⚡ZurzAI.com⚡

Companies Similar to Arya AI

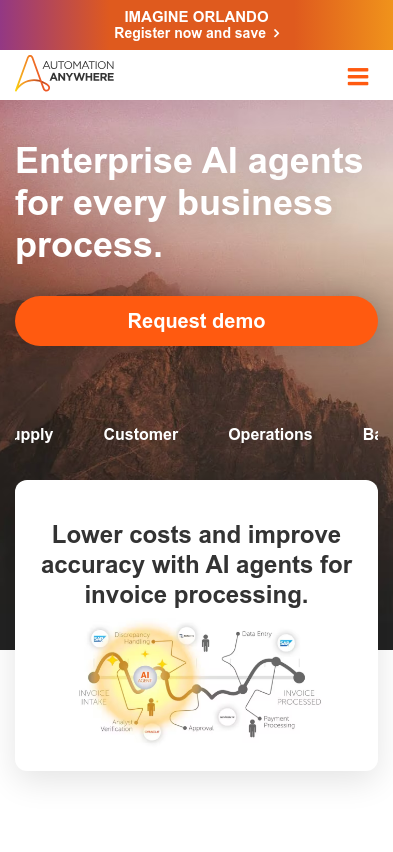

Automation Anywhere

AI agents optimize business processes by reducing costs, enhancing accuracy, and boosting productivity, leading to significant savings and improved customer satisfaction.

Locations | Locations | Locations | Locations | Locations | Locations | News | Awards | Locations | Locations | Locations | Locations | Locations | Leadership | Locations | Locations | Locations | Locations | Locations | Locations | Locations | News | Locations | Locations | Locations | Locations | Locations | Locations | Locations | News | Locations | Locations | Locations | Locations | Locations | Locations | News | Locations | Locations | Locations | Locations | Locations | Locations | Locations | News | Locations | Locations | Locations | Locations | Locations | Locations | Locations | News | Locations | Locations | Locations | Locations | Locations | Locations | Locations | News | Locations | Locations | Locations | Locations | Locations | Locations | News | Locations | Locations | Locations | Locations | Locations | Locations | News | Locations | Locations | Leadership | Leadership | Leadership | Leadership | Leadership | Leadership | Leadership | Leadership

Summary of Automation Anywhere

1) Key Focus Area:

Automation Anywhere's primary focus is the development and deployment of sophisticated automation solutions, particularly through its Agentic Process Automation System. This system targets the automation of complex, mission-critical workflows, integrating artificial intelligence (AI) and automation technologies. Their platform is designed to handle tasks across various applications, catering to industries like healthcare, financial services, and manufacturing.

2) Unique Value Proposition and Strategic Advantage:

-

Comprehensive Platform: Their platform facilitates a full range of automation needs from simple task automation to complex enterprise processes. It's built to work with any application, offering a seamless integration into existing systems.

-

AI-Powered Solutions: Automation Anywhere leverages AI to enable smarter automation. The AI Agent Studio allows the automation of advanced tasks, facilitating more accurate data processing and streamlined workflows.

-

Scalability and Flexibility: The platform is highly flexible, allowing the integration of various AI models tailored to industry-specific needs. This adaptability, combined with the ability to operate within any enterprise application or cloud environment, offers significant strategic advantages to businesses seeking scalable solutions.

-

Security and Governance: Automation Anywhere emphasizes security and oversight through architecturally robust solutions designed with governance controls to ensure data protection and operational integrity.

3) Delivery on Value Proposition:

-

AI Agent Studio: The platform includes a suite of tools designed for building AI agents that automate complex tasks. The low-code tools empower developers to connect quickly to enterprise data, customize processes, and deploy actions efficiently.

-

Automation Co-Pilot: This feature provides AI-assisted support within applications, enabling users to quickly and easily automate tasks without deep technical knowledge, thereby improving productivity across teams.

-

Community Edition and Extensive Support: Automation Anywhere offers a free Community Edition for immediate access to their cloud-based features, alongside various support plans aimed at matching business requirements, ensuring continued customer engagement and adaptation.

-

Integration with Major Cloud Solutions: Their strategic alliances with companies like Google Cloud and AWS demonstrate their commitment to enhancing enterprise automation capabilities and efficiency, reducing operational costs.

Avoided Overly Complimentary Language: Throughout the summary, the information is presented factually and without unnecessary superlatives, focusing on the strategic benefits and features of Automation Anywhere's offerings.

Kore.ai

Kore.ai specializes in conversational AI solutions for enterprises, with a focus on specific industries like banking, healthcare, and retail. It offers advanced natural language processing capabilities for streamlined operations and voice interaction support.

News | News | News | News | News | News | News | News | News | News | News | News | News | News | News | News | News

Kore.ai, a company focused on artificial intelligence (AI) solutions, offers a diverse set of products aimed at automating processes and enhancing customer and employee experiences across various industries. Their product suite is categorized into distinct offerings targeting work, process, and service-related challenges using AI technologies.

Key Offerings:

-

AI for Work:

- Designed to empower employees with tools for improved efficiency.

- Features include workspace search, pre-built AI agents, and no-code tools for custom AI agent creation.

- Supports HR, recruiting, and IT processes to streamline operations with role-based access and contextual learning.

-

AI for Process:

- Focuses on automating complex workflows and enhancing operational efficiency through AI agents.

- Offers no-code development tools, process templates, and data management capabilities.

- Includes features for real-time AI analytics, data anonymization, and enterprise compliance.

-

AI for Service:

- Aims to improve customer service experiences by integrating generative AI.

- Supports human-like self-service, intelligent routing, and real-time agent assistance across channels.

- Offers pre-built solutions for industries such as banking, retail, and healthcare.

Platforms and Tools:

- XO Platform: Provides a comprehensive suite for optimizing customer and employee interactions with AI Chat Bot capabilities, automation, and an agent orchestrator.

- GALE Platform: Supports generative AI model development, fine-tuning, and deployment with tools for enhanced AI creation and prompt management.

- Search AI: Offers a robust search functionality across structured and unstructured enterprise data, focusing on transforming content into actionable insights.

Solutions and Services:

- CXO AI Toolkit: This toolkit supports enterprises in adopting AI technologies effectively, offering guides and resources to deliver measurable ROI.

- Industry-Specific Solutions: Solutions such as BankAssist, RetailAssist, and HealthAssist cater to specific sectors, providing tailored virtual assistants and automation tools.

- Professional Services and Support: Kore.ai provides professional services to aid in the customization and deployment of AI solutions, and offers continuous support and training through the Kore.ai Academy.

Pricing and Plans:

Kore.ai provides a flexible pricing model across various tiers:

- Essential Plan: For small businesses or beginners, focused on basic chatbot capabilities.

- Advanced Plan: For more extensive AI functionalities and higher usage limits.

- Enterprise Plan: Offers custom pricing with features tailored for large businesses, including high limits and extensive support.

In terms of compliance and responsible use, Kore.ai underscores the importance of a comprehensive security framework with AI guardrails and governance utilities, ensuring their solutions adhere to industry standards and regulations.

Additional Resources:

Kore.ai provides a range of educational content and resources to foster AI literacy and adoption, including:

- Blogs, webinars, and whitepapers to keep users informed of the latest AI trends and technologies.

- A supportive community and robust documentation for developers and users.

Overall, Kore.ai presents itself as a versatile AI platform seeking to drive innovation and efficiency in business operations through its AI-powered offerings across work, process, and service domains.

ADVANCE.AI

ADVANCE.AI is an AI company providing AI-driven risk management and digital lending solutions for enterprise clients in Southeast Asia, South Asia, and Mexico. It is part of Advance Intelligence Group, ranked No. 1 on LinkedIn's 2021 Top Startups List in Singapore.

ADVANCE.AI provides technology-driven solutions focused on digital identity verification and fraud prevention across multiple industries including finance, healthcare, travel, and more.

Key Offerings:

-

OneStop Platform: A comprehensive solution that facilitates seamless customer onboarding and lifecycle management, ensuring compliance with KYC and AML requirements. It integrates various AI-powered technologies to streamline and automate workflows, catering to businesses' ever-evolving needs.

-

Digital Identity Verification: Facilitates remote identity verification using AI technologies like biometrics, liveness detection, face comparison, and document recognition to accommodate a variety of use scenarios, from banking and payments to IoT applications.

-

AI-Powered Biometrics and Document Verification: Uses advanced algorithms and AI models to authenticate users and detect identity fraud through facial recognition, liveness detection, and document verification technologies. These tools are essential for industries like banking, e-commerce, and healthcare to ensure the individual's identity is authentic.

-

Fraud Intelligence and Credit Insight: Employs big data and machine learning to detect and prevent fraudulent activities. The system analyses a wide range of data to provide fraud intelligence and credit scoring, which assist in areas such as customer management, risk assessment, and debt collection.

Industries Served:

-

Banking and Financial Services: ADVANCE.AI's solutions help financial institutions enhance customer experiences and ensure compliance with KYC/AML requirements through innovative identity verification and fraud prevention.

-

Payment Services: Protect payment transactions with risk management systems that effectively tackle fraud issues like account theft and compliance with cashless transaction standards.

-

Healthcare: Utilizes identity verification to protect sensitive medical data and prevent fraud in insurance claims and prescription management.

-

Travel and Hospitality: Assists in quickly verifying traveller identities, reducing fraud, and expediting processes such as hotel check-ins and airport procedures.

-

Sharing Economy and E-commerce: Builds user trust and platform security by ensuring the verification of identities in peer-to-peer rental services, online marketplaces, and other shared resource environments.

Technology and Innovation:

-

AI and Machine Learning: Central to ADVANCE.AI's offering, helping businesses mitigate fraud risks and optimize operations by leveraging predictive analytics, data mining, and advanced natural language processing.

-

Liveness Detection and Face Comparison: Ensures the person presenting the ID is the actual owner through real-time validation of facial movements and comparison with stored images.

-

ID Forgery Detection: Able to identify altered or forged documents using machine learning models, addressing typical forgery patterns and inaccuracies.

-

Joint Modelling and Credit Insight: Enhances decision-making with real-time fraud scores and risk evaluations, designed for multi-dimensional credit analysis and management.

Support and Customization:

-

ADVANCE.AI provides a configurable API and SDK support for integrating their solutions into existing business workflows, ensuring localized, tailored solutions for diverse markets in Asia and beyond.

-

Customer Support and Collaboration: Services include 24/7 support for inquiries, with a focus on understanding business-specific needs to ensure optimal deployment and performance of ADVANCE.AI's solutions.

With these offerings, ADVANCE.AI aims to guide multiple industries towards more secure, efficient, and innovative business operations by using cutting-edge technology to solve complex identity and verification challenges.

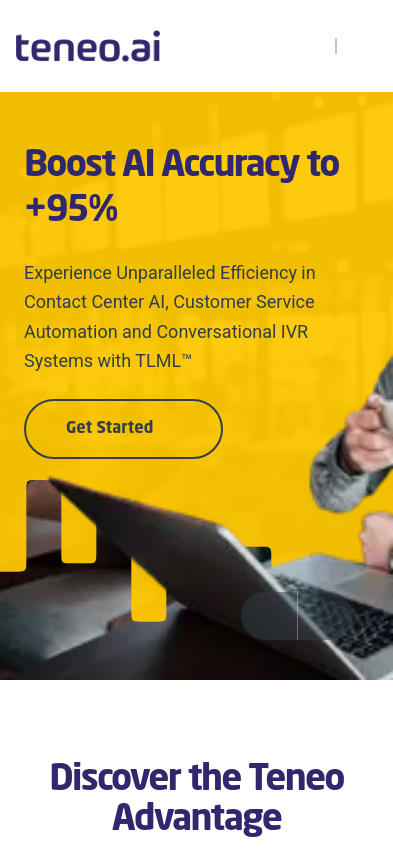

Teneo.AI

Teneo.AI is an AI-driven platform designed for high-volume contact centers, providing solutions in Contact Center AI, Customer Service Automation, and Conversational IVR Systems.

Teneo.ai offers a comprehensive suite of AI-driven solutions designed to enhance customer interactions and streamline operations in contact centers. The platform is known for its high efficiency in AI applications, particularly in contact center environments where fast, scalable, and accurate solutions are essential. Here are key points from their offerings:

Platform Capabilities:

-

Teneo's Advanced AI Engine: Teneo employs a sophisticated Natural Language Understanding (NLU) system, TLML™ (Teneo Linguistic Modeling Language), to deliver AI solutions with over 95% accuracy in customer interaction. This approach minimizes misrouted calls by 90%, optimizing customer satisfaction.

-

Operational Cost Reduction: Teneo claims a reduction of up to 98% in AI operational expenses and provides rapid deployment capabilities that enhance return on investment swiftly—in just 60 days.

Flexible and Scalable Infrastructure:

-

Open Architecture: Teneo's open architecture allows seamless integration with various generative AI models, catering to diverse tech stacks and supporting growth across languages and channels.

-

Rapid Implementation: Teneo supports fast deployment and transformation, aiming to restructure contact center setups to enhance service quality and operational efficiency through more intelligent, tailored solutions.

AI Solutions and Their Impact:

Teneo offers a diverse range of solutions that cater to different sectors and needs:

-

Contact Center Automation: This reduces the workload on human agents by automating up to 95% of standard processes, reducing operational costs.

-

OpenQuestion IVR System: This conversational AI system transforms traditional interactive voice response (IVR) systems into more intuitive AI-powered systems, significantly decreasing both call misrouting and abandonment rates.

-

Scalable, Multilingual Support: Teneo adapts to various languages, making it an ideal solution for businesses with international reach. The multilingual support is a key feature that empowers businesses like Swisscom, enabling a stable and scalable customer interaction platform.

Case Studies Highlighting Industry Solutions:

-

Swisscom's Transformative AI Journey: Using OpenQuestion, Swisscom has integrated a scalable and efficient AI solution that supports German, Italian, French, and English, resulting in a dramatic improvement in customer engagement ratings and an 18-point increase in the Net Promoter Score.

-

Healthcare Tech Company: Leveraging Teneo’s system, significant improvements in call center efficiency were achieved, saving $6 million annually and enhancing customer and employee satisfaction with reduced wait times and increased service levels.

-

Telefónica Germany: Teneo's AI solutions helped Telefónica Germany improve its IVR resolution rates by 6%, handling nearly a million requests per month, and revitalizing customer service operations post criticism.

Development and Integration Resources:

-

Developer Resources: Teneo offers a robust development environment intended to optimize conversational AI implementation, including tools to create, deploy, and analyze bots across multiple channels.

-

Security and Compliance: The platform emphasizes top-tier security and privacy through its ISO 27001 certification and comprehensive data encryption measures, positioning itself as a trusted partner for large enterprises with stringent data protection requirements.

Learning and Partner Ecosystem:

- Learning Hub and Partnership Opportunities: Teneo provides a learning hub with resources like whitepapers, case studies, and e-books, alongside a network of partners that enhance and extend the platform's capabilities.

Overall, Teneo.ai focuses on improving operational efficiency and customer experience through advanced AI technologies, offering tailored solutions that adapt to a myriad of industry-specific challenges and operational needs.

Digital.ai

Digital.ai empowers Global 5000 enterprises in digital transformation with a comprehensive suite of DevOps, Agile, and security tools for enhanced software delivery and insights.

Digital.ai presents a suite of solutions aimed at enhancing software development and delivery processes, particularly focusing on the benefits of integrating artificial intelligence (AI) into software development life cycles. Here’s a breakdown of their offerings and strategic focuses:

Products and Solutions:

-

Agility - Provides enterprise agile planning to ensure quicker delivery times and integrates best practices for software development.

-

Application Security - Offers solutions for protecting applications by monitoring and automatically reacting to threats within applications, and includes features like runtime application self-protection (RASP).

-

Continuous Testing - Ensures comprehensive testing solutions for both web and mobile applications, with capabilities to scale as demands increase.

-

Deploy - Automates application deployment across a wide range of environments, helping organizations scale efficiently.

-

Intelligence - Leverages AI to provide insights throughout the software development and delivery lifecycle, supporting various decision-making processes.

-

Release - Focuses on automating and orchestrating software releases within complex technological environments to improve efficiency and governance.

-

TeamForge - A platform that ensures compliance and security standards are maintained throughout the development process, assisting with governance and policy adherence.

-

Platform - Offers a unified approach that integrates various aspects of software development, from planning and security to release and monitoring, all enhanced by AI capabilities.

Strategic Initiatives:

-

AI-Assisted Development: Digital.ai emphasizes leveraging AI tools to boost developer productivity while maintaining software compliance and security standards. The integration of AI aims to streamline and automate coding, testing, and deployment processes, reducing bottlenecks and improving output quality.

-

Industry-specific Solutions: The company outlines solutions tailored for government entities and the financial services industry, focusing on governance, agile and DevOps transformations, security enhancements, and compliance.

-

Cloud Transformation: Digital.ai helps organizations transition to cloud environments, managing complex deployments and maintaining effective governance across various infrastructures, including hybrid and multi-cloud environments.

Key Reports and Resources:

-

2024 Application Security Threat Report: This report highlights an increase in app attacks, driven by factors like AI-generated malware, providing insights into trends and strategies for safeguarding applications.

-

AI Strategy Resources: These resources help enterprises understand how AI can be harnessed to unlock potential, improve efficiencies, and mitigate risks throughout software development processes.

Community and Support:

- Offering extensive support through community engagements, webinars, and personalized consultation services, Digital.ai assists organizations in maximizing their software development and deployment strategies.

In summary, Digital.ai positions itself as a key enabler for digital transformation by integrating AI across the software delivery lifecycle, ensuring security, compliance, and innovation. This is achieved through comprehensive product offerings that address the needs of large enterprises and specific industry sectors, promoting end-to-end visibility, automation, and intelligence.

Scienaptic AI

Scienaptic AI offers adaptive AI-powered credit underwriting, fraud detection, and investment analytics tools to enhance decision-making for banks and institutional investors.

Scienaptic AI offers advanced AI-driven credit decision technology designed to improve credit accessibility by automating underwriting and providing intelligent risk predictions. The platform is utilized by over 150 lenders and facilitates faster credit decisions while maintaining compliance with regulatory standards.

Key Features:

-

AI Technology: Scienaptic’s AI models are built on 200 years of combined credit risk expertise and are trained on over 400 million records. They provide significantly higher risk differentiation compared to traditional bureau-based scores. The technology promises increased automation, higher approval rates, and reduced default risks.

-

Integration and Partnerships: Scienaptic seamlessly integrates with existing Loan Origination Systems (LOS) and partners with various data, bureau, and league partners to enhance decision-making capabilities. This integration aims to ensure a disruption-free deployment and more efficient credit decision processes.

-

Regulatory Compliance: The platform assists clients in passing regulatory audits and integrates thorough disparate impact analysis to ensure unbiased model design. Comprehensive documentation and explainable AI models provide transparency and compliance with fair lending guidelines.

-

Focus on Inclusivity: Scienaptic emphasizes fair and equitable lending practices. Over 1.3 million underserved applicants are approved each month, and the platform is capable of scoring over 95% of applications without a traditional credit score. This includes a higher rate of approvals for protected classes and new-to-credit segments like Gen-Z.

Client and Partner Experiences:

- Client Testimonials: Numerous credit unions, such as the Credit Union of Colorado and Southwest Louisiana Credit Union, report improved approval rates, enhanced decision-making processes, and a higher return on investment after adopting Scienaptic’s solutions.

- Partner Collaborations: Partners like Kentucky Credit Unions and Magiloop highlight the value of AI in improving membership growth, risk management, and service delivery, particularly for underserved populations.

Company Overview:

- Foundation and Mission: Founded in 2014, Scienaptic AI's mission is to drive financial inclusion on a large scale through its AI-powered credit decisioning platform. The company integrates data from various sources, leveraging advanced machine learning algorithms to enhance lending practices.

- Leadership and Culture: The leadership team comprises experienced professionals with deep credit risk management expertise. The company provides a flexible work culture, promotes cross-functional learning, and invests in technological advancements to maintain a competitive edge.

- Career Opportunities: Scienaptic is expanding its workforce, seeking talented individuals for roles such as Chief Growth Officer and Vice President of Strategic Partnerships, to further drive its growth in the financial technology sector.

Thought Leadership and Educational Resources:

- Webinars and Podcasts: Scienaptic regularly hosts webinars and releases podcasts that cover topics on AI's role in lending, economic uncertainty strategies using AI, and credit union growth opportunities. These sessions feature industry leaders discussing practical applications of AI in credit decisioning.

- Case Studies and Insights: They offer detailed case studies showcasing the transformative impact of their AI technology on various lending institutions. Additionally, blogs and whitepapers provide insights into AI adoption and its implications for financial services.

In summary, Scienaptic AI positions itself as a company addressing the limitations of traditional credit systems through innovative AI solutions, enhancing fair lending practices, regulatory compliance, and overall efficiency in credit decisioning for financial institutions.

AYR

AYR is a leading provider of AI-powered solutions for businesses of all sizes and industries. Their mission is to make AI accessible to everyone by offering user-friendly and affordable solutions that enable businesses to harness the power of AI to drive growth and innovation. They specialize in Intelligent Document Processing, which includes computer vision, natural language processing, proprietary OCR, and machine learning.

Careers | Careers | Careers | Careers | Careers | Leadership | About | About | About | About | About | About

AYR, Inc., a company previously known as Singularity Systems, focuses predominantly on Intelligent Document Processing (IDP). Their core mission is centered around leveraging AI technologies to convert unstructured data into actionable insights, significantly improving business operations through automation and enhanced efficiency.

Key Focus Area: AYR specializes in automating document processing through its platform, SingularityAI. The company's key focus is to tackle the challenges posed by unstructured data in various industries—like banking, insurance, healthcare, etc.—by transforming it into machine-readable formats that allow real-time decision-making.

Unique Value Proposition and Strategic Advantage: AYR presents its SingularityAI platform as a solution that integrates advanced technologies such as proprietary OCR (Optical Character Recognition), Natural Language Processing (NLP), and computer vision. The platform stands out for:

-

Data Simulator Advantage: The Intelligent Data Simulator allows AYR to minimize the need for large data sets to train AI models. By creating synthetic data, AYR enables robust AI models that can handle substantial data variations with minimal input data.

-

Human-Driven AI: The platform enables real-time interaction between the human workforce and AI, allowing business users to train AI models without needing data scientists, which simplifies the model training process, reduces dependencies, and accelerates deployment.

-

Scalability and Adaptability: By using transfer learning and domain-specific models, AYR offers solutions that retain high accuracy even as underlying data and formats evolve, which is a major pain point in traditional AI deployments.

Delivery on Value Proposition: AYR's delivery on its promises includes streamlined model deployment, optimized through its AutoML capabilities. The platform enables:

-

Faster Deployment: With its patented AI Pathfinder technology, models can be trained and deployed within days. This is a drastic reduction compared to the traditional timeline of weeks or months.

-

High Accuracy and Speed: By integrating several cutting-edge AI technologies, AYR promises and reportedly achieves nearly 100% straight-through processing for complex use cases. The platform boasts a high extraction rate and precision accuracy, mitigating the risks of errors and inefficiencies.

-

Reduced Human Involvement: AYR’s automation capabilities are designed to significantly reduce human redundancy in processes like data entry, enabling businesses to focus on higher-value tasks.

AYR's demonstrated use cases, ranging from processing banking cover letters with high accuracy to automating mortgage deed data extraction, epitomize its product's impact on reducing processing times and increasing ROI. This further illustrates its strategic advantage in efficiently handling large volumes of complex document processing tasks.

In summary, AYR aims to transform traditional document processing with its IDP solutions by making AI applications more accessible, thereby facilitating significant operational improvements and cost efficiencies for enterprises dealing with massive unstructured data loads.

Arthur AI

Arthur AI provides tools for monitoring AI model performance and detecting bias, ensuring high-quality applications and protection for large language models.

Arthur.ai is a platform focused on enhancing the deployment, monitoring, and management of AI models, both traditional and generative. The platform offers various solutions aimed at optimizing business operations through AI while ensuring security, compliance, and efficiency. Here's an overview of the primary features and solutions provided by Arthur.ai:

Solutions:

-

Evaluation (Bench):

- The Arthur Bench is an open-source evaluation tool that enables enterprises to compare and assess large language models (LLMs) comprehensively.

- It facilitates informed model selection, budget and privacy optimization, and the translation of academic benchmarks into real-world performance metrics.

-

Firewall (Shield):

- The Arthur Shield acts as a security layer for LLM deployments, addressing risks such as data leakage, hallucinations, and toxic language generation.

- It integrates into existing LLM workflows, providing real-time protection by intercepting potentially harmful prompts and responses.

-

Observability (Scope):

- The Observability component allows businesses to monitor and improve the performance of their AI models across various types, including tabular, CV, NLP, and LLMs.

- It detects data drift, ensures model accuracy, and provides fairness and explainability metrics to build trust and compliance.

-

Agentic Support:

- This solution offers advanced tools for monitoring and securing AI agent workflows, crucial for maintaining innovation and automation within enterprises.

- Comprehensive logging and real-time metrics support collaborative workflows and model protection.

Products:

-

Model Monitoring:

- Arthur’s monitoring solutions cater to models of all kinds (NLP, CV, tabular), emphasizing accuracy, explainability, and fairness.

- It incorporates automatic drift detection, bias mitigation strategies, and transparency tools to improve model outcomes.

-

Arthur Chat:

- A turnkey chat platform utilizing LLMs built on enterprise data, providing secure and optimized AI-powered chat solutions while leveraging internal knowledge bases for enhanced responses.

Research & Development:

- Generative Assessment Project:

- A research initiative that evaluates the strengths and weaknesses of various LLMs from industry leaders.

- It involves experiments analyzing LLM sensitivity, responses, and effectiveness in real-world scenarios.

Company Vision:

Arthur.ai focuses on enabling safe, optimized, and efficient use of AI technology across industries. Through tools like Bench, Shield, and Scope, Arthur aids businesses in managing AI risks while enhancing their model's performance. The company supports ethical AI development by integrating fairness and bias detection features into its platforms.

Additional Offerings:

- Comprehensive security measures compliant with SOC 2 Type II standards.

- Extensive resources for AI research and ongoing developments in fair and transparent AI practices.

- Engagement with a research-led approach, emphasizing innovation in the field of AI and machine learning.

Arthur.ai positions itself as a versatile platform that addresses the evolving challenges of AI deployment in enterprises, aiming to make AI a safe and integral part of business processes by focusing on evaluation, protection, and optimization.

JIFFY.ai

JIFFY.ai offers an app-based intelligent automation suite that increases productivity, transforms processes, and encourages creativity and innovation.

JIFFY.ai offers a comprehensive AI-powered automation platform targeted towards financial services, media, and broader enterprise transformations. Below is an overview of the company-authored content detailing their offerings and capabilities:

Platform Capabilities:

-

No-Code Automation: The platform is designed to support the creation of applications without the need for coding, leveraging AI. This approach is particularly aimed at accelerating the digital transformation of financial services firms, enabling quicker application development than traditional methods.

-

User Experience Design: JIFFY.ai emphasizes an intuitive and personalized user experience, providing drag-and-drop features for building interfaces that are role-based and customer-centric.

-

Intelligent Document Processing: The software utilizes AI and machine learning to automate data extraction from structured and unstructured documents, enhancing accuracy and efficiency in data processing.

-

Robust Integrations: Facilitates seamless connectivity with third-party systems, allowing for smooth data flow and automation across different applications and processes without requiring APIs.

-

Robotic Process Automation (RPA): Handles repetitive tasks by simulating human interactions, with capabilities augmented by AI for decision-making processes involving unstructured data.

-

Workflow Automation: The Workflow Builder module enables businesses to automate complex processes, reducing reliance on manual workflows and streamlining operations.

-

Extract, Transform, Load (ETL): Powerful data processing capabilities designed to handle large volumes of records efficiently, aiding in tasks such as customer onboarding and data transformation.

Sector-specific Solutions:

-

Financial Services: JIFFY.ai’s solutions cater to Wealth Management, Banks, and Credit Unions, offering modules for investor onboarding, account servicing, and advisor transitions, emphasizing automated and efficient operations.

-

Wealth Management: Solutions streamline onboarding, servicing requests, and advisor transitions using AI for data capture and automated document processing.

-

CFO’s Office: The platform provides tools for automating finance processes like Accounts Payable and Order-to-Cash, focusing on reducing manual effort and optimizing financial operations.

-

Media and Advertising: The AUTOMATE platform helps media companies streamline operations such as media planning and campaign execution through AI-driven automation, improving overall efficiency and performance.

Security and Compliance:

- JIFFY.ai adheres to high security and compliance standards, achieving certifications such as SOC 1 Type 2, ISO/IEC 27001: 2013, HIPAA, and GDPR compliance, ensuring data protection and security management.

Company Vision and Culture:

-

JIFFY.ai was launched at Stanford University and has grown into a global entity serving marquee clients. The company focuses on bridging the gap between human and machine intelligence, offering tools that democratize innovation by making it accessible to non-technical users.

-

They emphasize a culture of innovation, valuing human input while harnessing AI's efficiency. They encourage a creative workplace environment where diverse team collaboration is integral to innovation and growth.

-

The company also undertakes initiatives like the Paanini Foundation to address workforce disruptions from automation, focusing on upskilling.

In summary, JIFFY.ai positions itself as a solution for automating and digitally transforming financial services and media operations, touting significant efficiencies and streamlined processes enabled by its no-code, AI-powered platform.

Arya AI

Arya AI provides advanced AI solutions to streamline and automate credit risk assessment and various aspects of financial operations, enhancing precision and speed.

Arya.ai is a technology platform offering a range of AI-driven solutions, primarily aimed at improving financial operations for banks, insurance companies, and other financial institutions. Here's a breakdown of their main offerings and solutions:

Product Lineup:

-

Apex: An AI-powered API library designed to streamline workflows through over 100+ AI APIs. These APIs facilitate automating tasks such as customer verification, document fraud detection, invoice extraction, KYC data processing, and more. It offers a low code solution for easy integration into existing systems.

-

Nexus: A secure and scalable API gateway that optimizes, secures, and governs APIs with high performance and ease. The gateway provides sophisticated traffic management, reliability, and compliance measures for managing APIs efficiently. Nexus aims to streamline large-scale integrations.

-

AryaXAI: A machine learning observability platform that assists in explaining, observing, and aligning mission-critical AI applications. This platform ensures AI models are performing in line with business needs and regulatory requirements.

Key Solutions:

-

AI Cashflow Forecasting: Automates cashflow forecasting, reducing manual labor and improving accuracy by consolidating vast sets of financial data and optimizing predictive models.

-

Intelligent Document Processing (IDP): Uses AI, OCR, and NLP to process documents more efficiently and accurately, significantly reducing manual work and errors associated with document management.

-

AI Onboarding: Streamlines onboarding processes by automating identity verification, fraud detection, and compliance checks, resulting in reduced drop-off rates and improved customer experience.

Applications in Finance:

-

Banking: From cash flow analysis to transaction anomaly detection, Arya.ai leverages AI to enhance security, streamline operations, and improve customer experiences in the banking sector.

-

Insurance: Arya’s technology supports automation in underwriting, claims processing, risk assessments, and fraud management, thereby enhancing process efficiency and service offerings in the insurance sector.

-

Lending: AI models assess risk, detect fraud, and help personalize loan offerings, which can help streamline lending processes and enhance credit assessments.

Customer Experiences:

- Companies like Tata AIG, ICICI Lombard, and Axis Bank have utilized Arya’s API solutions to streamline operations such as KYC processes, onboarding, document classification, and fraud reduction. Users have reportedly experienced heightened process efficiency and significant reductions in operational costs and time.

Compliance and Security:

- Arya.ai emphasizes compliance with global regulations such as GDPR and ISO 27001. Their systems are designed to handle sensitive data securely with end-to-end encryption and robust privacy controls.

AI in Practice:

-

AI Agents: Arya’s AI agents perform a wide variety of tasks ranging from operational to strategic decisions using large language models and other advanced AI techniques to mimic complex human decision-making processes.

-

Real-time Services: Arya provides insights and analytics in real-time through various APIs, aiding in quick decision-making and fraud prevention.

The emphasis across Arya.ai's product line is on enhancing efficiency, reducing manual errors, and providing robust security, particularly aimed at financial institutions looking to leverage AI for better operational results and customer service.

Effy AI

Effy AI is a tool that improves employee engagement and performance evaluation through data analysis, providing insights and recommendations for development.

News | Culture | Careers | About | About | Leadership | Leadership | Vision/Values | About | About | Management | About

Effy AI positions itself in the performance management software space, focusing on enhancing employee performance and engagement through AI-driven solutions. Their key focus is to streamline the process of performance reviews, 360-degree feedback, and 90-day reviews to understand and improve team dynamics and individual development.

Key Focus Area: Effy AI's central mission is to use artificial intelligence to facilitate comprehensive team performance evaluations. Their suite of products includes performance reviews, 360-feedback, and onboarding processes like the 90-day review. These tools enable businesses to conduct performance assessments quickly and efficiently, aiming to foster a growth culture within organizations.

Unique Value Proposition and Strategic Advantage:

-

AI Integration: Effy AI differentiates itself by offering AI-powered solutions that automate and simplify performance management tasks. This automation saves time by replacing manual processes with AI-generated forms and automated calculations, allowing managers to focus more on strategic decision-making rather than administrative tasks.

-

Slack-Friendly Interface: The platform integrates seamlessly with Slack, enabling users to receive notifications and submit reviews directly within a familiar workspace, reducing friction and improving user adoption rates.

-

Customization and Flexibility: Effy AI offers a flexible platform that accommodates various review types with customizable forms and reports, thus catering to diverse organizational needs rather than a one-size-fits-all model.

Value Delivery Method: Effy AI delivers its value proposition through a comprehensive set of features designed to streamline and enhance the review process:

-

AI-Generated Forms and Summarizing: The platform uses AI to create customized performance review forms and deliver summarized insights from feedback data, facilitating actionable insights without the need for extensive manual data processing.

-

Multi-Source Feedback: Effy AI supports multi-source feedback, incorporating inputs from peers, subordinates, and managers, which ensures a holistic view of performance metrics.

-

Slack Integration: By integrating with Slack, users can interact with the review process within their daily communication tools, which simplifies the task of providing and receiving feedback.

-

Automated Reminders: The system automatically sends reminders to ensure timely feedback submissions and keeps all stakeholders informed through dashboard notifications.

-

Security and Privacy Compliance: Effy AI prioritizes the security of user data with robust measures, including encryption and compliance with standards such as GDPR, which offers peace of mind to their customers regarding data privacy and integrity.

Effy AI's business model is supported by various pricing tiers designed to cater to different organization sizes and needs, ensuring they offer value through scalable solutions that can grow with a business. Their ratings from software review platforms indicate user satisfaction and reliability within their offerings, although these should be interpreted with due consideration that they might not always reflect long-term performance consistency or real-world use case effectiveness.

Integrate.ai

A Toronto-based startup offering AI solutions in the form of AI as a Service, primarily aimed at personalizing client offerings in industries like banking and retail.

Integrate.ai is focused on providing solutions within the realm of federated data science, specifically catering to data science collaboration and experimentation without the necessity of data transfer. Here is a summary tailored to an executive audience:

-

Key Focus Area: Integrate.ai's primary focus is enabling secure, collaborative AI and data science efforts through its federated data science platform. This technology underpins their efforts in fostering data collaboration across different enterprises and sectors, as their platform facilitates machine learning and analytics capabilities without the need for moving sensitive data between entities.

-

Unique Value Proposition and Strategic Advantage: The unique value proposition lies in their federated learning technology, which allows organizations to harness the potential of distributed data securely. The strategic advantage is threefold:

- Data Security and Privacy: Data never leaves the local environment, ensuring privacy and compliance with regulations like GDPR and HIPAA.

- Operational Efficiency: Their infrastructure-agnostic platform integrates seamlessly with existing data environments and enhances data evaluation by supporting simultaneous assessment of various datasets.

- Collaboration Without Risks: They offer the ability to connect data and analytics providers with enterprise customers in a controlled environment, increasing accessibility to more extensive datasets without compromising privacy or governance.

-

How They Deliver on Their Value Proposition: Integrate.ai addresses data collaboration challenges through the following approaches:

- Federated Learning Server and Task Runners: Data scientists deploy task runners locally to perform privacy-preserved operations that contribute to a global model, thus enabling collaborative analysis without data movement.

- Data and Model Evaluation Capabilities: The platform provides tools for exploratory data analysis, feature importance quantification, and model validation against diverse datasets.

- Comprehensive Data Governance: They offer granular control over data usage through permissions and role-based access controls, enhancing security while fostering collaboration.

- Integration with Popular Data Science Tools: Compatibility with leading data science technologies and cloud platforms ensures users can continue utilizing their preferred tools and environments.

Integrate.ai is aimed at organizations looking to break down data silos without sacrificing data security, thus driving innovation across several industries by leveraging federated learning to elevate AI's impact on organizational effectiveness. Their approach seeks to enable firms to safely experiment and derive insights from novel datasets, ultimately boosting adoption and integration of AI solutions in business processes.

Lydia AI

Lydia AI is a platform for health insurers using artificial intelligence.

Lydia AI: Company Overview and Strategic Focus

-

Key Focus Area: Lydia AI concentrates on revolutionizing the insurance industry by employing artificial intelligence (AI) to develop personalized and predictive health scores. Their solutions aim to make life and health insurance more accessible and efficient by enabling insurers to underwrite policies faster and more accurately. The primary focus is on improving customer experience, enhancing agent capabilities, and optimizing algorithmic underwriting processes.

-

Unique Value Proposition and Strategic Advantage: Lydia AI's value proposition lies in its ability to transform unstructured data from various sources into actionable health insights that improve underwriting decisions. The strategic advantage is derived from their AI-driven predictive health scoring system, which utilizes machine learning algorithms validated against clinical and actuarial benchmarks. They leverage vast datasets (over 33 million lives) to deliver granular risk assessments that help insurers better understand an individual's health status without needing a medical examination.

-

Delivery on Value Proposition:

-

Predictive Risk Analytics: Lydia AI provides insurers with predictive insights drawn from digital data sources, enabling instant and reliable assessment of health risks. This reduces the need for traditional exams and shortens the underwriting process, increasing approval rates and minimizing risk.

-

AI-Powered Sales and Customer Experience: The company's WellAged app streamlines the insurance-buying process through an omni-channel approach, offering personalized customer journeys that integrate both physical and digital touchpoints. This enhances the pre-sales and purchase experience, boosting sales conversions and customer satisfaction.

-

Role-Specific Solutions: Lydia AI offers tailored solutions for different stakeholders. Insurance agents gain tools to digitize workflows and improve sales, while underwriters receive AI-supported insights to optimize decision-making, ensuring alignment with industry benchmarks.

-

Data-Driven Integrations: Through partnerships and open data utilization, Lydia AI is continuously expanding and improving its platforms. These integrations support comprehensive health assessments and product recommendations that align with individual needs.

-

In summary, Lydia AI's focus on data-driven, AI-enabled solutions sets them apart in the insurance sector. By converting complex health data into understandable health scores, they facilitate more informed insurance underwriting and sales processes. Despite their innovative offerings, it is important to keep in mind that this description is promotional, and actual results and performance should be evaluated thoroughly.

4CRisk.ai

4CRisk.ai provides solutions focused on natural language processing for risk management and compliance.

- Company's Key Focus Area

4CRisk.ai focuses primarily on leveraging artificial intelligence to create solutions for compliance and risk management. Their key offerings include products that facilitate regulatory research, change management, compliance mapping, and the provision of accurate compliance answers through an AI assistant called Ask ARIA Co-Pilot. These tools are designed to help organizations efficiently manage compliance by automating regulatory processes and improving traceability and cost-efficiency.

- Unique Value Proposition and Strategic Advantage

4CRisk.ai's unique value proposition lies in its specialized language models and AI-powered platform that cater specifically to regulatory, risk, and compliance requirements. The use of domain-specific AI models offers significant advantages by providing private, secure interactions that enhance the accuracy and relevance of compliance processes, reducing operational stress on data governance and privacy.

The strategic advantage facilitated by these AI models is their ability to produce more reliable outputs, with fewer errors compared to broader language models. This precision is crucial for ensuring accurate compliance in complex regulatory environments. The efficiency in processing and the capability to integrate seamlessly with existing governance frameworks further position 4CRisk at a competitive advantage.

- Delivery on Their Value Proposition

4CRisk.ai delivers on its value proposition through a cloud-based platform incorporating advanced AI features aimed at automating and optimizing compliance and risk management processes:

-

AI-Powered Tools: Their products harness AI to simplify complex regulatory landscapes, generating efficient rulebooks, managing obligations, and creating compliance maps that enhance traceability.

-

Regulatory Change Management: AI automates the processes of tracking, assessing, and implementing changes, streamlining compliance and risk management tasks within organizations to ensure agility.

-

Compliance Map and AI Assistant: By highlighting gaps in compliance and aiding in filling those gaps, these tools enhance an organization's internal controls and regulatory compliance.

-

Specialized Language Models: These private, domain-specific models ensure that compliance processes are faster, more secure, and tailored to specific business needs. The models provide a significant improvement in processing speeds and cost-effectiveness compared to general AI solutions.

-

Data Privacy: With zero-trust security, these models are deployed in private environments, ensuring stringent data privacy and security compliance.

Through this comprehensive suite of AI-driven products, 4CRisk offers organizations a way to manage compliance more efficiently, reduce the risk of non-compliance, and ensure that their practices keep up with rapidly evolving regulatory landscapes.

Insight AI

Insight AI is a fintech company offering AI-powered solutions like AI underwriting and cash flow forecasting to enhance financial decision-making.

-

Key Focus Area: Insight AI concentrates on the development and deployment of AI-driven solutions, specifically focusing on AI chatbots and automation for businesses. Their services cater to organizations looking to incorporate artificial intelligence into their processes to enhance efficiency, streamline operations, and provide data-driven insights.

-

Unique Value Proposition and Strategic Advantage: Insight AI leverages custom AI chatbots and automated workflows adapted to a company's specific informational context. The strategic advantage is their methodology of using organization-specific data, enabling seamless integration into existing business operations. This tailored approach allows businesses to optimize internal processes by providing precise interactions and automations grounded in their proprietary data.

- Customization and Specificity: Insight AI’s leverage of company-specific training ensures solutions align closely with existing data systems, such as internal wiki pages and document repositories.

- Privacy and Security: Through data cleansing processes, they ensure sensitive information is protected, bolstering client trust in AI implementations.

- No-Code and Low-Code Solution Flexibility: By using platforms like Stack-AI, RelevanceAI, and Python, they accommodate both rapid development needs and the customization depth for complex tasks.

-

Delivering on Their Value Proposition: Insight AI implements its value proposition through several key methods and technological strategies:

-

AI Chatbots: Custom chatbots facilitate employee and customer interactions, drawing from a company’s specific data to provide prompt replies. This is critical in industries where quick and factual responses are necessary for operations or customer service improvements.

-

Automation Pipelines: Businesses can automate routine tasks, such as report generations and test evaluations, thus reducing manual labor and human error. For instance, automated reporting processes use pre-defined templates and sequential prompts to generate detailed reports.

-

AI Knowledge Bots and Tools: For example, tools are created for use in specialized sectors such as ERP providers and financial consulting, ensuring the AI is relevant and valuable to a company's unique needs.

-

Advanced Technology Stack: Utilizing advanced large language models (LLMs) like GPT-4o and GPT-4 Turbo, Insight AI is able to ensure robust and scalable AI solutions that are adaptable to various business scenarios.

-

In sum, Insight AI's approach combines the harnessing of custom AI technologies with an emphasis on practical applicability, privacy, and technology integration. They strive to enable businesses to better utilize their proprietary data, enhancing productivity and decision-making processes across different verticals.

Stark AI

Stark AI specializes in HR solutions, particularly in job placement using AI. Stark AI is a job placement platform that uses AI to improve human resource processes.

Company's Key Focus Area

Stark.ai specializes in leveraging artificial intelligence to streamline the job search and recruitment process. The company targets multiple facets of the employment market, focusing on job seekers, employers, educational institutions, and staffing agencies. Stark.ai aims to simplify job placement and talent acquisition through technology-driven solutions like resume building, AI-driven job matching, interview preparation, and recruitment automation.

Unique Value Proposition and Strategic Advantage

-

AI-Powered Tools: Stark.ai markets itself as pioneering AI-driven solutions that transform job searching and recruitment. The integration of AI enables efficiency in matching candidates with job opportunities more accurately and swiftly compared to traditional methods.

-

Diverse Features for Various Stakeholders:

- Job Seekers: Offers tools such as AI-powered resume optimization, AI mock interviews, personalized job matches, and an auto-apply function, which are designed to improve their visibility and success rate in job applications.

- Employers: Provides access to a vast candidate database and AI-driven video interviews, helping organizations reduce the time and cost involved in hiring processes.

- Colleges and Staffing Firms: Supports these institutions in enhancing placement strategies with AI resources, mock interviews, and candidate progress tracking, aiming to bridge the gap between education and employment effectively.

-

Free and Accessible Model: Stark.ai emphasizes democratizing access to its tools, providing many features at no cost and offering flexible options for utilizing additional services through credits. This accessibility can potentially broaden their user base and enhance their market reach.

Delivering on Their Value Proposition

-

Technology and Integration: Stark.ai employs advanced AI algorithms to streamline the job application process. Their technology assesses user profiles, aligns them with job descriptions, and identifies potential matches, reducing the legwork for both job seekers and employers.

-

Automation and Efficiency: By offering tools like the auto-apply feature and a Chrome extension, Stark.ai simplifies the application submission across multiple platforms, thereby saving time for users.

-

Community and Partnership Focus: Stark.ai aims to cultivate a community-based approach where users can earn or purchase credits for accessing premium features. This creates an ecosystem of shared growth, enhancing the effectiveness of the platform.

-

Comprehensive Support: For employers, Stark.ai's suite includes video interview capabilities, AI-driven candidate assessments, and a career portal, providing a more holistic recruitment solution. Meanwhile, colleges benefit from tools that improve student employability through mock interviews and real-time feedback.

-

Security and Trust: Stark.ai assures users of data security, employing encryption and stringent measures to protect user information, which is crucial in maintaining trust and credibility in a digital platform.

Stark.ai's strategic advantage lies in its leveraging of AI to automate and enhance traditional recruitment processes, making them faster and potentially more precise, aiming to deliver significant value to job seekers, employers, and educational institutions alike. However, as this information is promotional, users should independently assess the platform’s claims and suitability for their needs.

Abacus.AI

Abacus.AI enables businesses to implement AI without needing expert developers by offering pre-trained models for tasks like customer service and forecasting. Abacus.AI offers pre-trained models for business tasks like customer service, simplifying AI implementation without expert developers.

News | About | About | About | About | About | About | About | About | About | About | About | About | About | Vision/Values | About | Vision/Values | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About

-

Company's Key Focus Area: Abacus.AI is primarily focused on providing AI-driven solutions tailored for both individual professionals and large enterprises. Their main goal is to automate and enhance business processes through the use of AI technology. This includes a broad range of applications, such as predictive modeling, personalization, anomaly detection, and AI-based decision-making tools. They offer platforms and tools to build AI agents and chatbots, optimize resources through discrete optimization, and utilize vision AI for modeling tasks.

-

Unique Value Proposition and Strategic Advantage: Abacus.AI positions itself as an AI super-assistant that leverages generative AI technology to automate various business processes. Their strategic edge lies in their state-of-the-art AI capabilities, including structured machine learning, vision AI, and personalized solutions, along with a commitment to open-source generative AI models. They claim that their AI systems can enhance productivity and efficiency by automating complex tasks and reducing human intervention.

-

Delivery on Their Value Proposition: To deliver on its value proposition, Abacus.AI employs:

-

AI Super Assistants: Tools like ChatLLM and CodeLLM are designed to integrate AI capabilities across platforms, providing services like web search, image generation, and code editing.

-

Comprehensive AI Platform: For larger organizations, they offer a platform capable of building enterprise-scale AI systems, using AI to create and manage other AI agents and processes. This platform aims to automate tasks such as fraud detection, contract analysis, and personalized marketing.

-

Structured ML and Predictive Modeling: Abacus.AI provides tools to create machine learning models tailored to specific data inputs, ensuring accurate business predictions and process optimizations.

-

Vision AI and Optimization: These services offer advanced solutions for image analysis and optimizing business processes under given constraints, aimed at reducing costs and increasing efficiency.

-

Integration and Customization: The company offers integration with existing data systems, allowing for customization and personalized setups that fit specific business needs and enable contextual AI interactions.

-

Consultation and Support: They provide consultations to help enterprises tailor the AI solutions to their specific requirements and offer support throughout the implementation process.

-

Overall, their approach focuses on using cutting-edge AI models and deep learning techniques to build custom solutions that improve business process efficiency and decision-making.

zypl.ai

zypl.ai provides GenAI SaaS to optimize risk management with macro-resilient zGAN for the financial sector.

Executive Summary of Zypl.ai

-

Key Focus Area: Zypl.ai is concentrated on pioneering innovations in synthetic data generation and artificial intelligence to optimize credit scoring. Their mission encompasses the advancement of AI technologies within the financial sector, particularly concerning credit scoring and lending models. The firm targets regions with emerging economies, focusing on improving credit availability and financial inclusivity through smarter, AI-driven solutions.

-

Unique Value Proposition and Strategic Advantage: The company offers a unique value proposition through its proprietary AI tools that leverage synthetic data to complement traditional credit scoring models. This approach allows financial institutions to account for outlier conditions, often not captured in typical lending evaluations. The strategic advantage lies in their ability to provide adaptive and convincing credit scoring solutions that can be customized to varying levels of risk appetite. By utilizing machine learning techniques to handle ‘black swan’ events, they enhance the stability and resilience of financial institutions’ credit portfolios.

-

Delivery on Value Proposition:

-

Generative AI Software (Zypl.score): The flagship product is ‘zypl.score,’ a software offering AI-as-a-service capabilities that support banks and financial institutions in adopting a macro-resilient decision-making framework. By using synthetic data-driven AI algorithms, zypl.score helps in providing a more robust credit evaluation process that is privacy-secure and customizable.

-

Partnerships: Zypl.ai collaborates with over 35 banks across 12 markets, which includes leading financial institutions in Eurasia, MENA, and Southeast Asia, effectively demonstrating the product's applicability and scalability across different geographies.

-

Strategic Collaborations: They maintain significant partnerships with global entities and leverage influential networks which enable the firm to access cutting-edge resources and insights. The collaboration with institutions like Commercial Bank International further solidifies its credibility in fintech innovation.

-

Market Expansion: Beyond its origins, zypl.ai has embraced a broad geographical expansion strategy, often highlighted by their move from a Tajik startup to establishing headquarters in Dubai’s International Financial Center and participating in international accelerators such as Hub71 and the Silkway Accelerator.

-

Technological and Market Innovation: Besides credit scoring, the company is venturing into underwriting insurance models and exploring other finance-related AI applications, thus broadening its impact and adaptation of its AI tools.

Zypl.ai’s strategic focus and technological advancements align with their ambition to be the first unicorn from Central Asia and their commitment to transforming the regional financial landscape. This is supported by their continual drive for innovation in AI-driven financial services.

Feedzai

Feedzai is the market leader in fighting fraud and financial crime with today’s most advanced cloud-based risk management platform, powered by machine learning and artificial intelligence.

Feedzai: An Overview for Executives

Key Focus Area:

Feedzai specializes in providing comprehensive solutions for fraud prevention and risk management. Their operations are tailored to protect financial institutions, encompassing a broad spectrum of products designed to mitigate financial crime such as transaction fraud, account takeover, and anti-money laundering (AML) concerns.

Unique Value Proposition and Strategic Advantage:

-

Comprehensive RiskOps Platform: Feedzai delivers a singular, cohesive platform that integrates a variety of fraud management functionalities, streamlining processes and data into a unified system. This platform leverages artificial intelligence to enhance detection capabilities and offers solutions across multiple financial crime types and channels.

-

Behavioral Biometrics Technology: Feedzai emphasizes the use of behavioral biometrics, providing a non-intrusive authentication layer that identifies potential fraud through the assessment of digital interactions such as typing patterns. This technology enhances the ability to detect subtle fraud patterns that could be missed by traditional methods.

-

Real-time Risk Analysis: Their strategic advantage lies in employing advanced AI models that continuously learn and adapt to emerging threats, ensuring proactive fraud detection. This real-time capability is pivotal in securing transactions while minimizing disruptions for genuine customers.

Delivery on Value Proposition:

Feedzai executes its value proposition by deploying a multi-faceted approach that encompasses:

-

AI and Machine Learning: Feedzai’s AI system supports advanced fraud detection by analyzing transactional and behavioral data to create individual risk profiles. This intelligence not only helps in reducing false positives but also enhances fraud detection rates.

-

Omnichannel Capabilities: The company’s solutions monitor customer activities across various payment channels, providing a comprehensive view and allowing for more accurate risk assessments. This approach mitigates risks associated with new and diverse payment methods, crucial for adapting to the rapidly evolving financial sector.

-

Scalable and Adaptable Solutions: With their platform’s scalability, Feedzai is capable of processing upwards of 59 billion events per year and securing around $6 trillion in payments, signifying readiness to tackle the current volume and diversity of threats that face global financial institutions.

-

User-friendly Interfaces and Dynamics: The platform offers user-centric designs and self-service capabilities that allow financial institutions to manage risk directly. It provides features for model deployment and rule customization without extensive IT involvement, promoting efficiency and agility.

-

Strong Industry Partnerships and Insights: Collaborations with financial leaders and firms such as Form3 help Feedzai to continually refine their approach to fraud detection, ensuring their technology remains at the forefront of industry standards.

Feedzai positions itself as a central player in the fight against financial crime, integrating innovative technology and strategic insight to deliver targeted, effective risk management solutions. This alignment with evolving industry and regulatory needs provides their clients with tools needed to maintain robust, adaptable security measures in an increasingly digitalized financial landscape.

Jiva.ai

Jiva.ai develops AI solutions for healthcare, emphasizing predictive analytics and patient data insights.

Jiva.ai is presented as a no-code platform that simplifies AI development for organizations dealing with various data types, including imaging, video, text, and audio. This platform aims to make AI accessible by eliminating the need for extensive coding skills, allowing both non-specialists and data scientists to build AI solutions. Jiva.ai's offerings focus on three main sectors:

-

Functionality and Features

- AutoML and Multimodal AI: Users can train and test numerous models to optimize performance, using a combination of multiple AI models.

- Pipelines and MLOps: These features facilitate the automation and deployment of AI solutions through a user-friendly interface that does not require coding skills.

- Data Science Assistant: A guided approach to data and AI engineering, helping users through the AI design process step by step.

-

Target Audience and Applications

- Jiva.ai is suitable for businesses of all sizes, including those who lack in-house AI expertise. It is positioned as a cost-saving measure by reducing the need for a specialized AI development team.

- The platform is also geared towards academia for research acceleration.

- Some specific case studies include medical diagnostics and finance, such as MRI imaging analytics for cancer detection and predicting loan defaults.

-

Security and Compliance

- The company has achieved Cyber Essentials Plus certification, reinforcing its commitment to robust cybersecurity measures. This certification provides assurance of the company's capability to handle sensitive data securely.

-

Industry Collaboration and Impact

- In healthcare, Jiva.ai has partnered with Aevice Health, leveraging its AI capabilities to predict asthma exacerbations.

- Jiva.ai is participating in a project funded by Innovate UK to advance diagnostic tools, aligning with broader research initiatives in healthcare.

-

Strategic Outlook and Market Position

- Jiva.ai emphasizes the significance of owning intellectual property in the realm of AI to mitigate risks of dependency on third-party solutions, particularly in light of recent AI industry volatility, such as the OpenAI leadership changes.

- The company suggests a need to integrate AI models without relying on language-focused solutions like large language models (LLMs), which they claim may not be essential for Artificial General Intelligence (AGI).

Jiva.ai identifies itself as a forward-thinking entity, active in engaging with global developments like the EU's AI regulations. The content details how the company encourages businesses to assess their AI strategies and compliance to align with upcoming regulatory frameworks.

In summary, Jiva.ai promotes an easy-access, no-code AI solution that supports a variety of users and applications, focusing on security and future-proofing technology integration. It also positions itself as a partner for innovation in the AI sector, particularly in healthcare, underscoring a commitment to enhancing data processing and decision-making capabilities across industries.