⚡ZurzAI.com⚡

Companies Similar to Federato

SambaNova Systems

SambaNova provides an enterprise-grade AI platform, enabling rapid deployment of advanced AI capabilities for various sectors, enhancing competitive edge and operational efficiency.

SambaNova: A Summary for Executives

1. Key Focus Area

SambaNova Systems is focused on providing an advanced artificial intelligence (AI) computing platform that supports generative AI and deep learning models. Their main objective is to enable businesses and government entities to leverage sophisticated AI technology to unlock data insights and enhance operational efficiencies. This is achieved through their flagship product, the SambaNova Suite, which offers a comprehensive end-to-end solution encompassing hardware, software, and services tailored specifically for enterprise-scale AI deployment.

2. Unique Value Proposition and Strategic Advantage

Unique Value Proposition:

- Full-Stack AI Platform: SambaNova offers the only complete enterprise-grade, full-stack AI platform, which includes the SambaNova Suite and DataScale systems. This solution integrates everything from AI model design to deployment, providing a unified solution that simplifies AI adoption for large-scale applications.

- Performance and Efficiency: The company prides itself on delivering one of the fastest inference platforms globally, which is facilitated by the DataScale's Reconfigurable Dataflow Unit (RDU). This allows for significantly faster data processing and reduced power consumption compared to conventional GPU systems.

- Customization and Security: SambaNova emphasizes complete data privacy and model ownership. Customers can securely train and refine their models, ensuring that sensitive data remains protected within their own infrastructure.

Strategic Advantage:

- SambaNova's strategic advantage lies in its ability to offer a highly scalable, flexible, and secure AI platform that outperforms traditional GPU-based systems. By using their RDU technology, they provide both high-speed model training and inference capabilities, ensuring that organizations can handle complex AI workloads efficiently.

3. Delivering on Their Value Proposition

Products and Technologies:

- SambaNova Suite: Encompasses a suite of tools including DataScale systems and SambaStudio software, which help organizations easily manage and deploy AI models.

- DataScale: Engineered to deliver world-record performance and energy efficiency across various AI model sizes, including large-scale models like Llama 3.1, 3.2, and 3.3.

- Composition of Experts (CoE): An innovative model architecture that allows multiple AI models to work collaboratively, enhancing model efficiency and performance.

Delivery Mechanisms:

- SambaNova offers flexible deployment options, allowing businesses to implement their solutions on-premises or in the cloud, tailored to their specific needs.

- The platform integrates with open-source machine learning frameworks, easing the transition for organizations migrating from legacy systems.

- By providing robust developer resources, support, and a dedicated startup accelerator program, SambaNova fosters innovation and speeds up AI adoption.

Sector-specific Applications:

- Public Sector: Supports rapid deployment for government and research facilities with secure, custom-built AI solutions.

- Science and Technology: Facilitates scientific discoveries and simulations with their high-performance architecture, enabling advancements in knowledge-intensive fields.

In conclusion, SambaNova Systems positions itself as a provider of advanced AI solutions tailored for large-scale, enterprise applications. Its comprehensive platform, combined with its unique RDU technology, supports organizations in unlocking value from their data while ensuring performance, efficiency, and security.

Rasa

Rasa provides an innovative, no-code framework for building advanced conversational AI assistants, focusing on ease of use, security, and scalability while enhancing customer experience.

Summary for Executive Audience: Rasa Technologies

-

Company's Key Focus Area: Rasa Technologies primarily focuses on developing sophisticated conversational AI solutions. Their core offering enables enterprises to create and deploy virtual assistants that facilitate seamless interaction between organizations and their customers. This focus is encapsulated in their multi-faceted approach, incorporating both text and voice-based AI systems that operate on a global scale.

-

Unique Value Proposition and Strategic Advantage:

- Conversational AI Infrastructure: Rasa provides an open-core framework tailored for enterprises, leveraging generative AI to create complex conversational experiences. This strategic advantage allows enterprises to develop AI that comprehends and adapts to the nuances of natural language, while ensuring compliance with existing regulations.

- Modular and Extensible Platform: Their architecture allows for extensive customization, facilitating integration with existing systems and deployment in various environments. This approach provides companies the flexibility to scale and personalize AI solutions without being restricted by vendor-specific constraints.

- Delivery on Value Proposition:

- Product Offering: Rasa delivers its value through a suite of products, including Rasa Pro, which is designed for robust conversational AI development. The platform supports deployment in secure, scalable environments and handles high-volume customer interactions.

- No-code User Interface: Rasa Studio enhances cross-department collaboration by offering a no-code UI for designing, testing, and optimizing AI systems. This empowers diverse teams to engage with the platform, streamlining the AI development process.

- Data Sovereignty and Compliance: Rasa allows enterprises to maintain control over their data, minimizing privacy risks by enabling deployments within their own infrastructure or private clouds. This is particularly advantageous for industries with strict compliance requirements.

- Conversational Development Methodology: Their conversation-driven development approach focuses on iterating AI solutions through real user interaction, ensuring alignment with customer needs and language use. By utilizing a data-driven cycle of design, testing, and refinement, Rasa supports the continuous improvement of their clients' virtual assistants.

Conclusion: Through a combination of sophisticated AI infrastructure, flexible deployment options, and a conversation-driven methodology, Rasa Technologies positions itself as a viable option for enterprises seeking to enhance their digital interaction channels. They aim to transform customer experiences by enabling tailored AI solutions that align with organizational objectives and regulatory demands.

Unsupervised

Offers an automated analytics platform that finds hidden insights in complex data.

Unsupervised is an analytics platform specializing in automating the process of data analysis using AI-driven insights, answers, and predictions. Its focus lies primarily in leveraging AI Data Agents to streamline complex data analytics tasks across multiple industries, including telecom, finance, healthcare, and technology.

Key Focus Area:

- Unsupervised serves various sectors by automating analytics to derive actionable insights from complex datasets. The focus is on empowering businesses to make data-driven decisions without needing extensive data science resources.

Unique Value Proposition and Strategic Advantage:

- Automated Analytics: Unsupervised offers an automated data platform featuring AI Agents that continuously learn from connected data platforms. These agents automate data preparation and analytics, promising substantial savings in time and resources.

- Actionable Insights: The platform's AI discovers insights considered actionable, claiming businesses can uncover these without the need for manual data crunching.

- Customization and Scalability: Users can customize AI agents to align with specific key performance indicators (KPIs), potentially minimizing unfilled analyst roles and onboarding.

- Integration and Adaptability: Compatible with existing data infrastructure, the platform can adapt and scale as companies grow, with AI that purportedly identifies large financial opportunities.

How They Deliver on Their Value Proposition:

- Deployment and Integration: Unsupervised's AI integrates with existing data infrastructures, purportedly requiring minimal setup. It continuously examines data to identify patterns and insights that can drive business actions.

- Industry-Specific Solutions: The platform claims to cater to different industries by offering tailored solutions, such as predicting churn in telecom or identifying segment patterns in healthcare.

- Comprehensive Analysis: AI Agents execute complex analyses, providing insights into areas like fraud detection, customer retention, and operation efficiencies. Solutions also aim to link insights directly to potential financial impacts, thereby supporting strategic decision-making.

- Client Success: Various case studies and testimonials cite significant ROI, with customers like AT&T uncovering over $100M in opportunities using Unsupervised's tools. However, these should be viewed with skepticism as they are presented as advertising material.

- Security and Governance: Unsupervised emphasizes data security and compliance through limited and controlled access, SOC 2 Type II adherence, and a framework of security policies.

While marketed capabilities such as reducing manual data preparation time and enhancing decision-making speed appeal to customers, it is critical to verify claims through independent evaluations and pilot tests tailored to specific business needs.

Onfido

Onfido provides AI-powered digital identity solutions for onboarding, compliance, and fraud prevention, helping businesses enhance customer trust and reduce operational costs.

About | About | About | About | About | News | Careers | News | About | Leadership | About | About | About | About | About

Onfido's Key Focus Area

Onfido specializes in digital identity verification. The company provides a comprehensive platform aimed at businesses needing to verify user identities online and ensure compliance with regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering). Their key focus is to create trust in digital interactions and onboarding processes through their suite of identity verification solutions.

Unique Value Proposition and Strategic Advantage

Onfido's proposition lies in its "Real Identity Platform," designed to perform identity verification in a seamless, efficient, and automated manner. Their strategic advantage hinges on the use of AI-powered technology, particularly their in-house developed Atlas AI, which is claimed to provide fast and fair biometric and document verification. This capability not only enhances the speed of onboarding but also reduces the risk of fraud, offering businesses a scalable solution to navigate complex compliance landscapes and manage costs effectively.

Delivering on Their Value Proposition

Onfido delivers its value proposition through a combination of product offerings and technological infrastructure:

-

The Real Identity Platform: This platform integrates document verification, biometric verification, data verification, and fraud detection into a single, cohesive service. It aims to streamline the identity verification process by providing fast and accurate results through automated systems.

-

Atlas AI: At the core of Onfido's offerings is the Atlas AI, which claims to deliver swift verification results, processing 95% of biometric verifications in under 10 seconds. Atlas AI is developed using global datasets to ensure that its algorithms are fair and unbiased, addressing potential issues such as racial or gender bias in its technology.

-

Smart Capture SDK: Onfido offers a software development kit (SDK) that enables businesses to incorporate identity verification functionalities into their mobile apps and websites. This is intended to enhance user experience by providing real-time feedback and optimizing the verification process to reduce friction during sign-up.

-

Compliance and Fraud Prevention: Onfido emphasizes its robust compliance framework designed to meet regional regulatory requirements, such as KYC and AML. This is coupled with comprehensive fraud detection, intended to safeguard businesses by accurately identifying fraudulent activities using machine learning-driven analytics.

-

Onfido Studio: A no-code orchestration tool that allows businesses to tailor verification workflows to meet specific needs and risk profiles, adapting swiftly to changes in market conditions without requiring specialized coding knowledge.

-

Global Coverage and Scale: Their suite supports identity document verification from over 2,500 document types across 195 countries, which provides businesses with global scalability and a consistent user experience worldwide.

Overall, Onfido positions its offerings as a pivotal enabler for businesses aiming to streamline user onboarding while ensuring compliance and fraud protection, all facilitated by advanced AI-driven technology. The company caters to industries like financial services, gaming, healthcare, and telecommunications, where digital identity verification is critical.

Vorto

Vorto develops AI platforms to automate logistics and supply chains, enhancing efficiency through machine learning and data-driven insights. Vorto is an AI-based platform that predicts demand for products, procures them from suppliers, and schedules logistics to fulfill demand.

Vorto is a company focused on supply chain automation through their AI-powered platforms. Founded in 2017, Vorto aims to transform supply chains by improving efficiencies and reducing the environmental impact of trucking logistics. Their platforms offer solutions that automate procurement and logistics processes, reducing the reliance on physical resources and allowing companies to significantly cut costs while improving operational efficiency.

Key Offerings:

-

ReLOAD Platform: This platform is claimed to revamp supply chains using AI to forecast demand, manage fleets, automate payments, and solve logistical issues in real-time.

-

AI-Powered Automation: Vorto's AI predicts product demand, procures supplies, and manages deliveries, optimizing the supply chain by learning from historical consumption data. This helps in maintaining optimal inventory levels.

-

Autonomous Supply Chain: Vorto offers a fully autonomous supply chain that enhances efficiency by automating decision-making for logistics and procurement needs.

-

ReLOAD, HAULi, and SANDi: These are proprietary tools from Vorto to streamline various supply chain processes.

Impact and Benefits:

-

Cost Savings: The AI-driven platform reportedly reduces supply chain operational costs by 40% and can save clients up to $480 million per year.

-

Environmental Benefits: Some case studies suggest a reduction of up to 150,000 tons in CO2 emissions and improved truck utilization, lowering the number of trucks on the road by up to 66%.

-

Efficiency: Vorto’s technology increases carrier efficiency by automating load dispatch based on driver location, service hours, and vehicle type, minimizing detention times and maximizing resource use.

Solutions to Common Industry Challenges:

-

Driver Shortages: Addressed by optimizing route assignments to keep drivers consistently on the road, enhancing their earning potential.

-

Demand Prediction and Supply Matching: Vorto’s platforms handle supply-demand imbalances that occur due to unforeseen circumstances like road closures or accidents.

-

Real-Time Problem Solving: Vorto’s systems make instantaneous decisions in the face of changes, adjusting logistics plans without the need for human intervention.

Company Vision and Expansion:

Vorto places a strong emphasis on creating a more sustainable and efficient operational model for companies of various sizes, from small trucking businesses to large Fortune 500 companies, across North America.

Leadership and Corporate Culture:

-

Leadership: CEO Priyesh Ranjan and a team sourced from various industry successes drive Vorto. The company emphasizes an innovative, mission-driven approach to solve the trucking industry challenges.

-

Work Culture: Vorto is described as a place that attracts individuals inclined towards resilience, innovation, and overcoming challenges, providing roles across engineering, operations, and administrative realms.

Growth and Advisory Board:

- Vorto is actively expanding its influence by adding experienced members to its advisory board, drawing from industry leaders in companies like Procter & Gamble, Anheuser-Busch, and Walmart.

Industry Engagement:

Vorto continually engages with contemporary logistic challenges and regulatory environments, such as California’s zero-emission mandates, to drive industry innovations.

In summary, Vorto presents itself as a forward-thinking company utilizing AI to address supply chain challenges, improve efficiencies, and reduce environmental impacts while fostering a supportive and growth-oriented culture among its employees. They offer various tools and automation platforms aimed at transforming supply chain processes across multiple industries.

Persado

Persado Marketing Language Cloud delivers AI-generated language that resonates with audiences for more effective marketing.

Persado is a company specializing in generative AI solutions for creating dynamic and personalized marketing content. Ranked highly by CB Insights with a score of 9.8/10 as a top generative AI text content firm, Persado provides a platform called Motivation AI that leverages artificial intelligence to optimize customer engagement through emotionally informed content. Here is a breakdown of the company’s offerings and insights into how they shape customer communication and engagement:

Platform and Capabilities

-

Motivation AI Platform: This platform is capable of generating, optimizing, and personalizing marketing language at scale. It boasts the power to deepen customer engagement and loyalty across various industries including financial services, retail and ecommerce, telecommunications, travel, and hospitality.

-

Full Stack GenAI: Incorporates integrations, governance, security, privacy features, and capabilities such as generating tailored content to specific audience segments, compliance with brand and legal guidelines, and the ability to analyze and predict content performance.

Key Features

-

Generate, Predict & Personalize: The platform creates emotionally engaging, on-brand content in real-time, informed by over a decade of consumer responses. It can generate content for multiple channels like web, mobile, email, SMS, and social media.

-

Experiment and Analyze: Persado's platform provides the ability to experiment with thousands of content variations at scale, allowing brands to identify which language elements enhance engagement and conversion rates.

-

Comply: The AI-driven solution ensures content is aligned with regulatory and legal requirements across various sectors, especially in financial services, ensuring that messages maintain compliance and brand integrity.

Industry Applications

- Financial Services: Persado is trusted by top U.S banks to craft highly personalized messages that drive customer engagement and loyalty.

- Retail & Ecommerce: The platform helps brands to create on-brand, motivational digital messages that encourage customer action across different shopping channels.

- Telecommunications: Carriers like Verizon and Vodafone utilize Persado's solutions to enhance customer interactions and lower churn rates.

- Travel & Hospitality: Enables travel brands to produce content that motivates consumers to engage, book services, and opt for upgrades.

Governance, Security, and Privacy

- Adheres to ISO 27001 and SOC 2 Type 2 standards, supporting responsible AI use through governance frameworks that ensure ethical, transparent, and compliant usage.

- Designed to protect data privacy with advanced encryption, access controls, and a non-sharing policy for personally identifiable information.

Customer Insights and Case Studies

- Major clients such as JPMorgan Chase, Ally Bank, and Vodafone have reported significant benefits from using Persado’s AI solutions, noting improvements in engagement, conversion rates, and CRM activities.

- Real-world applications demonstrate enhanced customer engagement, with some companies like Vodafone witnessing up to a 42% increase in conversion rates by personalizing messages for individual customer segments.

Recognition and Differentiators

- Highlighted as a leader in the generative AI landscape by CB Insights, Persado stands out with its dataset of over 330 billion consumer interactions and its ability to support content across all marketing channels.

- The company’s solutions are regarded for their ability to deliver quantifiable results and continuously adapt to changing consumer dynamics and preferences.

Overall, Persado offers a comprehensive suite of AI-driven marketing tools that help brands connect more effectively with their audiences by tailoring messages to resonate emotionally, improve engagement, and drive business growth, while ensuring compliance and reducing manual effort in content creation.

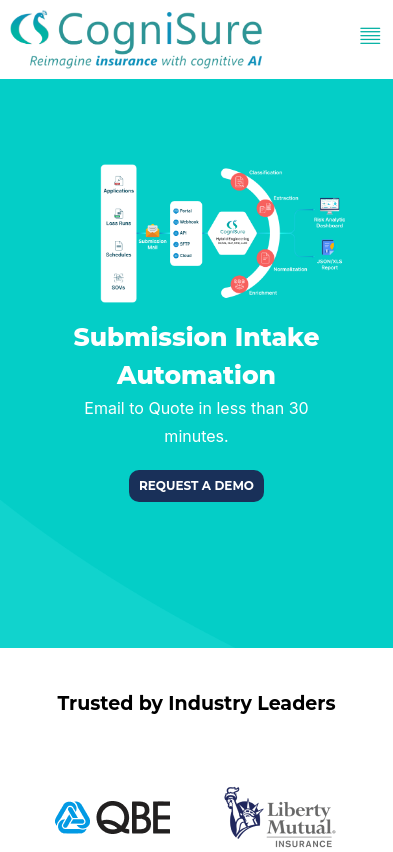

CogniSure

CogniSure is a company focused on transforming the future of insurance by providing smart and efficient underwriting solutions.

CogniSure AI is a company focused on utilizing artificial intelligence to address challenges in the insurance industry, particularly dealing with unstructured data. The company offers specialized solutions aimed at enhancing underwriting efficiency, risk management, and financial reporting for insurance stakeholders. Here's a consolidated overview of their offerings and approach:

Solutions Offered:

-

Submission Insights: Aimed at optimizing the underwriting process by reducing the time and resources needed to transition from submission to quote. The platform automates document ingestion and decision-making, helping reduce inefficiencies and cycle times.

-

Loss Run Insights: Facilitates data extraction from unstructured insurance documents, providing insights into trends, patterns, and potential risks quickly. This solution allows insurance brokers and underwriters to better manage and analyze loss run data across various carriers.

-

Benefit Insights: Designed for employers managing benefit plans, this platform streamlines financial reporting by automating data processing from multiple vendors. It delivers analytics capable of identifying cost drivers and coverage gaps, thereby facilitating better decision-making.

Platform Features:

CogniSure employs a mixed approach of non-symbolic AI (like machine learning and deep learning) and symbolic AI (embedding human intelligence) to add value through data enrichment. The platform includes various elements, such as:

- MailExtract: Automates the extraction of relevant data from emails.

- SplitAny and ClassifyAny: Divides large documents into sections for easier processing and uses algorithms to identify types and origins of documents.

- ExtractAny and InterpretAny: Facilitates detailed data extraction according to user needs and deciphers textual insights using natural language processing.

- Any2Any and SearchAny: Converts data into standard formats for better compatibility and retrieves particular insights from large data sets.

Technological Infrastructure and Security:

CogniSure uses a cloud-hosted, scalable infrastructure on platforms like AWS to ensure data security and availability. The platform is designed to meet stringent security standards, with features like encryption, access control, and regular security audits to protect sensitive information.

Partnerships and Client Testimonials:

CogniSure has strategic partnerships with companies like Duck Creek Technologies and Federato, and collaborates with organizations to integrate its solutions into broader insurance processes. Testimonials highlight the platform’s effectiveness in transforming complex data into useful insights, reducing operational costs, and enabling smarter risk management decisions.

Strategic Vision:

CogniSure focuses on innovation to reshape how the insurance industry handles unstructured data. Their AI-powered platform aims to increase productivity, reduce manual processes, and enhance data-driven decision-making for better risk evaluation and underwriting strategies.

This approach positions CogniSure as an influential player in the InsurTech space, aiming to drive digital transformation within the insurance sector. Their solutions are tailored to make the processing of previously untapped or underutilized data a manageable and insightful task.

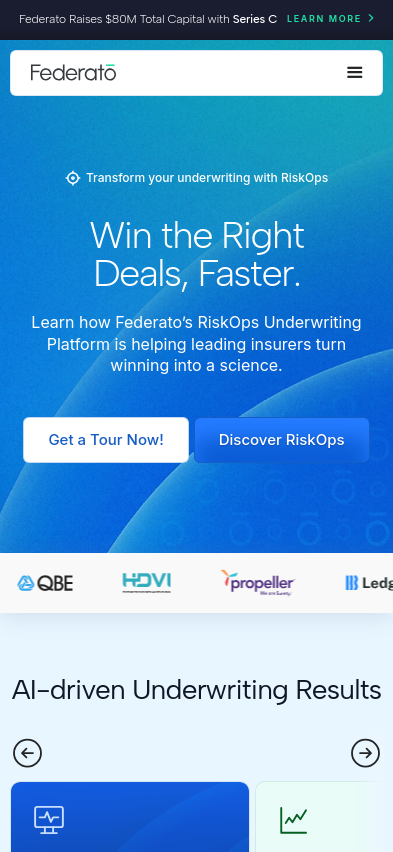

Federato

A company that recently partnered with CogniSure to drive commercial lines underwriting transformation.

Federato is a technology company focusing on transforming the underwriting process in the insurance industry through its AI-driven platform called RiskOps. The company has recently raised a total of $80 million in funding, aiming to enhance its platform's capacity to manage insurance underwriting for carriers, managing general agents (MGAs), and mutuals.

Federato’s RiskOps Platform:

- Automatic Submission Triage: Using AI, the platform helps insurers identify and prioritize the most promising insurance submissions, streamlining the workflow for underwriters and enabling them to focus on profitable deals.

- Real-Time Decision Support: Federato's platform uses data-driven algorithms to assist underwriters in determining the most winnable submissions by integrating "type 1" data (account size and risk) with "type 2" interaction data (past interactions), enhancing the accuracy of risk assessment.

- Single Pane of Glass: Federato consolidates multiple systems into a unified interface, eliminating the need for underwriters to switch between different systems and reducing operational complexity.

Areas of Impact:

- Efficiency and Speed: The platform significantly reduces time-to-quote by providing a centralized system that combines both internal data and third-party integrations, improving underwriters' ability to assess risks quickly and accurately.

- Rater and Submission Interfaces: Federato includes streamlined interfaces for rating engines and submissions, integrating various tools and data sources to minimize the manual entry and ensure accurate risk evaluation.

- Industry Challenge Mitigation: The platform addresses challenges such as overwhelmed traditional underwriting processes and fragmented workflows across legacy technology, providing a more cohesive and data-centric approach.

Targeted Solutions:

- For Carriers: Federato's platform helps insurance carriers optimize portfolio management and modernize systems to align with business goals, reducing inefficiencies and improving the speed of signing new deals.

- For MGAs and Mutuals: The platform enhances MGAs' and mutuals' ability to attract high-value business and manage data effectively to achieve portfolio objectives. It supports operational efficiency by providing tools that facilitate faster underwriting decisions.

Case Studies and Use Cases:

- Velocity Risk and HDVI: The RiskOps platform has been applied to improve underwriting processes for companies like Velocity Risk, which saw an 89% reduction in time-to-quote, and HDVI, which uses real-time data to enhance underwriting efficiency.

- QBE Partnership: Federato's collaboration with QBE demonstrates its impact on transforming underwriting operations through efficient data management and real-time decision-making capabilities.

Federato aims to empower its clients with cutting-edge AI technologies to provide inclusive and resilient insurance coverage, adapting to societal risks such as climate change and cyber threats. The company's long-term vision is reflected in its continued efforts to innovate and improve underwriting efficiency through its comprehensive RiskOps platform. Additionally, Federato's strategic partnerships and product innovations showcase its commitment to supporting insurers in modernizing their operations.

SixFold

No summary available.

Sixfold provides an artificial intelligence platform tailored for insurance underwriting. It aims to enhance underwriting efficiency, accuracy, and transparency for insurers, Managing General Agents (MGAs), and reinsurers.

Features and Capabilities:

-

Risk Assessment and Recommendations: Sixfold automates risk assessment by ingesting and analyzing data according to a company’s underwriting guidelines. This enables the platform to identify and suggest recommendations based on positive, negative, and disqualifying risk factors. The platform collects and processes data from various sources and outputs summaries and risk recommendations tailored to the client's specific risk appetite.

-

Data Management and Summarization: The AI tool handles vast amounts of collected data efficiently, converting detailed documents and application forms into structured summarizations. This reduces the manual workload involved in going through complex and bulky data, improving the speed and efficiency of underwriting processes.

-

Transparency and Compliance: Transparency in decision-making is a crucial aspect of the platform. Sixfold ensures every decision is traceable and explainable, aligning with compliance requirements through measures like SOC 2 Type II and HIPAA compliance.

-

Tailored Solutions for Various Insurance Lines: Sixfold is adaptable for different insurance categories, including Property & Casualty (P&C), Speciality, Cyber, Life & Disability, and Reinsurance. For example, weighted risk signals are used to align decisions with a customer's specific underwriting guidelines, showcasing the adaptability and specificity of Sixfold's AI capabilities in diverse fields.

-

Enhanced Underwriting Workflow: To assist underwriters in making informed decisions quickly, Sixfold offers tools like automatic triaging of submissions, use of NAICS/SIC codes for classification, and data collection from both internal and external sources to provide a comprehensive overview of risks.

AI and Underwriting Integration:

The integration of AI in underwriting addresses challenges such as lengthy manual data processing, potential inaccuracies in risk assessment, and overall inefficiencies. Sixfold's approach combines Large Language Models (LLMs) and Intelligent Document Processing (IDP) to overcome these issues, providing actionable insights and freeing underwriters to focus on decision-making rather than data processing.

Security and Data Privacy:

Data security and customer privacy are prioritized by providing isolated environments for data processing and ensuring no data is used for further training of the model. Sixfold guarantees complete data lineage, enabling insurers to track the origins of any data input and how it is utilized for underwriting.

Collaborations and Partnerships:

Sixfold is engaged in partnerships, such as with AXIS, to enhance underwriting processes by leveraging AI solutions. Through such collaborations, Sixfold aims to provide measurable ROI to its customers by increasing operational efficiency and accountability in underwriting decisions.

Upcoming Developments:

Sixfold continues to refine its solution offerings through ongoing research and development, aiming to augment underwriting processes further with improved data extraction, triaging, and AI model enhancements for more precise and informed risk assessments.

In conclusion, Sixfold focuses on transforming the insurance underwriting industry by harnessing the power of AI to provide a more efficient, accurate, and transparent process. By integrating advanced technologies, Sixfold supports underwriters in navigating complex risk landscapes swiftly and informedly, while ensuring compliance with industry regulations and data privacy standards.

Simplifai AI

No summary available.

Simplifai specializes in Artificial Intelligence (AI) solutions directed at optimizing insurance processes. The company offers diversified AI solutions that target operational inefficiencies, reduce costs, and enhance customer satisfaction through automation.

Key Offerings:

-

InsuranceGPT: An AI-powered platform built to streamline insurance processes. This includes Claims Processing and Customer Interaction, where automation is used to handle data and communication, minimizing manual intervention.

-

Claims Processing: Simplifai’s claims processing solution automatically summarizes case data, integrates relevant laws, and suggests appropriate resolutions. It is designed to improve efficiency, reduce costs, and ensure compliance with data privacy standards like GDPR.

-

Customer Interaction: AI is used to automate responses to customer inquiries, reducing response times and increasing accuracy. This improvement aims to enhance customer satisfaction and retention rates.

-

Claims Intake: The solution automates the claims intake process, handling a majority of claims automatically, reducing errors, and improving processing speed.

Platform Technologies:

-

AI Automation Platform: A no-code platform enabling organizations to integrate AI technology without extensive technical knowledge. It facilitates the automation of business processes using natural language processing (NLP) and machine learning for tasks like document reading and customer inquiry responses.

-

Data Privacy and Compliance: Simplifai asserts strong compliance protocols aligned with GDPR and ISO/IEC standards. The company emphasizes data privacy through secure platform design and development stages using a "privacy by design" approach ensuring customer data protection.

Benefits Provided:

-

Operational Efficiency: The automation of claims and customer interactions aims to significantly reduce operational costs and enhance productivity. For instance, their solutions have been shown to handle up to 80% of inquiries automatically.

-

Data Security: Simplifai’s focus on data security includes encryption, data center segregation, and regular vulnerability assessments to prevent unauthorized data access.

-

Versatility with Integration: The AI solutions are adaptable and can be integrated with third-party services and industry platforms, ensuring seamless data retrieval and maintenance of customer service levels.

Customer and Market Impact:

-

Testimonials indicate that businesses using Simplifai solutions, such as Knif Trygghet and Eika Forsikring, have witnessed improved automation grades and operational efficiencies.

-

Simplifai has received various industry recognitions, including awards for innovation and technology integration in customer experiences, highlighting the impact their solutions have in transforming traditional processes into more efficient, AI-driven operations.

Company Evolution:

-

Founded by Bård Myrstad and Erik Leung, Simplifai emphasizes a vision to revolutionize workforce processes through AI. The leadership comprises experienced professionals from diverse industry backgrounds, guiding the company's global expansion and technological advancements.

-

With a commitment to innovation and compliance, Simplifai continues to support industries like insurance and public sectors, driving forward the adoption of AI technologies, while maintaining a focus on data security and process efficiency.

Overall, Simplifai strives to simplify complex business processes, ensuring organizations can scale effectively and meet ever-changing customer needs without compromising on quality or security.

Arturo

Information on Arturo, Inc.'s description and services is not provided in the presented text.

Arturo Intelligence, Inc. provides an artificial intelligence (AI)-based platform offering solutions for the insurance industry, focusing on underwriting, risk management, and claims. Originating as a spin-off from American Family Insurance, the company leverages expertise in insurance to assist carriers with managing risk and improving customer experiences. The platform integrates computer vision models and analytics to deliver insights that optimize insurance operations across the United States and Australia.

Key Features of Arturo's Platform:

-

Underwriting Solutions: The company claims its technology enables precise property assessments in under 300 milliseconds. Their platform helps underwriters detect risks such as deteriorating infrastructure and unperceived changes on properties, facilitating swift and cost-effective underwriting processes.

-

Risk Management: Arturo's platform offers a comprehensive view of risk with data visualization tools, maps, and dashboards. The platform aims to aid insurers in setting their own risk appetites by analyzing aggregate vulnerabilities, thereby reducing underinsurance and preventing premium leakage.

-

Claims Solutions: Arturo facilitates the claims adjustment process by providing property-specific insights. Its technology is designed to predict potential damages using pre-existing data and disaster response tools, which helps to minimize time and costs in the claims cycle while enhancing the customer experience.

Additional Offerings and Initiatives:

-

Strategic Partnerships: The organization collaborates with various industry players, using both aerial imagery and AI technologies to analyze properties. Arturo aims to empower insurance carriers to set risk parameters more accurately and make informed decisions.

-

Geographic and Environmental Insights: The platform provides insights into various geographical zones, focusing on understanding vulnerabilities due to weather conditions like hailstorms, as evidenced by detailed reports on Colorado's hail risk. This analysis helps stakeholders—homeowners, insurers, and contractors—prepare and mitigate risks proactively.

-

Impactful Case Studies: Arturo showcases its practical applications through case studies such as its collaboration with Vave during Hurricane Ida and with Australian insurer Suncorp during extensive flooding events. These case studies highlight improved loss ratios, faster disaster response times, and better risk assessments leveraging Arturo's technology.

-

Resource Optimization: The use of Arturo’s technology allows insurers to make more efficient resource allocations, minimizes unnecessary site visits, and contributes to lowering the overall carbon footprint by deploying digital assessments and reducing travel.

Company Vision and Values:

-

Commitment to Clarity and Sustainability: Arturo aims to enhance the transparency of property-related data and protect valuable assets while promoting sustainable practices within the insurance industry.

-

Diverse Leadership and Innovation: The company is led by a team of technologists and industry veterans, fostering a culture of bold thinking and accountability. Arturo values diversity and encourages innovative approaches to industry challenges.

-

Customer Success as Core: With a mission centered around empowering clients, the company sees its success intertwined with customer satisfaction, aiming to improve client business outcomes continuously.

Engagement and Interaction:

-

Opportunities for Developers: Arturo provides APIs and application insights for developers interested in integrating its technology into their workflows.

-

Continuous Learning and Updates: The platform offers access to resources like white papers and reports to keep stakeholders informed about evolving technologies and industry trends.

In summary, Arturo Intelligence, Inc. positions itself as a tech-driven supporter for insurers, looking to streamline processes, reduce costs, and enhance the policyholder experience through its advanced property intelligence platform.

Senso

Toronto-based FinTech startup building an AI-powered knowledge base for customer support, marketing, and sales teams.

Senso.ai Overview

1) Key Focus Area: Senso.ai focuses on improving operational efficiency, member experience, and data-driven decision-making for the financial services and credit union sector. Their platform leverages artificial intelligence (AI) to streamline processes such as document retrieval, member interactions, and workflow management.

2) Unique Value Proposition and Strategic Advantage: Senso distinguishes itself by providing AI-enabled solutions tailored to the specific needs of credit unions:

- Generative AI Collaboration: Through their CUCopilot Network, Senso facilitates a collaborative environment where credit unions can share insights and standardize practices, resulting in enhanced operational efficiencies.

- AI-Driven Knowledge Engine: The platform transforms unstructured data into actionable insights, helping organizations refine strategies, improve member experiences, and streamline operations.

- Endorsement by Notable Entities: Their partnership with Filene Research Institute and integration with CU 2.0 creates a framework for industry-wide learning and innovation.

3) Delivery on their Value Proposition: Senso employs several strategies and tools to deliver on its promise of improving efficiency and efficacy for credit unions:

- AI-Powered Agents like Agent Echo and Agent Fetch:

- Agent Echo automates call tagging and utilizes AI to improve conversation outcomes for call centers and voice agents.

- Agent Fetch helps identify content gaps within organizational documents, enhancing the quality of responses and processing efficiency.

- CUCopilot Network:

- Provides a platform for credit unions to collaborate on AI-driven initiatives.

- Facilitates real-time updates and uniformity across credit unions, enhancing the flow of industry knowledge.

- Offers continuous learning and shared best practices among credit union members.

- Focus on Practical Execution:

- Senso emphasizes "real-world application" of AI strategies, assisting credit unions in implementing AI initiatives practically rather than theoretically.

- The platform's design reduces member wait times and call volumes by streamlining procedural documentation and service interactions.

Conclusion: Senso.ai’s core strategy is to harness AI technology to create a more intuitive and efficient operating environment for credit unions. Their unique position lies in blending cutting-edge AI functionalities with a collaborative framework that enables industry-wide transformation in operational efficiencies, member engagement, and resource management. Through its platform, Senso supports credit unions in transitioning to AI-centric operating models, thereby future-proofing their operations and aligning them with modern technological advances.

Integrate.ai

A Toronto-based startup offering AI solutions in the form of AI as a Service, primarily aimed at personalizing client offerings in industries like banking and retail.

Integrate.ai is focused on providing solutions within the realm of federated data science, specifically catering to data science collaboration and experimentation without the necessity of data transfer. Here is a summary tailored to an executive audience:

-

Key Focus Area: Integrate.ai's primary focus is enabling secure, collaborative AI and data science efforts through its federated data science platform. This technology underpins their efforts in fostering data collaboration across different enterprises and sectors, as their platform facilitates machine learning and analytics capabilities without the need for moving sensitive data between entities.

-

Unique Value Proposition and Strategic Advantage: The unique value proposition lies in their federated learning technology, which allows organizations to harness the potential of distributed data securely. The strategic advantage is threefold:

- Data Security and Privacy: Data never leaves the local environment, ensuring privacy and compliance with regulations like GDPR and HIPAA.

- Operational Efficiency: Their infrastructure-agnostic platform integrates seamlessly with existing data environments and enhances data evaluation by supporting simultaneous assessment of various datasets.

- Collaboration Without Risks: They offer the ability to connect data and analytics providers with enterprise customers in a controlled environment, increasing accessibility to more extensive datasets without compromising privacy or governance.

-

How They Deliver on Their Value Proposition: Integrate.ai addresses data collaboration challenges through the following approaches:

- Federated Learning Server and Task Runners: Data scientists deploy task runners locally to perform privacy-preserved operations that contribute to a global model, thus enabling collaborative analysis without data movement.

- Data and Model Evaluation Capabilities: The platform provides tools for exploratory data analysis, feature importance quantification, and model validation against diverse datasets.

- Comprehensive Data Governance: They offer granular control over data usage through permissions and role-based access controls, enhancing security while fostering collaboration.

- Integration with Popular Data Science Tools: Compatibility with leading data science technologies and cloud platforms ensures users can continue utilizing their preferred tools and environments.

Integrate.ai is aimed at organizations looking to break down data silos without sacrificing data security, thus driving innovation across several industries by leveraging federated learning to elevate AI's impact on organizational effectiveness. Their approach seeks to enable firms to safely experiment and derive insights from novel datasets, ultimately boosting adoption and integration of AI solutions in business processes.

4CRisk.ai

4CRisk.ai provides solutions focused on natural language processing for risk management and compliance.

- Company's Key Focus Area

4CRisk.ai focuses primarily on leveraging artificial intelligence to create solutions for compliance and risk management. Their key offerings include products that facilitate regulatory research, change management, compliance mapping, and the provision of accurate compliance answers through an AI assistant called Ask ARIA Co-Pilot. These tools are designed to help organizations efficiently manage compliance by automating regulatory processes and improving traceability and cost-efficiency.

- Unique Value Proposition and Strategic Advantage

4CRisk.ai's unique value proposition lies in its specialized language models and AI-powered platform that cater specifically to regulatory, risk, and compliance requirements. The use of domain-specific AI models offers significant advantages by providing private, secure interactions that enhance the accuracy and relevance of compliance processes, reducing operational stress on data governance and privacy.

The strategic advantage facilitated by these AI models is their ability to produce more reliable outputs, with fewer errors compared to broader language models. This precision is crucial for ensuring accurate compliance in complex regulatory environments. The efficiency in processing and the capability to integrate seamlessly with existing governance frameworks further position 4CRisk at a competitive advantage.

- Delivery on Their Value Proposition

4CRisk.ai delivers on its value proposition through a cloud-based platform incorporating advanced AI features aimed at automating and optimizing compliance and risk management processes:

-

AI-Powered Tools: Their products harness AI to simplify complex regulatory landscapes, generating efficient rulebooks, managing obligations, and creating compliance maps that enhance traceability.

-

Regulatory Change Management: AI automates the processes of tracking, assessing, and implementing changes, streamlining compliance and risk management tasks within organizations to ensure agility.

-

Compliance Map and AI Assistant: By highlighting gaps in compliance and aiding in filling those gaps, these tools enhance an organization's internal controls and regulatory compliance.

-

Specialized Language Models: These private, domain-specific models ensure that compliance processes are faster, more secure, and tailored to specific business needs. The models provide a significant improvement in processing speeds and cost-effectiveness compared to general AI solutions.

-

Data Privacy: With zero-trust security, these models are deployed in private environments, ensuring stringent data privacy and security compliance.

Through this comprehensive suite of AI-driven products, 4CRisk offers organizations a way to manage compliance more efficiently, reduce the risk of non-compliance, and ensure that their practices keep up with rapidly evolving regulatory landscapes.

Terzo

Terzo is a company that specializes in AI-powered contract analysis software. They leverage artificial intelligence and machine learning to enhance data quality and risk monitoring for both business and legal teams.

Terzo Technologies focuses on leveraging artificial intelligence (AI) to transform financial intelligence and contract management for enterprise-scale organizations. Their primary aim is to help businesses uncover insights hidden in their contracts and other financial documents, providing greater visibility and operational efficiency.

Key Focus Area:

- Terzo places a strong emphasis on AI-powered financial intelligence and contract analytics. Their solutions are tailored to optimize financial results by centralizing contracts, aggregating financial data, and automatically extracting critical data.

Unique Value Proposition and Strategic Advantage:

- Terzo's differentiation lies in their AI-as-a-Service model which combines proprietary AI extraction with human quality assurance. This approach ensures high data accuracy, exceptional precision, and actionable insights.

- With an AI-driven platform recognized by Gartner as a Cool Vendor, Terzo presents itself as a cutting-edge choice for finance and procurement teams. The platform is designed to facilitate smart, quick decisions that contribute to significant cost savings and improved spend management.

- The robust integration capabilities with existing systems such as ERP, CRM, and more, support seamless data flow, enhancing collaboration and unifying processes across departments.

How They Deliver on Their Value Proposition:

- Data Extraction and Analysis: Utilizing AI, Terzo automates the extraction of financial and contractual data from documents. This process is further refined with human oversight to ensure data quality and accuracy, allowing enterprises to efficiently manage contracts, invoices, and supplier spend.

- Contract Analytics and Supplier Management: The platform offers comprehensive visibility into contract hierarchy, renewal tracking, and supplier relationships. It allows businesses to negotiate effectively, manage spend, and ensure compliance through advanced contract analytics and a centralized data hub.

- Operational Efficiency and Cost Reduction: Terzo’s solutions automate workflows and manual tasks, significantly reducing time and costs associated with data retrieval and contract management. They report a 70% reduction in cycle time and a 10% savings in costs due to their integrated view of contract and spend data.

- Proactive Risk Management: By providing real-time insights and automated alerts for contract terms and renewals, Terzo ensures that enterprises remain compliant and minimize risks related to contract oversight.

- Comprehensive Integration Capabilities: Terzo supports a wide range of integrations with leading enterprise systems to ensure seamless data exchange and operational continuity. This ensures that data is readily accessible and insights are aligned with business strategies.

In conclusion, Terzo Technologies positions itself as a strategic partner for enterprises looking to harness AI for enhanced financial and contract management. They prioritize addressing the challenges of data inaccessibility and operational inefficiencies, thereby enabling organizations to optimize spending and drive informed decision-making.

Feedzai

Feedzai is the market leader in fighting fraud and financial crime with today’s most advanced cloud-based risk management platform, powered by machine learning and artificial intelligence.

Feedzai: An Overview for Executives

Key Focus Area:

Feedzai specializes in providing comprehensive solutions for fraud prevention and risk management. Their operations are tailored to protect financial institutions, encompassing a broad spectrum of products designed to mitigate financial crime such as transaction fraud, account takeover, and anti-money laundering (AML) concerns.

Unique Value Proposition and Strategic Advantage:

-

Comprehensive RiskOps Platform: Feedzai delivers a singular, cohesive platform that integrates a variety of fraud management functionalities, streamlining processes and data into a unified system. This platform leverages artificial intelligence to enhance detection capabilities and offers solutions across multiple financial crime types and channels.

-

Behavioral Biometrics Technology: Feedzai emphasizes the use of behavioral biometrics, providing a non-intrusive authentication layer that identifies potential fraud through the assessment of digital interactions such as typing patterns. This technology enhances the ability to detect subtle fraud patterns that could be missed by traditional methods.

-

Real-time Risk Analysis: Their strategic advantage lies in employing advanced AI models that continuously learn and adapt to emerging threats, ensuring proactive fraud detection. This real-time capability is pivotal in securing transactions while minimizing disruptions for genuine customers.

Delivery on Value Proposition:

Feedzai executes its value proposition by deploying a multi-faceted approach that encompasses:

-

AI and Machine Learning: Feedzai’s AI system supports advanced fraud detection by analyzing transactional and behavioral data to create individual risk profiles. This intelligence not only helps in reducing false positives but also enhances fraud detection rates.

-

Omnichannel Capabilities: The company’s solutions monitor customer activities across various payment channels, providing a comprehensive view and allowing for more accurate risk assessments. This approach mitigates risks associated with new and diverse payment methods, crucial for adapting to the rapidly evolving financial sector.

-

Scalable and Adaptable Solutions: With their platform’s scalability, Feedzai is capable of processing upwards of 59 billion events per year and securing around $6 trillion in payments, signifying readiness to tackle the current volume and diversity of threats that face global financial institutions.

-

User-friendly Interfaces and Dynamics: The platform offers user-centric designs and self-service capabilities that allow financial institutions to manage risk directly. It provides features for model deployment and rule customization without extensive IT involvement, promoting efficiency and agility.

-

Strong Industry Partnerships and Insights: Collaborations with financial leaders and firms such as Form3 help Feedzai to continually refine their approach to fraud detection, ensuring their technology remains at the forefront of industry standards.

Feedzai positions itself as a central player in the fight against financial crime, integrating innovative technology and strategic insight to deliver targeted, effective risk management solutions. This alignment with evolving industry and regulatory needs provides their clients with tools needed to maintain robust, adaptable security measures in an increasingly digitalized financial landscape.

Sambanova

Sambanova Systems develops integrated software and hardware platforms to support advanced AI applications.

SambaNova Systems is primarily focused on providing a comprehensive AI platform tailored for the development and deployment of generative AI, offering the technology backbone for next-generation AI computing. Their solutions target both enterprise and governmental sectors, addressing the demands of AI-enabled businesses through advanced technological innovations.

Key Focus Area: SambaNova's primary focus is on deploying state-of-the-art AI and deep learning capabilities to enable organizations to gain a competitive edge. They offer specialized platforms for generative AI, utilizing their proprietary DataScale® system, targeted at a variety of uses including public sector applications, scientific research, and sovereign AI efforts.

Unique Value Proposition and Strategic Advantage:

- Full-Stack Platform: SambaNova delivers an enterprise-grade full stack platform, ranging from chips to models, purpose-built for generative AI. Their offerings include both software and hardware solutions that are specifically designed to handle large-scale AI workloads with improved efficiency and scalability.

- RDU Technology: Their SN40L Reconfigurable Dataflow Unit (RDU) stands as a GPU alternative, designed to power demanding AI workloads. This technology offers advantages in memory capacity and model execution speed, purportedly achieving better performance metrics than traditional GPU-based systems.

- Model Ownership and Data Privacy: SambaNova emphasizes data security and privacy, ensuring that customers own their AI models and maintain control over their data, purportedly offering advantages over cloud-based AI models that might pose vendor lock-in issues.

How They Deliver on Their Value Proposition:

- SambaNova Suite: This platform includes SambaNova DataScale, SambaStudio software for infrastructure management, and the Composition of Experts (CoE) model architecture, claimed to deliver unprecedented performance and scalability for AI workloads across various sectors.

- Innovative AI Hardware: Their hardware solutions are engineered for efficiency, providing a small footprint and lower energy consumption. The DataScale system aims to facilitate both training and inference with significant performance gains over competing GPU-based systems.

- Resources and Support: SambaNova offers a comprehensive support system, including resources such as webinars, white papers, and starter kits to accelerate AI deployment for businesses.

- Sovereign AI Initiatives: For governmental bodies and large enterprises, SambaNova provides tailored solutions to support sovereign AI development, allowing these entities to build and maintain their own AI infrastructure.

- Startup Accelerator Program: SambaNova also supports early-stage startups through their accelerator program, offering resources and higher usage limits to facilitate the creation of advanced AI applications.

In essence, SambaNova seeks to differentiate itself with a robust, integrated, and customizable AI platform that is tailored to meet the diverse needs of enterprise and government customers while addressing significant concerns around data privacy and model ownership.

Adversa

Adversa automates red teaming activities, enhancing organizations' abilities to assess their security guardrails' robustness against AI model threats.

About | News | About | About | About | About | About | Management | About | About | About | About | About | About | About | About | About | News | About | About

Adversa AI, an Israeli AI startup, focuses on securing artificial intelligence primarily through the protection of AI systems from cyber threats, privacy issues, and safety risks. Their key focus revolves around providing security solutions for AI to various industries such as finance, insurance, automotive, biometrics, and more. By identifying and managing the myriad of AI risks specific to different sectors, Adversa seeks to create more secure and trustworthy AI environments.

Unique Value Proposition and Strategic Advantage:

- Comprehensive AI Security: Adversa AI positions itself uniquely by offering complete solutions for AI systems' safety across industries. They deliver security awareness, assessment, and assurance that help clients protect their AI models from various threats such as adversarial attacks or data leakage.

- Research and Innovation: The company has developed pioneering technologies for secure AI, which have been recognized in multiple industry reports and conferences. Their research includes methods to navigate the security challenges in AI models, such as Large Language Models (LLMs).

- Collaborative Approach: Adversa AI places emphasis on partnerships with industry and technology leaders to further the development and implementation of secure AI practices.

Delivery on Value Proposition:

- Secure AI Awareness: Adversa provides services to help organizations develop an understanding of AI risks and integrate these insights into their governance strategies. This includes policy development, training, and threat intelligence to keep organizations informed about the latest industry threats.

- AI Integrity Assessments: Adversa offers AI integrity validation and vulnerability identification services. They employ threat modeling and vulnerability audits to understand potential exploits of AI systems and provide recommendations for strengthening security.

- Continuous Red Teaming: Adversa's continuous AI Red Teaming involves ongoing attack simulations to identify and mitigate emerging threats in AI applications. This includes testing for unknown risks unique to specific client applications.

- Trusted AI Development: They support organizations in developing and monitoring secure AI by offering solutions that integrate controls and provide operational security assurance.

- Industry-Leading Insights: Continuously engaging in cutting-edge research and industry dialogue, Adversa provides insights and thought leadership on AI security. Their platforms allow companies to stay abreast of trends, predictions, and vulnerabilities affecting AI technology.

In essence, Adversa AI aims to be a pioneer in advocating and realizing secure and trustworthy AI systems by addressing the complex landscape of cyber threats that organizations face in AI deployment. Through a combination of proprietary technology, strategic research, and industry collaboration, they aim to position themselves as key facilitators in the journey toward resilient AI practices.

Sherpa.ai

Sherpa is a predictive and conversational AI digital assistant for consumer products.

Sherpa.ai focuses on advancing Privacy-Preserving Artificial Intelligence (AI). Their platform is designed to facilitate the development and deployment of AI applications across various industries while maintaining stringent privacy and compliance standards.

Key Focus Area: The company's central theme is the creation and implementation of privacy-preserving AI solutions. It serves diverse sectors, including financial services, healthcare, life sciences, Industry 4.0, and internal data collaboration, by allowing organizations to harness the power of AI without compromising data privacy.

Unique Value Proposition and Strategic Advantage: Sherpa.ai’s unique offering lies in its Federated Learning (FL) platform. The platform enables collaborative AI model training while ensuring that data never leaves the owner's environment. This capability addresses significant pain points in data-driven initiatives, such as privacy concerns and regulatory obstacles. Their approach ensures that organizations can gain insights and make decisions using distributed datasets without the need for data sharing. This is particularly advantageous in heavily regulated sectors such as healthcare and financial services, where the privacy of sensitive information is paramount. Sherpa.ai is recognized for integrating Privacy Enhancing Technologies (PETs), which adds a two-layer system emphasizing data security and regulatory compliance.

How They Deliver on Their Value Proposition:

- Federated Learning Platform: Sherpa.ai’s platform is designed to be easily deployable, adaptable to a range of AI models and tuneable with data from multiple sources while maintaining privacy standards.

- Compliance with Regulations: The platform ensures compliance with global and regional data protection regulations such as GDPR and HIPAA, reducing the risk of data breaches and associated penalties.

- Plug-and-Play Deployment: Designed for rapid deployment, the platform allows businesses to connect their data sources, select models, and begin training without delay, thereby accelerating time-to-value.

- Seamless Integration: The platform’s flexible architecture integrates with various data lakes and frameworks like TensorFlow and Keras, allowing organizations to leverage their existing data infrastructure.

- Privacy and Security Features: Through its implementation of Federated Learning, differential privacy, and cryptographic measures like Secure Multi-party Computation and Homomorphic Encryption, Sherpa.ai provides a secure data collaboration environment. The data remains within its original environment while aggregated model updates are shared securely.

- Collaborative Ecosystem: Sherpa.ai collaborates with major industry players such as KPMG and Telefónica to extend the benefits of federated learning, enabling organizations to optimize business outcomes through shared innovation without data exchange.

Through these mechanisms, Sherpa.ai positions itself as a strategic partner for businesses looking to integrate AI into their operations while safeguarding their informational assets. This approach not only alleviates privacy concerns but also capitalizes on the rapidly expanding capabilities of AI, fostering an environment for cross-organizational partnerships and innovation.

Hypatos

Hypatos applies AI language processing and computer vision to expedite financial document processing for various business use cases.

Hypatos offers AI-powered solutions to automate document processing in various business functions, with a focus on improving efficiency, accuracy, and reducing costs across different industries.

Key Features and Solutions:

-

AI Agent Studio: A central hub for AI activity, facilitating the transfer of business knowledge, task delegation, and interaction with live documents. It enables firms to fully automate up to 80% of their transactional processing operations.

-

Accounts Payable: Automates the AP journey, reducing manual errors and mismanagement of invoices. This involves capturing invoices upon receipt, enforcing compliance with budget and cost policies, and maintaining transparency over billing issues to enhance supplier relationships.

-

Order Processing: Automates order capture and processing, ensuring order accuracy and quick fulfillment. It helps manage orders from different sources and matches them to an up-to-date catalog, minimizing errors and returns.

-

Travel Expenses: Automates travel booking, tracking, and reporting, enhancing compliance with company policies and providing real-time insights into travel expenses.

-

Purchase-to-Pay: Aims to reclaim lost value in the purchase-to-pay process by reducing manual handling, eliminating duplicate or fraudulent invoices, and capturing information accurately.

-

Order-to-Cash: Streamlines sales document processing, using AI to capture, validate, and match documents efficiently. This helps sales teams focus more on sales than on following up on order issues.

Platform and Integrations:

Hypatos offers a platform that supports seamless integration with major ERP and accounting software like SAP, Coupa, Workday, and Microsoft Dynamics, ensuring quick deployment and minimal disruption. This integration allows for accurate data ingestion and seamless document export across systems.

Business Benefits:

-

Efficiency and Cost Savings: By automating document processing, Hypatos reduces manual data entry and errors, fostering a shift to high-value tasks and enhancing decision-making processes. This results in reduced operational costs and improved accuracy.

-

Scalability and Compliance: Autonomous processes can scale with business growth while managing compliance with changing regulations. This minimizes legal risks and optimizes data usage.

Security and Reliability:

Hypatos prioritizes customer data security, adhering to international standards like ISO 27001, SOC 2, and GDPR. The platform ensures confidentiality, integrity, and availability through regular penetration tests and security audits.

Business Partnerships:

Hypatos partners with various firms to enhance its offerings, allowing for deeper integration and more comprehensive solutions in AI-driven document processing. These partnerships encompass advisory, consulting, and technology, allowing for an expanded reach and refined services.

Hypatos aims to enable organizations to maximize the potential of digital transformation without the typical bottlenecks of manual data processing. By leveraging AI technologies, businesses are better equipped to handle increasing transaction volumes efficiently and seamlessly, focusing more on strategic growth and innovation.