⚡ZurzAI.com⚡

Companies Similar to Lendbuzz

Zoox

Zoox is revolutionizing transportation with fully autonomous, all-electric robotaxis, focusing on safety, reducing human error, and enhancing the riding experience while lowering congestion and pollution.

About | About | Contact | News | Careers | About | About | About | News | Careers | About | Vision/Values

Zoox Company Overview

1. Key Focus Area: Zoox is concentrating on developing an autonomous ride-hailing service. Their primary product is an all-electric, fully autonomous robotaxi designed to operate in dense urban environments. Their goal is to address the issues of traffic congestion, pollution, and road safety by removing the human factor in driving and leveraging advanced AI for vehicle operations.

2. Unique Value Proposition and Strategic Advantage: Zoox positions itself as an innovator by designing its vehicle from the ground up rather than retrofitting existing car models. This approach allows Zoox to integrate safety and autonomous technology more thoroughly. Notably, their robotaxi is devoid of typical manual controls, appealing to a future-forward mobility vision. Their strategic partnership with Amazon supports them in achieving this vision, providing them with resources to enhance their vehicle technology and market position.

3. Delivery on Value Proposition:

-

Innovative Design: Zoox emphasizes a rider-focused design, offering a spacious, symmetrical cabin without the traditional driver seat or steering wheel, providing equal comfort to every occupant.

-

Advanced Autonomy: Zoox's approach to autonomy involves developing and testing in-house hardware and software to create a refined driving experience. This includes an extensive sensory system with a 360-degree field of view, facilitating comprehensive environmental perception and decision-making.

-

Safety Focus: Zoox highlights a safety-first approach, with their vehicle featuring more than 100 unique safety innovations inspired by aviation industry standards. This includes comprehensive airbag systems and extensive testing protocols aimed at surpassing ordinary vehicle safety requirements.

-

Environmental Commitment: Aligning with sustainability, Zoox vehicles are all-electric, aimed at minimizing emissions. By owning and operating their fleet, they seek to reduce the environmental footprint, enhance vehicle use efficiency, and contribute to transformative urban mobility.

-

Community Engagement: Zoox actively engages with communities where its services are tested and launched, ensuring transparency and collaboration with local authorities and residents. This includes hosting events to showcase their robotaxi and gain community insights.

These elements combine to position Zoox not only as a technological innovator but as a company striving to redefine urban mobility through a holistic, safety-oriented, and sustainable approach.

Nuro

Nuro is evolving from delivery bots to robotaxis and autonomous vehicles, focusing on adaptable AI solutions and prioritizing safety in its innovative mobility approach.

Nuro's key focus area is the advancement of autonomous driving technology, particularly aimed at revolutionizing personal mobility and logistics. The company offers solutions for various mobility platforms including robotaxis, personally owned autonomous vehicles, and logistics services. They emphasize the deployment and refinement of Level 4 (L4) autonomous driving technology, with a commitment to safety and operational efficiency.

Nuro's unique value proposition lies in its adaptable, AI-first approach to autonomy, offering scalable solutions across different vehicle platforms and sectors. They leverage their technology to provide full autonomous capabilities in sectors such as ride-hailing, personal automotive use, and logistics, focusing on reducing operational costs and enhancing service efficiency.

Key elements of their strategic advantage include:

- Scalable AI-First Autonomy: Nuro's technology supports various levels of autonomy from driver-assist features (L2) to full self-driving capabilities (L4), adaptable to different customers’ needs including OEMs in the automotive sector.

- Proven Track Record: The Nuro Driver™ has been operational across multiple states in the U.S., showcasing a significant safety record with millions of autonomous miles driven without reported at-fault incidents.

- Safety Centric Development: By embedding safety into every phase of product development and deployment, from initial system designs through rigorous testing and validation, they emphasize the trustworthiness of their solutions.

Nuro delivers on their value proposition through a combination of innovative AI technologies and strategic business approaches:

- Advanced AI and Mapping Technologies: They integrate real-time AI-driven mapping and sophisticated perception systems to enable safe and efficient vehicle operations in complex urban environments.

- Infrastructure and Tooling Support: The Nuro AI Platform™ enhances developer capabilities with robust tools for simulation, validation, and analytics, ensuring continuous improvement and high-performance standards.

- Partnership Strategy: By collaborating with commercial mobility providers and OEMs, Nuro extends its capabilities, offering flexible deployment options to various industry partners.

- Commitment to Safety and Community Engagement: Nuro ensures that safety is at the forefront of their operations, with redundant systems and proactive community engagement to address safety concerns and maintain trust.

Nuro continues to adapt and expand its business model by licensing its autonomous driving technology, allowing other companies to integrate their AI systems into different vehicle types and mobility services. They aim to play a crucial role in the future of transportation, driven by a vision of making robotics and AI an integral part of everyday life, enhancing mobility, safety, and efficiency across sectors.

Zest AI

Zest AI enhances underwriting by utilizing AI to assess borrowers with limited credit history, providing data-driven insights to improve lender risk management and decision-making.

Zest AI is a technology company specializing in AI-powered lending solutions aimed at improving the efficiency, transparency, and accessibility of credit decision-making. It provides a range of AI-driven products and services tailored for different types of lending institutions, including credit unions, banks, and specialty lenders. Here's a summary of the key offerings and recent updates from Zest AI:

Key Offerings:

-

AI-Automated Underwriting: Zest AI offers AI-automated underwriting solutions designed to improve lending decisions by considering a wider array of data points than traditional models. This helps institutions make more accurate predictions about an applicant's credit risk and ensures consistency in decision-making.

-

Fraud Detection: The company's fraud detection solutions use advanced AI to protect against various types of application fraud. These systems leverage a wide range of data to detect both first-party and third-party fraud and enable lenders to make confident lending decisions.

-

Lending Intelligence: Zest AI's lending intelligence tools provide actionable insights and metrics to help institutions optimize their lending strategies. This includes performance data across all lending stages from marketing to portfolio management, aiding lenders in making more informed decisions.

Industry Impacts:

-

Zest AI is notable for its commitment to fair lending practices. Its technology aims to increase access to credit for underserved groups, effectively removing biases present in traditional credit scoring systems.

-

The company has developed various strategic partnerships to enhance its service delivery, including integrations that aid in seamless implementation within financial institutions' existing systems.

Recent Developments:

-

Funding: Zest AI recently secured a $200 million growth investment from Insight Partners, which will be used to advance product innovation, particularly in fraud protection and generative AI, as well as pursue M&A opportunities.

-

Awards and Recognition: The firm has been recognized as one of North America's fastest-growing tech companies by Deloitte Technology Fast 500 for 2024, underscoring its significant market impact and growth trajectory.

-

Product Innovation: Zest AI unveiled the first generative AI lending intelligence companion named LuLu, enhancing financial institutions' ability to glean insights via intuitive, natural language prompts.

-

Compliance and Risk Management: The company emphasizes compliance, with technology aligning with legal standards such as the Fair Credit Reporting Act and the Equal Credit Opportunity Act. Zest AI's solutions are crafted to meet and exceed these regulatory expectations, offering robust documentation and reporting for model risk management.

Customer and Market Engagement:

-

Zest AI supports over 500 active AI models in the lending ecosystem, covering a broad spectrum of credit union members and financial assets.

-

Customer feedback from entities like credit unions and banks highlight the transformative impact of Zest AI’s technology in terms of reduced delinquency rates, increased automation, and expanded credit access.

Educational and Supportive Initiatives:

-

The company provides educational resources such as a "Lender's Guide to Implementing AI", aimed at assisting financial institutions to understand and integrate AI tools effectively.

-

Zest AI emphasizes continuous customer support, offering dedicated expert teams to assist clients in optimizing their lending processes.

Overall, Zest AI is positioning itself as a catalyst in the lending industry, advocating for equitable lending practices and leveraging the power of AI to transform traditional underwriting and fraud detection methodologies for better economic equity.

Homebot

Homebot is a company that provides a financial dashboard for homeowners to track their property value, mortgage balance, and equity, and offers advice on refinancing, selling, or renting their property.

Homebot is a technology platform focused on enhancing the connection between homeowners and their financial advisors, primarily loan officers and real estate agents. Its mission is to facilitate informed homeownership decisions, recognizing that a significant portion of an individual's wealth often comes from their home equity. The platform's main features include delivering personalized, actionable insights to clients to help them manage their home wealth effectively and staying engaged with their clients through regular updates.

Target Audience:

- Homeowners: Homebot provides a suite of features that deliver personalized home financial data, market insights, and tips to help homeowners manage and increase home equity. It offers tools for refinancing notifications, investment property calculations, and even facilities for renting out spaces via platforms like Airbnb.

- Loan Officers and Real Estate Agents: The platform is designed to help these professionals maintain and grow their business through repeated client engagement. Homebot automates client communications with monthly reports, personalized action items, and market data analysis to keep advisors informed and active in their clients' financial journeys.

Platform Features:

- Monthly Digests: Regular updates provide personalized home value assessments, equity tracking, and financial tips for saving money.

- Refinancing Options: Tools and calculators help homeowners evaluate potential refinance benefits and calculate long-term savings.

- Investment Tools: Homebot offers property and market analysis tools for informed real estate investment decisions.

- API and Integrations: The platform connects with other tech solutions like Zapier, Mortgage Coach, and BombBomb to streamline processes and enhance functionality.

Business Model & Pricing:

- Tiered Pricing Structure: Homebot's pricing is flexible, tailored for both real estate agents and loan officers, with options for individual and team subscriptions. It involves a monthly fee, with the option of adding co-sponsorships and additional features at discounted rates.

- Co-Sponsorship Model: Enables collaboration between agents and loan officers to share costs and benefits of Homebot subscriptions, promoting partnership-driven engagements.

Recent Initiatives:

- COVID-19 Response: During the pandemic, Homebot implemented a business continuity plan to support remote operations and enhance its features to meet evolving client and partner needs in a digitally transformed real estate market.

- Product Developments:

- Partner Intel: A new feature to help loan officers better connect and collaborate with real estate agents using data-driven insights.

- Consumer Savings Program: Partnership with Newzip to offer cash rewards to consumers, reducing transaction costs significantly during buying and selling.

Partnerships and Industry Impact:

- Homebot collaborates with financial institutions like credit unions to enhance member engagement and retention by offering educational home finance tools.

- The platform continues to expand its influence by forming strategic partnerships designed to leverage advanced technology for improved client conversion and engagement.

Company Mission: Homebot aims to transform the real estate market by empowering consumers and professionals alike with the data and tools needed to make informed decisions and build wealth through homeownership. The company's ongoing developments and partnerships reflect its commitment to fostering valuable client relationships and promoting financial education.

Homebot is driven by a commitment to providing tools that help manage the largest asset class in the world – home equity – and relies on technology to streamline and deepen the advisor-client relationship.

Senso

Toronto-based FinTech startup building an AI-powered knowledge base for customer support, marketing, and sales teams.

Senso.ai Overview

1) Key Focus Area: Senso.ai focuses on improving operational efficiency, member experience, and data-driven decision-making for the financial services and credit union sector. Their platform leverages artificial intelligence (AI) to streamline processes such as document retrieval, member interactions, and workflow management.

2) Unique Value Proposition and Strategic Advantage: Senso distinguishes itself by providing AI-enabled solutions tailored to the specific needs of credit unions:

- Generative AI Collaboration: Through their CUCopilot Network, Senso facilitates a collaborative environment where credit unions can share insights and standardize practices, resulting in enhanced operational efficiencies.

- AI-Driven Knowledge Engine: The platform transforms unstructured data into actionable insights, helping organizations refine strategies, improve member experiences, and streamline operations.

- Endorsement by Notable Entities: Their partnership with Filene Research Institute and integration with CU 2.0 creates a framework for industry-wide learning and innovation.

3) Delivery on their Value Proposition: Senso employs several strategies and tools to deliver on its promise of improving efficiency and efficacy for credit unions:

- AI-Powered Agents like Agent Echo and Agent Fetch:

- Agent Echo automates call tagging and utilizes AI to improve conversation outcomes for call centers and voice agents.

- Agent Fetch helps identify content gaps within organizational documents, enhancing the quality of responses and processing efficiency.

- CUCopilot Network:

- Provides a platform for credit unions to collaborate on AI-driven initiatives.

- Facilitates real-time updates and uniformity across credit unions, enhancing the flow of industry knowledge.

- Offers continuous learning and shared best practices among credit union members.

- Focus on Practical Execution:

- Senso emphasizes "real-world application" of AI strategies, assisting credit unions in implementing AI initiatives practically rather than theoretically.

- The platform's design reduces member wait times and call volumes by streamlining procedural documentation and service interactions.

Conclusion: Senso.ai’s core strategy is to harness AI technology to create a more intuitive and efficient operating environment for credit unions. Their unique position lies in blending cutting-edge AI functionalities with a collaborative framework that enables industry-wide transformation in operational efficiencies, member engagement, and resource management. Through its platform, Senso supports credit unions in transitioning to AI-centric operating models, thereby future-proofing their operations and aligning them with modern technological advances.

Boosted.ai

Boosted.ai enhances portfolio management outcomes for the global financial industry using machine learning algorithms to analyze financial data.

Management | About | About | About | About | About | About | About | About | About | Management | News | About | About | About | About | About | About | About | About | News | About | About | About | About | About

Boosted.ai: Key Insights

1. Key Focus Area Boosted.ai specializes in integrating artificial intelligence into the realm of investment management. Their primary focus is on augmenting the capabilities of asset managers by providing AI-driven tools aimed at enhancing productivity, improving portfolio performance, and facilitating more informed, data-driven decision-making in the financial sector. They cater to both fundamental and quantitative managers, offering solutions specifically designed to streamline the workflow of investment professionals.

2. Unique Value Proposition and Strategic Advantage Boosted.ai offers a strategic advantage through its proprietary AI platform, Boosted Insights. This platform enables investment managers to utilize advanced machine learning algorithms tailored to sift through large volumes of data, predict market movements, and identify high-value trade ideas efficiently. The core value proposition lies in delivering deep, quantitative and qualitative insights, reducing the time investment managers spend on stock research, and offering explainable AI to ensure transparency in decision-making processes. By empowering asset managers to process vast datasets swiftly, Boosted.ai positions itself as a crucial partner in navigating complex market environments.

3. Delivery of Value Proposition

- AI Workflow Automation: Through their product Alfa, Boosted.ai automates the mundane and time-consuming aspects of investment management, such as thesis validation and competitor analysis, freeing up managers to focus on strategic decision-making.

- AI Stock Research: Their platform utilizes large language models to condense thousands of news sources and financial reports into digestible insights, significantly accelerating the research process for investment managers.

- Portfolio Workspaces: Boosted.ai provides customizable portfolio tools that allow for real-time adjustments based on risk metrics and scenario analyses. This tailored approach ensures that managers can align portfolios closely with their investment styles and preferences.

- Data Integration: Boosted.ai’s data partnerships ensure that they aggregate credible and comprehensive datasets, enabling precise AI-driven recommendations.

- AI Stock Picker and Idea Generation: By ranking stocks based on proprietary algorithms, the platform enables investment managers to isolate stocks that match their investment mandate, leveraging both qualitative and quantitative factors for better-informed stock picking.

Boosted.ai’s offerings are designed to enhance the confidence of investment managers in their strategies through the support of predictive analytics and transparency in AI model outputs. With a focus on providing actionable insights and optimizing portfolio performance, they seek to redefine conventional investment management practices by integrating cutting-edge AI technologies. However, it's important to critically assess these advertised benefits with actual performance and market outcomes due to the promotional nature of the content.

Airwallex

Airwallex is an Australian-born fintech unicorn that provides financial services to support innovators, entrepreneurs, and startups. They offer solutions for managing international transactions and business expenses.

Key Focus Area

Airwallex's central focus is providing a comprehensive fintech platform for conducting global financial operations. Their suite of products and services is directed towards businesses looking to scale globally by simplifying international payments, managing multi-currency accounts, and offering integrated financial solutions. Their service portfolio includes business accounts, payment processing, foreign exchange, treasury management, and embedded finance solutions, all facilitated through advanced APIs that cater to a broad range of finance-related functions.

Unique Value Proposition and Strategic Advantage

Airwallex presents itself as an all-encompassing financial platform that enables businesses to operate without borders by integrating various financial services into a single interface. The strategic advantage lies in their:

- Proprietary Payments Network: This offers businesses faster and more cost-effective cross-border transactions compared to traditional banking services. Their ability to open accounts in local currency across numerous markets reduces the friction of forced currency conversions.

- Integrated Financial Infrastructure: They allow businesses to not only process payments and manage multiple currency transactions but also integrate these processes within existing business ecosystems, thereby streamlining operations and reducing administrative burdens.

- Embedded Finance Capabilities: Clients can leverage Airwallex's infrastructure to create custom financial products tailored to their specific business needs, adding another layer of utility for businesses seeking to deploy unique financial solutions.

Delivering on Their Value Proposition

Airwallex executes its value proposition through a robust combination of products and technological solutions aimed at streamlining and enhancing financial operations globally. The primary methods include:

- Business Accounts: These accounts allow businesses to manage funds globally, accepting and holding money in various currencies without fees on conversions, thus removing a significant pain point in international transactions.

- Core API: Businesses can integrate Airwallex's APIs into their platforms, offering flexibility and control over their financial operations at scale.

- Payments and FX Management: Their platform supports online payment acceptance, managing currency risk with interbank rates, and the issuance of multi-currency payment cards to streamline expense management.

- Treasury Services: The platform enables efficient global fund collection, storage, and distribution, helping businesses manage their liquidity across multiple regions.

- Partnership and Integration: By integrating with popular business tools (like accounting software and e-commerce platforms), Airwallex ensures that businesses can seamlessly incorporate its financial services into their existing workflows.

- Comprehensive Support Networks: They offer dedicated support teams that focus on compliance and security, ensuring that funds and data are safeguarded in line with local and international regulations.

Overall, Airwallex positions itself as a utility provider for businesses with global aspirations, offering a wide array of solutions aimed at reducing financial overheads and operational complexities associated with international commerce. Through continuous service enhancement and integration capabilities, they aim to empower companies by focusing on innovation and tailored financial services.

Browse.ai

Provides an easy way to extract and monitor data from the web through automation.

Browse AI Company Summary

1) Key Focus Area: Browse AI's key focus is facilitating data extraction from the web. Its core objective is to provide a point-and-click interface to scrape specific data points from any website with no need for coding expertise. The company positions itself as a solution for businesses to easily gather and manipulate web data, transforming websites into data sources for further analysis, whether it’s for e-commerce, real estate, recruitment, or other sectors requiring constant data updates.

2) Unique Value Proposition and Strategic Advantage:

- No-Code Solution: Browse AI's unique value proposition lies in its no-code data extraction platform, allowing users, regardless of technical skill, to automate data scraping swiftly.

- Prebuilt Robots: Another strategic advantage is the availability of over 200 prebuilt robots designed to perform common data extraction tasks from popular websites, providing a fast-start option for users.

- Security and Reliability: The service integrates bank-level security measures and maintains high data reliability with automated site monitoring and layout tracking.

- Scalability and Customization: The platform is built to handle scaling needs with capabilities to scrape large data volumes across multiple sites, supporting custom API generation.

- Integration Capability: Users can link extracted data with thousands of applications, thanks to integrations with tools like Google Sheets, Airtable, and Zapier, thus enhancing workflow automation.

3) Delivery of Value Proposition:

- User-Friendly Interface: Browse AI delivers its value proposition by offering an intuitive user interface, where tasks are recorded with a simple point-and-click mechanism to train robots for data extraction without writing code.

- Monitoring and Alerts: The company provides monitoring tools alerting users to updates or changes on specified websites, ensuring data is always current and relevant.

- Broad Use Cases and Industry Applications: Browse AI supports various industry applications, from monitoring e-commerce prices to extracting job listings, providing users versatile tools to gather insights specific to their business needs.

- Managed Services: For businesses seeking direct assistance, Browse AI offers fully managed data extraction services, handling setup, execution, and data delivery, thereby minimizing user effort.

- Compliance and Security: With a strong commitment to data security, Browse AI ensures the protection and privacy of user data through encrypted credentials and secure data transfer protocols.

- Prebuilt and Custom Solutions: By offering both prebuilt robots and options for users to train custom robots, Browse AI caters to a broad range of scraping needs, from straightforward to more complex requirements.

In essence, Browse AI markets itself as a practical and accessible tool for managing web data with efficiency, precision, and scalability, aiming to democratize data extraction and make it accessible for all levels of business users.

Longtail.ai

Longtail.ai assists airlines in optimizing pricing for low-volume flight connections using AI, which over time has expanded to cover more services for their clients.

-

What is this company's key focus area? Longtail Technologies focuses on the airline industry through its development of intelligent, autonomous pricing platforms. This technology aims to optimize airline revenue by expanding network footprints and providing more travel options across competitive price points.

-

What is their unique value proposition and strategic advantage? Longtail Technologies presents a unique value proposition through its fully autonomous system which eliminates the need for daily human intervention. The strategic advantage lies in its ability to adapt to rapid changes in the airline industry, including price updates and schedule modifications, promoting extensive network possibilities and competitive pricing without requiring integration with existing IT infrastructure. Additionally, its platform expands airlines’ visibility and coverage in market searches by continuously scouting for potential online and offline network opportunities.

-

How do they deliver on their value proposition?

-

Data Utilization and Algorithms: Longtail Technologies employs advanced algorithms to analyze vast amounts of airline schedule, pricing, and consumer demand data. This intelligence creates a comprehensive journey network for airlines, comparing and ranking possible itineraries against competitors.

-

Autonomous Operations: The platform makes adjustments autonomously based on competitor movements and market changes, ensuring airlines remain competitively priced and visible without daily manual input.

-

Ease of Implementation: Longtail’s platform runs independently, requiring no integration with airlines’ IT systems, which streamlines its deployment and operation without extensive corporate resource allocation.

-

Customer Engagement: Their system is being implemented by several large airline clients such as Aeromexico, SAS, and TAP Portugal, illustrating the effectiveness of their platform in generating more routings, enhanced market presence, and increased potential revenue streams.

In summary, Longtail Technologies is strategically positioned in the airline sector with its autonomous pricing platform, which utilizes comprehensive data-driven insights to enhance network strategies and revenue potential without necessitating extensive client-side resources.

Insight AI

Insight AI is a fintech company offering AI-powered solutions like AI underwriting and cash flow forecasting to enhance financial decision-making.

-

Key Focus Area: Insight AI concentrates on the development and deployment of AI-driven solutions, specifically focusing on AI chatbots and automation for businesses. Their services cater to organizations looking to incorporate artificial intelligence into their processes to enhance efficiency, streamline operations, and provide data-driven insights.

-

Unique Value Proposition and Strategic Advantage: Insight AI leverages custom AI chatbots and automated workflows adapted to a company's specific informational context. The strategic advantage is their methodology of using organization-specific data, enabling seamless integration into existing business operations. This tailored approach allows businesses to optimize internal processes by providing precise interactions and automations grounded in their proprietary data.

- Customization and Specificity: Insight AI’s leverage of company-specific training ensures solutions align closely with existing data systems, such as internal wiki pages and document repositories.

- Privacy and Security: Through data cleansing processes, they ensure sensitive information is protected, bolstering client trust in AI implementations.

- No-Code and Low-Code Solution Flexibility: By using platforms like Stack-AI, RelevanceAI, and Python, they accommodate both rapid development needs and the customization depth for complex tasks.

-

Delivering on Their Value Proposition: Insight AI implements its value proposition through several key methods and technological strategies:

-

AI Chatbots: Custom chatbots facilitate employee and customer interactions, drawing from a company’s specific data to provide prompt replies. This is critical in industries where quick and factual responses are necessary for operations or customer service improvements.

-

Automation Pipelines: Businesses can automate routine tasks, such as report generations and test evaluations, thus reducing manual labor and human error. For instance, automated reporting processes use pre-defined templates and sequential prompts to generate detailed reports.

-

AI Knowledge Bots and Tools: For example, tools are created for use in specialized sectors such as ERP providers and financial consulting, ensuring the AI is relevant and valuable to a company's unique needs.

-

Advanced Technology Stack: Utilizing advanced large language models (LLMs) like GPT-4o and GPT-4 Turbo, Insight AI is able to ensure robust and scalable AI solutions that are adaptable to various business scenarios.

-

In sum, Insight AI's approach combines the harnessing of custom AI technologies with an emphasis on practical applicability, privacy, and technology integration. They strive to enable businesses to better utilize their proprietary data, enhancing productivity and decision-making processes across different verticals.

Abacus.AI

Abacus.AI enables businesses to implement AI without needing expert developers by offering pre-trained models for tasks like customer service and forecasting. Abacus.AI offers pre-trained models for business tasks like customer service, simplifying AI implementation without expert developers.

News | About | About | About | About | About | About | About | About | About | About | About | About | About | Vision/Values | About | Vision/Values | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About

-

Company's Key Focus Area: Abacus.AI is primarily focused on providing AI-driven solutions tailored for both individual professionals and large enterprises. Their main goal is to automate and enhance business processes through the use of AI technology. This includes a broad range of applications, such as predictive modeling, personalization, anomaly detection, and AI-based decision-making tools. They offer platforms and tools to build AI agents and chatbots, optimize resources through discrete optimization, and utilize vision AI for modeling tasks.

-

Unique Value Proposition and Strategic Advantage: Abacus.AI positions itself as an AI super-assistant that leverages generative AI technology to automate various business processes. Their strategic edge lies in their state-of-the-art AI capabilities, including structured machine learning, vision AI, and personalized solutions, along with a commitment to open-source generative AI models. They claim that their AI systems can enhance productivity and efficiency by automating complex tasks and reducing human intervention.

-

Delivery on Their Value Proposition: To deliver on its value proposition, Abacus.AI employs:

-

AI Super Assistants: Tools like ChatLLM and CodeLLM are designed to integrate AI capabilities across platforms, providing services like web search, image generation, and code editing.

-

Comprehensive AI Platform: For larger organizations, they offer a platform capable of building enterprise-scale AI systems, using AI to create and manage other AI agents and processes. This platform aims to automate tasks such as fraud detection, contract analysis, and personalized marketing.

-

Structured ML and Predictive Modeling: Abacus.AI provides tools to create machine learning models tailored to specific data inputs, ensuring accurate business predictions and process optimizations.

-

Vision AI and Optimization: These services offer advanced solutions for image analysis and optimizing business processes under given constraints, aimed at reducing costs and increasing efficiency.

-

Integration and Customization: The company offers integration with existing data systems, allowing for customization and personalized setups that fit specific business needs and enable contextual AI interactions.

-

Consultation and Support: They provide consultations to help enterprises tailor the AI solutions to their specific requirements and offer support throughout the implementation process.

-

Overall, their approach focuses on using cutting-edge AI models and deep learning techniques to build custom solutions that improve business process efficiency and decision-making.

Tazi.ai

Provides an AutoML platform focused on making machine learning accessible and understandable, allowing continuous learning from data. An AutoML platform that makes it easy to create, update, deploy machine learning models continuously.

Key Focus Area:

TAZI AI focuses on delivering AI-driven solutions to financial service sectors, particularly banking, wealth management, and insurance. Their primary objective is to aid institutions in enhancing client retention, fraud detection, and voice of customer through a secure and adaptive AI platform. TAZI aims to transform business operations by providing AI solutions that facilitate rapid, data-driven decision-making, ensuring compliance and efficiency.

Unique Value Proposition and Strategic Advantage:

-

Adaptive AI Technology: TAZI AI's core strategic advantage lies in its patented adaptive AI learning technology, which allows solutions to continually update with new data streams and user insights. This continuous learning approach ensures that the AI solutions are always aligned with current market conditions, providing a strategic edge over traditional batch learning methods.

-

Computation & Human-Centric Design: The platform integrates human expertise through a “Human-in-the-Loop” system, allowing businesses to blend regulatory insights and industry experience with advanced technological capabilities. This combination ensures AI solutions are not only data-driven but also practically applicable.

-

Security & Compliance: Another advantage is TAZI’s demonstrated commitment to security, evidenced by compliance with SOC 2 and HIPAA certifications. This assures clients of high standards in protecting data privacy and adhering to worldwide AI regulations.

Value Proposition Delivery Mechanisms:

TAZI AI delivers on its value proposition through the following methods:

-

Industry-Specific Solutions: TAZI provides tailored AI solutions for various financial sectors, ensuring that each platform is suitable for distinct needs like client retention, fraud prevention, and customer experience optimization.

-

Generative and Composite AI Solutions: By combining traditional AI/ML and generative AI technologies, TAZI offers solutions that provide comprehensive insights into customer behavior and business risks, thereby enhancing operational precision and customer satisfaction.

-

Explainability and Transparency: Their technology offers explainable AI, eliminating the “black box” problem by providing transparent processes and decisions, which is critical for regulation and executing compliance strategies effectively.

-

Integration Capabilities: By facilitating seamless integration with existing business systems through comprehensive APIs and robust infrastructure, TAZI enables financial institutions to leverage their current investments and minimize disruption.

-

Sustainability and Governance: TAZI promotes sustainability by designing environmentally friendly AI operations, aligning with global sustainability goals. They also adhere to EU Ethics Guidelines for building trustworthy AI and foster responsible AI usage.

Overall, TAZI AI emphasizes a commitment to providing robust and flexible AI solutions tailored for financial institutions, focused on ensuring secure, compliant, and efficient operations. The strategic integration of continuous learning AI, business adaptability, and a human-centric approach positions TAZI AI as a notable vendor in the sector of financial services AI technology.

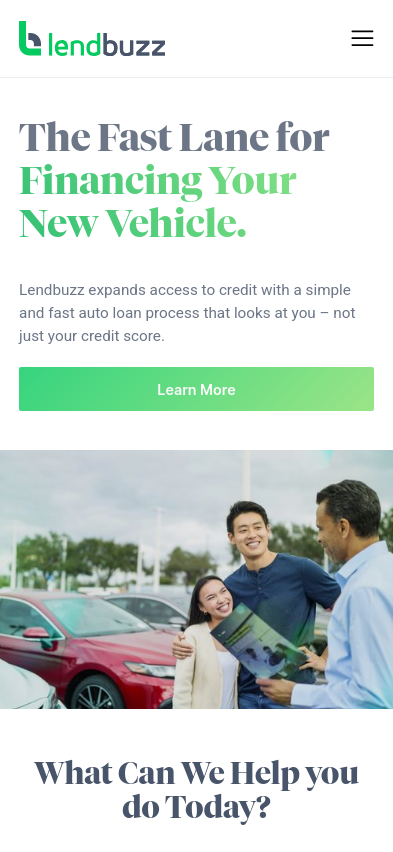

Lendbuzz

Lendbuzz is a fintech company offering financial solutions and services, particularly focusing on the automotive finance sector.

Lendbuzz Company Overview

Key Focus Area: Lendbuzz focuses primarily on providing auto loans to underserved segments of the population, including individuals with thin or no credit history, such as international students and other newcomers to the United States. Their operations extend across various states, continually expanding to offer financial solutions in more regions.

Unique Value Proposition and Strategic Advantage: Lendbuzz's unique value proposition lies in its use of comprehensive financial assessments beyond traditional credit scoring. The strategic advantage comes from leveraging their proprietary Artificial Intelligence Risk Analysis (AIRA) platform. This technology accounts for numerous financial data points to evaluate potential borrowers' creditworthiness more accurately than the conventional credit score model. Such innovations enable Lendbuzz to cater to a broader customer base, typically left unserved by standard banking institutions.

Delivery on the Value Proposition: Lendbuzz fulfills its value proposition through a few strategic approaches:

-

Technology Utilization: Lendbuzz employs its AI platform to process and evaluate loan applications rapidly. This system considers a holistic view of a borrower's financial footprint, facilitating credit access for those with unconventional or limited credit histories.

-

Dealer Partnerships: By forming alliances with car dealerships, Lendbuzz enables dealers to finance customers without requiring a social security number or a robust credit history. This can boost dealership sales by reaching otherwise neglected segments of the car-buying market. Dealers benefit from perks such as low fees, higher payout checks, and fast, same-day funding.

-

Product Offerings: The company provides various loan types including financing for new and used vehicles from both dealerships and private sellers, as well as refinancing options. Their loans ensure quick approval times—potentially within two business days—which is supported by an efficient application process that can be started online or through dealer partnerships.

-

Customer Support and Resources: Lendbuzz maintains an accessible customer service team and offers numerous resources like FAQs and borrower insights to assist customers through the application process and their financial decisions. Their support infrastructure is designed to handle inquiries promptly, enhancing the customer experience.

-

Trust and Security Assurance: The platform is built with an emphasis on security, ensuring a safe transaction process from application to loan closure. Lendbuzz assures its potential borrowers and dealers of secure, reliable, and transparent services.

Through these strategies, Lendbuzz aims to expand access to vehicle financing, promote inclusivity in financial services, and boost their dealership partners' sales while accruing benefits for both lenders and borrowers.

zypl.ai

zypl.ai provides GenAI SaaS to optimize risk management with macro-resilient zGAN for the financial sector.

Executive Summary of Zypl.ai

-

Key Focus Area: Zypl.ai is concentrated on pioneering innovations in synthetic data generation and artificial intelligence to optimize credit scoring. Their mission encompasses the advancement of AI technologies within the financial sector, particularly concerning credit scoring and lending models. The firm targets regions with emerging economies, focusing on improving credit availability and financial inclusivity through smarter, AI-driven solutions.

-

Unique Value Proposition and Strategic Advantage: The company offers a unique value proposition through its proprietary AI tools that leverage synthetic data to complement traditional credit scoring models. This approach allows financial institutions to account for outlier conditions, often not captured in typical lending evaluations. The strategic advantage lies in their ability to provide adaptive and convincing credit scoring solutions that can be customized to varying levels of risk appetite. By utilizing machine learning techniques to handle ‘black swan’ events, they enhance the stability and resilience of financial institutions’ credit portfolios.

-

Delivery on Value Proposition:

-

Generative AI Software (Zypl.score): The flagship product is ‘zypl.score,’ a software offering AI-as-a-service capabilities that support banks and financial institutions in adopting a macro-resilient decision-making framework. By using synthetic data-driven AI algorithms, zypl.score helps in providing a more robust credit evaluation process that is privacy-secure and customizable.

-

Partnerships: Zypl.ai collaborates with over 35 banks across 12 markets, which includes leading financial institutions in Eurasia, MENA, and Southeast Asia, effectively demonstrating the product's applicability and scalability across different geographies.

-

Strategic Collaborations: They maintain significant partnerships with global entities and leverage influential networks which enable the firm to access cutting-edge resources and insights. The collaboration with institutions like Commercial Bank International further solidifies its credibility in fintech innovation.

-

Market Expansion: Beyond its origins, zypl.ai has embraced a broad geographical expansion strategy, often highlighted by their move from a Tajik startup to establishing headquarters in Dubai’s International Financial Center and participating in international accelerators such as Hub71 and the Silkway Accelerator.

-

Technological and Market Innovation: Besides credit scoring, the company is venturing into underwriting insurance models and exploring other finance-related AI applications, thus broadening its impact and adaptation of its AI tools.

Zypl.ai’s strategic focus and technological advancements align with their ambition to be the first unicorn from Central Asia and their commitment to transforming the regional financial landscape. This is supported by their continual drive for innovation in AI-driven financial services.

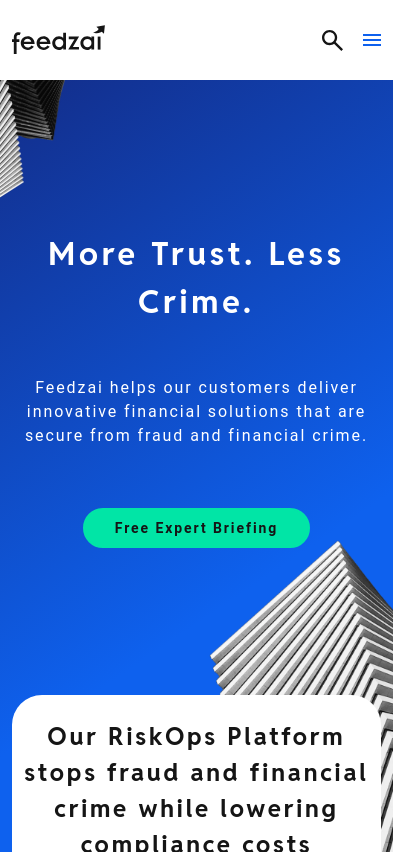

Feedzai

Feedzai is the market leader in fighting fraud and financial crime with today’s most advanced cloud-based risk management platform, powered by machine learning and artificial intelligence.

Feedzai: An Overview for Executives

Key Focus Area:

Feedzai specializes in providing comprehensive solutions for fraud prevention and risk management. Their operations are tailored to protect financial institutions, encompassing a broad spectrum of products designed to mitigate financial crime such as transaction fraud, account takeover, and anti-money laundering (AML) concerns.

Unique Value Proposition and Strategic Advantage:

-

Comprehensive RiskOps Platform: Feedzai delivers a singular, cohesive platform that integrates a variety of fraud management functionalities, streamlining processes and data into a unified system. This platform leverages artificial intelligence to enhance detection capabilities and offers solutions across multiple financial crime types and channels.

-

Behavioral Biometrics Technology: Feedzai emphasizes the use of behavioral biometrics, providing a non-intrusive authentication layer that identifies potential fraud through the assessment of digital interactions such as typing patterns. This technology enhances the ability to detect subtle fraud patterns that could be missed by traditional methods.

-

Real-time Risk Analysis: Their strategic advantage lies in employing advanced AI models that continuously learn and adapt to emerging threats, ensuring proactive fraud detection. This real-time capability is pivotal in securing transactions while minimizing disruptions for genuine customers.

Delivery on Value Proposition:

Feedzai executes its value proposition by deploying a multi-faceted approach that encompasses:

-

AI and Machine Learning: Feedzai’s AI system supports advanced fraud detection by analyzing transactional and behavioral data to create individual risk profiles. This intelligence not only helps in reducing false positives but also enhances fraud detection rates.

-

Omnichannel Capabilities: The company’s solutions monitor customer activities across various payment channels, providing a comprehensive view and allowing for more accurate risk assessments. This approach mitigates risks associated with new and diverse payment methods, crucial for adapting to the rapidly evolving financial sector.

-

Scalable and Adaptable Solutions: With their platform’s scalability, Feedzai is capable of processing upwards of 59 billion events per year and securing around $6 trillion in payments, signifying readiness to tackle the current volume and diversity of threats that face global financial institutions.

-

User-friendly Interfaces and Dynamics: The platform offers user-centric designs and self-service capabilities that allow financial institutions to manage risk directly. It provides features for model deployment and rule customization without extensive IT involvement, promoting efficiency and agility.

-

Strong Industry Partnerships and Insights: Collaborations with financial leaders and firms such as Form3 help Feedzai to continually refine their approach to fraud detection, ensuring their technology remains at the forefront of industry standards.

Feedzai positions itself as a central player in the fight against financial crime, integrating innovative technology and strategic insight to deliver targeted, effective risk management solutions. This alignment with evolving industry and regulatory needs provides their clients with tools needed to maintain robust, adaptable security measures in an increasingly digitalized financial landscape.

LYNK Capital

Specializes in commercial real estate loan fraud prevention.

LYNK Capital - Business Overview for Executives

1. Company’s Key Focus Area

LYNK Capital primarily targets the real estate investment sector, focusing on providing a range of financing solutions nationwide. The firm offers various types of loans explicitly catering to real estate investors engaging in fix-and-flip projects, construction, rental property investment, and bridging finance needs. Their services encompass short-term and long-term loan products tailored to different investment strategies within the market.

2. Unique Value Proposition and Strategic Advantage

LYNK Capital distinguishes itself through flexibility and speed in lending processes. Their strategic advantage lies in a deep understanding of construction lending, backed by decades of experience, allowing them to adeptly serve real estate investors. Their loan products are structured to be competitively priced and adaptable to the fluctuating demands of real estate investments. As a direct lender, they promise rapid loan approvals and closings, addressing market needs for expedited access to funds without the typical bureaucratic delays seen in traditional banking.

3. How They Deliver on Their Value Proposition

LYNK Capital emphasizes a comprehensive service delivery framework:

-

Diverse Loan Options: They provide housing investors with fix-and-flip, construction, bridge, and DSCR rental loans, each product tailored to specific project requirements.

-

Streamlined Pre-Approval Process: With an efficient online application process, potential borrowers can receive pre-approvals quickly, often in just minutes, ensuring they can act swiftly in competitive markets.

-

No Requirement for Traditional Credit Checks or Documentation: LYNK Capital's loan approvals often avoid cumbersome personal financial assessments, such as tax returns, focusing instead on the potential profitability of projects.

-

Investor-Centric Approach: With significant experience in real estate investment financing―having funded over $1 billion in loans―LYNK Capital uses this insight to offer contractual terms that align more closely with the investor’s project timelines and financial needs than traditional banks.

-

Quick Draw Process for Construction Loans: For construction or renovation loans, LYNK Capital facilitates a staged disbursement of funds, matched against project milestones to maintain fund control aligned with budget use and verification.

-

Customizable Loan Structures: Through competitive LTV (Loan-to-Value) and LTC (Loan-to-Cost) ratios, alongside flexible term lengths and interest structures, they provide options that can be fine-tuned to align investor business models with project goals.

-

Dedicated Support: They promise focused customer service to navigate the complexities of loan management, ensuring that borrowers have access to knowledgeable teams that can provide assistance throughout the loan lifecycle.

-

Efficient Use of Technology: Utilizing an online platform for applications and information dissemination offers a user-friendly experience designed to keep investors promptly and effectively connected to their lending solutions.

LYNK Capital’s strategic focus is on serving not as a general financial institution, but as an invested partner understanding the unique challenges and fluidity of the real estate market. They aim to empower investors with the financial tools necessary to capitalize on market opportunities swiftly and confidently.

BuzzBoard

BuzzBoard offers AI-powered solutions to assist businesses in demand generation, sales development, and digital marketing for small businesses. They provide integrations with platforms like Salesforce and offer tools for sales automation, customer insights, and personalized marketing strategies.

BuzzBoard focuses primarily on equipping sales and marketing teams with a comprehensive, AI-driven account intelligence platform designed specifically for small and mid-sized businesses (SMBs). It provides detailed insights into over 30 million SMBs globally, leveraging proprietary data and machine learning algorithms to streamline prospecting, enhance sales strategies, and personalize customer engagement.

Key Focus Area

- The company's key focus is on small and medium-sized businesses (SMBs) and helping organizations target these entities with precision by providing detailed account intelligence, data-driven insights, and hyper-personalized sales strategies.

Unique Value Proposition and Strategic Advantage

-

Account Intelligence Platform: BuzzBoard prides itself on its ability to offer in-depth account intelligence that helps users identify, segment, and target the right SMBs more effectively. They claim to manage the largest and most configurable SMB database.

-

Hyper-Personalization: Its generative AI capabilities enable users to create tailored, detailed content—such as emails and conversation starters—that align closely with the specific needs and behaviors of each SMB.

-

Extensive Data Signals: Over 6,400 signals for each business allow BuzzBoard to offer precise insights into a business's digital maturity and operational dynamics, purportedly beating traditional data scoring and segmentation methods.

-

AI and Machine Learning: The use of AI and machine learning to assess SMB prospects and categorize them into micro-segments for better targeting is another strategic advantage mentioned.

Delivery on Value Proposition

-

Technology Integration: BuzzBoard integrates seamlessly with popular customer relationship management (CRM) tools and other platforms like Salesforce, Zapier, Zendesk, and Chrome, enhancing usability by providing account insights within these environments.

-

Data Enrichment: Their SMB Data API and Chrome Extension provide real-time data enrichment and insights into prospects by leveraging rich data streams. It claims to have a high match rate for SMB data, ensuring that CRM databases are kept up-to-date and accurate.

-

No Templates Approach: Their strategy dismisses generic templates, opting instead for AI-driven messaging uniquely customized to meet each prospect's characteristics and communication channel.

-

SMB-Dedicated Platforms: BuzzBoard offers specific platforms for different aspects of sales and marketing, such as 'Demand' for demand generation and 'Ignite' for sales content creation. These platforms aim to ensure users can harness data for better conversion strategies and richer sales conversations.

-

Dedicated Data Science Support: BuzzBoard offers expertise beyond data provision; they provide consultation with a team of data scientists to help businesses refine their approaches using data intelligently.

The company suggests that its proprietary, AI-driven platforms and data capabilities empower teams to effectively engage and manage relationships with SMBs, promising improved targeting, personalized engagement, and increased sales efficiency.

Unify AI

Unify revolutionizes AI deployment by merging open source and proprietary tools for fast pipelines, ensuring optimal performance across various tasks.

Unify.ai Company Overview

1) Key Focus Area: Unify.ai concentrates on optimizing the use of Large Language Models (LLMs) for application development. The company aims to provide solutions that simplify the integration and deployment of these models, specifically targeting improved quality, cost efficiency, and speed.

2) Unique Value Proposition and Strategic Advantage: Unify offers a platform that integrates various LLMs from different providers into a single API, making it easier for developers to access and leverage the strengths of multiple models. This approach capitalizes on providing more efficient and cost-effective AI application solutions compared to using a single model. The strategic advantage lies in the reduction of complexity and overhead associated with managing multiple LLMs, enabling developers to switch between them to optimize for specific tasks.

3) How They Deliver on Their Value Proposition:

- Integrated Access: Through a single API, developers can access all available LLMs across providers, simplifying the integration process and allowing easier experimentation with different models.

- Customization: The platform allows for personalized configurations to tailor performance in terms of speed, cost, and quality based on specific user needs.

- Optimization Tools: Live dashboards and transparent benchmarks are provided to objectively compare LLMs, ensuring users can select the best possible model combinations.

- Routing Technology: Unify’s routing technology helps direct requests to the optimal LLM based on evolving model capabilities, thus enhancing efficiency and reducing costs.

- Collaboration and Prototyping: They offer tooling for developers to build their workflows rapidly, ensuring rapid prototyping and iteration.

Unify has positioned itself as a pivotal resource within the LLM ecosystem, providing a centralized platform for accessing, comparing, and optimizing various AI models. This service is aimed primarily at developers who face the challenge of navigating the complex and rapidly growing landscape of AI models.

Hirebee

Hirebee is a recruitment platform that streamlines hiring through job distribution, candidate sourcing, automated screening, and analytics, enhancing efficiency for businesses of all sizes.

- Key Focus Area:

Hirebee's primary focus is on advancing and streamlining the recruitment and talent acquisition process. Their main aim is to provide an adaptable, intelligent hiring solution that caters to businesses of all sizes, helping them manage the rapidly evolving recruitment landscape efficiently. Key areas include global job distribution, candidate sourcing, relationship management, automated candidate screening, recruitment marketing, and analytics.

- Unique Value Proposition and Strategic Advantage:

Hirebee's unique value proposition lies in its comprehensive hiring platform powered by artificial intelligence. This platform promises to reduce time-to-hire and enhance hiring efficacy by automating key aspects of the recruitment process. Strategic advantages include:

- AI-Based Screening: Hirebee utilizes advanced algorithms to objectively match candidates to job roles based on skills and experience, aiming to eliminate bias and promote diversity within hiring processes.

- Integration with Multiple Platforms: The platform integrates seamlessly with over 3000 job boards and numerous social media channels, allowing companies to efficiently distribute job postings and enhance their reach.

- Customer Support: Hirebee emphasizes its award-winning customer success team, which is positioned as friendly and supportive, helping clients through their hiring journey.

- Flexibility: The ability to customize workflows and integrate with various tools and resources provides businesses with the adaptability they require to cater to diverse recruitment needs.

- Delivery on Value Proposition:

Hirebee delivers on its value proposition through multiple features and strategic methods, including:

- Automated Job Distribution: By empowering users to post job openings on multiple channels quickly, Hirebee ensures a broad reach for potential hires and accelerates the recruitment timeline.

- Candidate Relationship Management: Tools are available for maintaining communication and relationships with candidates, including direct chat capabilities and advanced profiling features, which are designed to enhance the candidate experience and facilitate better recruitment outcomes.

- Advanced Analytics and Reporting: The platform provides robust analytics capable of offering insights into hiring methods and channel efficacy, which can guide strategic decisions and improve recruitment ROI.

- Intelligent Candidate Matching: The use of AI in screening processes aims to ensure unbiased selection, thereby supporting a more diverse and inclusive hiring process.

- Tailored Solution for Different Business Segments: Hirebee's tools and services are customized to meet the specific needs of various business types, including small to medium enterprises, startups, and staffing agencies, ensuring relevance and efficiency across different contexts.

Hirebee positions itself as a proactive partner in talent acquisition, seeking to alleviate the complexities of hiring by offering a blend of automation, intelligence, and flexible support. Through these offerings, Hirebee aims to enhance recruitment effectiveness both locally and globally.

Bizway

No summary available.

Careers | Careers | Careers | Leadership | Management | About | About

Executive Summary for Bizway

Key Focus Area:

Bizway primarily operates within the realm of business automation and process optimization through Artificial Intelligence (AI). It assists businesses in streamlining operations, automating repetitive tasks, and scaling output. The company's focus extends from helping entrepreneurs get a business idea off the ground to adjusting and automating existing business processes, enabling businesses to grow efficiently.

Unique Value Proposition and Strategic Advantage:

Bizway's unique value proposition lies in its no-code platform that allows even those without technical skills to build AI agents to perform a variety of business tasks. The strategic advantage of Bizway is its intuitive, user-friendly system, which democratizes access to AI tools, thus enabling small businesses, freelance professionals, and creators to enhance productivity without the traditional overhead costs associated with hiring additional staff. This ease of use is coupled with a marketplace where users can access and rent AI agents, adding versatility and scalability to its value proposition.

Delivery on Value Proposition:

Bizway delivers its value proposition through several key features and strategies:

-

AI Agents Marketplace: By providing a marketplace for AI agents, Bizway enables businesses to either hire specialist AI agents created by other users or create their own to automate specific tasks. This model not only provides access to sophisticated AI solutions but also creates opportunities for users to earn revenue.

-

No-Code AI Agent Builder: The platform empowers users to build AI solutions using a "Lego-like" block builder, which simplifies the deployment of AI without the need for programming skills. This builder facilitates the automation of content planning, market research, customer support, and more.

-

Integrations: Bizway supports integrations with widely used business tools such as Webflow, Notion, Airtable, Google Analytics, Stripe, and more. This allows users to incorporate existing workflows and data seamlessly into the platform, amplifying the efficiency of the AI solutions.

-

Customizable AI Assistants and Templates: Users can access pre-made templates or create custom AI assistants tailored to their business needs. These solutions are designed to fulfill roles typically associated with multiple employees, providing significant time and cost savings.

-

Automations and Scheduling: The platform enables users to automate task lists and schedule AI agents for 24/7 operations, thereby maximizing productivity and ensuring ongoing task management without manual intervention.

-

Scalable Pricing Models: Bizway offers scalable pricing plans, including free tiers for beginners to more advanced packages for users who require extensive automation capabilities, ensuring accessibility to businesses of varying sizes and scopes.

Through these strategies, Bizway not only facilitates business growth and efficiency but also creates a flexible, scalable ecosystem where businesses can leverage AI to react swiftly to market demands and operational challenges.