgage Brokerage Service: Customers receive free access to expert mortgage advice and can apply online. Habito is compensated by lenders, not by customers, which underscores their promise of free service.

- Complete Home-buying Package: For a starting fee, Habito proposes a comprehensive service that includes mortgage arrangement, legal conveyancing, and property surveying—essentially managing all administrative aspects of home buying.

- Personalized Support: They claim to provide a personalized experience with their "qualified mortgage broker and case manager," offering support throughout the process.

- Protection Products: Understanding that life is unpredictable, Habito also offers advice on insurance products to protect homeowners from potential risks like critical illness or loss of income.

- Digital Tools and Education: To further support buyers, Habito provides digital calculators, comparison tools, and educational resources to inform and assist users in their home-buying journey.

This model aims to offer simplicity and peace of mind to customers during what is often an overwhelming experience. Despite the reassurance of comprehensive services and no customer-facing fees for mortgage brokerage, it's important to view these claims through a critical lens, as this information primarily serves promotional purposes.

Finom

Focuses on cross-border AML transaction monitoring.

Key Focus Area:

Finom is focused on providing comprehensive financial services tailored for small and medium-sized enterprises (SMEs), freelancers, and companies in various stages of their lifecycle. The company prioritizes creating a holistic suite of digital financial tools, including business accounts with cashback, e-invoicing, and accounting integrations, as well as facilitating seamless international payments.

Unique Value Proposition and Strategic Advantage:

Finom’s unique value proposition lies in their digital-first approach, tailored specifically for small business needs. The strategic advantage is highlighted by their ability to quickly open IBAN accounts within 24 hours and offer up to 3% cashback on expenses. The company aims to enhance business operations by integrating financial functions with automated tools designed for invoicing, accounting, and expense management. These tools streamline business processes and are intended to enable businesses to be financially efficient with minimal administrative burden.

Delivery on Value Proposition:

To deliver on its value proposition, Finom leverages the following capabilities:

- Digital Business Accounts: Quick account setup with online registration aimed at minimizing entry barriers for businesses needing swift financial solutions.

- Cashback Incentives: Up to 3% cashback on spending, which reduces operational costs for businesses and incentivizes the use of their financial products.

- Comprehensive E-Invoicing Tools: Integrated billing and invoicing services designed to support quicker payments and reduce time spent on reconciliation.

- Security and Compliance: Finom ensures financial security through partnerships with regulated bodies like Solaris Bank and Treezor, thereby protecting client accounts and providing deposit insurance.

- Global Payment Capabilities: Support for international transactions in over 20 currencies, facilitating smooth global operations for businesses.

- Integration with Accounting Software: The service extends compatibility with over 30 business and accounting processes, reducing the manual labor involved in bookkeeping and enhancing productivity.

- Accessible Support: A support team available seven days a week with quick response times, and dedicated managers for advanced plan subscribers, ensuring customer queries and needs are promptly addressed.

Overall, Finom presents itself as a comprehensive digital banking solution, focusing on speed, cost-efficiency, and ease of use, specifically catering to the financial management needs of freelancers and SMEs across Europe. They achieve this through a combination of practical tools, secure operations, and incentivized use of their banking services.

Altamira

Altamira is a company that offers a range of software development services, including custom software development, software integrations, and web development. They also provide consulting services for AI, data and analytics, and offer team augmentation and dedicated development teams.

Altamira is a software development company with a strategic emphasis on providing tailor-made solutions for businesses at various stages of growth, particularly focusing on scaling up and system optimization.

Key Focus Area: Altamira primarily focuses on software development and consultancy services, covering areas like custom software development, mobile and web application development, AI consultancy, and vendor audit and transitions.

Unique Value Proposition and Strategic Advantage: Altamira offers a comprehensive suite of services designed to address common challenges faced by businesses as they scale. A key component of their strategy is their discovery phase, a pre-development process that helps to clarify scope, validate ideas, and mitigate risks. This is bolstered by their unique vendor audit and transfer framework, which aims to ensure seamless transitions between service providers, avoiding potential disruptions. Their consultancy and audit services stand out by providing deep insights into existing processes and recommending operational improvements, thus allowing for enhanced efficiency and sustainability.

Delivery on Value Proposition:

-

Comprehensive Services: Altamira provides a wide range of services from software auditing and consulting to custom development and vendor management. This scope ensures that their clients can find solutions tailored to their specific needs, whether they are startups or large enterprises.

-

Discovery Phase: They promote a well-defined project initiation phase to help clients better understand their development needs. This is designed to reduce uncertainties and improve budgeting and timeline predictions, thereby creating a solid foundation for subsequent development work.

-

Vendor Audit and Transition: By focusing on smooth vendor transitions and thorough vendor evaluations, Altamira minimizes operational disruptions. They employ a structured vendor audit to identify and rectify inefficiencies, ultimately optimizing vendor relationships and outcomes.

-

AI and Modern Development Practices: Altamira leverages advanced technologies such as artificial intelligence, no-code/low-code platforms, and data analytics to enhance productivity and reduce time-to-market. This approach is particularly beneficial for businesses looking to scale their operations swiftly and effectively.

-

Software Development Consultancy: The consultancy aspect delves into refining technology strategies and aligning them with business objectives. Altamira assesses technology stacks, architecture, and processes to ensure they are fit for purpose and scalable.

-

Quality and Compliance: The company places emphasis on compliance and security standards across their services, ensuring that all deliverables meet regulatory requirements and industry best practices.

In conclusion, Altamira's blend of software development services, strategic planning through discovery, and comprehensive vendor management capabilities equips them to address the multifaceted challenges businesses face while scaling. They focus on ameliorating development bottlenecks and paving the way for sustained growth and innovation.

IQM

IQM builds scalable hardware for universal quantum computers, focusing on superconducting technology.

IQM is primarily an industry-specific digital advertising platform, with a strong focus on facilitating programmatic media buying and audience intelligence for political, healthcare, B2B, finance, travel, retail, and sensitive sectors. The company offers targeted solutions that enable advertisers to effectively reach their desired audiences across these industries.

Key Focus Area:

- Industry-Specific DSP Platform: IQM specializes in developing demand-side platforms (DSP) tailored to the unique characteristics and requirements of various industries. This bespoke approach aims to optimize advertising efficiency and effectiveness within each sector.

Unique Value Proposition and Strategic Advantage:

-

Contextual and Audience Intelligence:

- IQM employs proprietary AI and machine learning algorithms to offer precise audience and contextual targeting, ensuring that campaigns are both relevant and impactful.

- Their AI-powered platform allows advertisers to reach their audience with enhanced precision, leveraging contextual and location intelligence.

-

Tailored Solutions:

- IQM differentiates itself by offering industry-specific solutions that cater to the unique needs and challenges of its various customer verticals. This includes specialized inventory, audience matching, and creative AI capabilities that align with specific industry characteristics.

-

Transparent and Efficient Operations:

- The company stresses transparency in campaign management, offering clients full visibility with advanced reporting and analytics tools.

-

No Minimum Fees:

- IQM promotes accessibility with no minimum financial barriers for campaign launches or management, differentiating them from competitors who may have high entry costs.

Delivery on Value Proposition:

-

Comprehensive Planning and Targeting Tools:

- IQM’s self-serve platform allows advertisers to plan, launch, track, and optimize campaigns using audience insights. The platform supports real-time optimization to improve agency effectiveness and return on investment.

-

Advanced Targeting Options:

- Utilizing technologies like geo-fencing and geo-farming for high-precision location targeting, IQM’s platform enables advertisers to reach audiences based on their location, past behaviors, and consumption patterns.

-

Creative AI and Optimization:

- Proprietary creative AI technology enhances ad performance by abstracting contextual data from ad creatives and matching it with curated inventories.

- AI-driven auto-optimization dynamically scales high-performing ad units and bids in real-time, ensuring optimal placement and cost-effectiveness.

-

24x7 Support and Expert Guidance:

- The company offers round-the-clock multilingual AdOps support, providing expert advice and campaign assistance to optimize audience targeting and campaign effectiveness.

-

Omnichannel Reach:

- IQM offers audience extension capabilities across various channels like social media, email, search, and direct mail, ensuring consistent messaging and maximizing reach across all touchpoints.

Together, these unique offerings position IQM as a potent choice for advertisers seeking effective, industry-specific digital advertising solutions tailored to their strategic objectives.

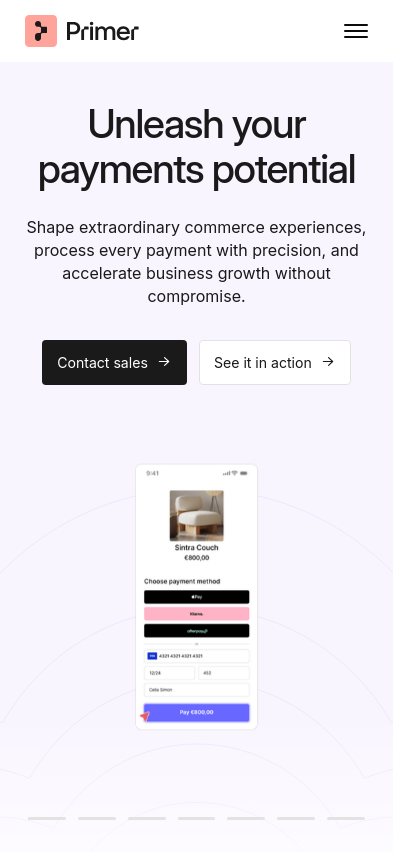

Primer

Primer develops machines that automate large dataset analysis using natural language processing to extract insights from open source intelligence.

Primer focuses on revolutionizing the payment infrastructure by providing a seamless, unified, and customizable payment experience for businesses. This platform integrates various payment methods, services, and processors to enable businesses to manage their entire payment lifecycle within a single interface, facilitating enhanced customer experiences and operational efficiencies.

Unique Value Proposition and Strategic Advantage: Primer’s unique value proposition is its ability to transform complex payment systems into a streamlined, easy-to-manage interface without the need for extensive coding or technical expertise. This positions Primer as a strategic partner for businesses looking to optimize their payment strategies by leveraging:

-

Unified Payment Infrastructure: Offers an open and adaptable framework that allows for seamless integration and management of multiple payment services and methods. This unification facilitates new service deployment, expands into new markets, and enhances overall payment efficiency without the complexities tied to traditional payment infrastructures.

-

No-Code Platform: Businesses can activate and configure payment services simply by utilizing Primer's no-code platform. This saves engineering resources and accelerates time-to-market for new product offerings, allowing companies to focus on strategic initiatives rather than technical integrations.

-

Comprehensive Payment API: Provides a single point of integration for businesses, reducing the overhead associated with managing multiple payment services through one API. This enables unified control over the entire payment process, from authorization to dispute management.

Delivery on Value Proposition: Primer delivers on its value proposition through several key strategies and features:

-

Apps and Integrations: With over 100 global integrations, businesses can easily customize their payment stack using a marketplace of processors and fraud providers. This flexible integration approach allows for easy adjustments and enhancements to the payment system as business needs evolve.

-

Optimization Features: Primer offers optimization tools such as network tokenization to increase authorization rates and reduce fraud, alongside fallback mechanisms that route payments to a secondary processor if the primary one fails. These features are designed to enhance payment success and operational efficiency.

-

Observability and Data Insights: By providing real-time visibility into the payment stack, Primer enables businesses to monitor performance, conduct A/B testing, and quickly address payment issues. Advanced data visualization tools aid in understanding payment flows, enhancing decision-making, and uncovering optimization opportunities.

-

Localized and Personalized Checkout Experiences: Through Universal Checkout and customizable checkout solutions, Primer allows businesses to create localized experiences that align with customer preferences, improving conversion rates across different geographies and currencies.

-

Robust Security and Compliance: Primer maintains PCI-DSS Level 1 compliance and offers agnostic 3D Secure (3DS) solutions, ensuring secure and compliant payment transactions without increasing the user burden during the payment process.

By providing a flexible, innovative payment framework, Primer empowers its clients to enhance customer experiences, optimize payment operations, and strategically position themselves within the competitive landscape of global commerce.

Composio

No summary available.

Key Focus Area

Composio's primary focus is on catering to aspiring authors by providing a comprehensive self-publishing platform. The company is designed to support users at every stage of the book creation process, from conceptualization and writing to publishing and marketing. Whether users have a book in the early idea stages or already require marketing solutions for an existing work, Composio provides tailored tools to help achieve these goals.

Unique Value Proposition and Strategic Advantage

Unique Value Proposition:

- Composio combines writing, publishing, and marketing capabilities into a single streamlined platform. This approach contrasts with the usual self-publishing process, which involves multiple platforms for writing, publishing, and marketing books.

Strategic Advantages:

- Integrated Platform: Unlike its competitors, Composio offers an all-in-one environment, eliminating the need to juggle between various services such as Google Docs for writing, Amazon KDP for publishing, and Buffer for marketing.

- Machine Learning: The incorporation of machine learning into the platform means it can learn from a user's writing style and preferences over time, offering personalized suggestions to enhance productivity and efficiency.

Delivery of Value Proposition

Composio delivers on its promise through the following structured solutions:

Writing Assistance:

- Offers customized smart templates to provide layouts and formats conducive to different book genres.

- Includes collaboration tools to enable writing with partners or teams.

- Provides professional editing services ensuring books are publication-ready.

Publishing Support:

- Facilitates easy self-publishing with minimal setup via a few clicks, optimizing books for both printed and e-book formats.

- Provides logistic support such as ISBN numbers and copyrights.

- Gives users the ability to distribute books on major platforms like Amazon, Barnes & Noble, and Apple iBooks, ensuring broad availability.

Marketing Tools:

- Equips authors with email and social media marketing tools to engage with potential audiences effectively.

- Composio's automated marketing solutions apply successful selling strategies with one-click deployment to transform book exposure.

- Emphasizes building an online community through direct reader interaction and feedback mechanisms using book excerpts.

Business Model and Market:

- The subscription and royalty-based revenue model underscores its viability within the blossoming $30 billion U.S. book industry.

- Composio markets its platform through partnerships with author groups and aggressive digital marketing strategies across various channels like social media and SEO.

By addressing the needs of both novice and professional authors and providing a fully integrated platform, Composio aims to not only streamline the self-publishing process but also empower authors to reach a wide audience with their works efficiently.