⚡ZurzAI.com⚡

Companies Similar to Scienaptic AI

ADVANCE.AI

ADVANCE.AI is an AI company providing AI-driven risk management and digital lending solutions for enterprise clients in Southeast Asia, South Asia, and Mexico. It is part of Advance Intelligence Group, ranked No. 1 on LinkedIn's 2021 Top Startups List in Singapore.

ADVANCE.AI provides technology-driven solutions focused on digital identity verification and fraud prevention across multiple industries including finance, healthcare, travel, and more.

Key Offerings:

-

OneStop Platform: A comprehensive solution that facilitates seamless customer onboarding and lifecycle management, ensuring compliance with KYC and AML requirements. It integrates various AI-powered technologies to streamline and automate workflows, catering to businesses' ever-evolving needs.

-

Digital Identity Verification: Facilitates remote identity verification using AI technologies like biometrics, liveness detection, face comparison, and document recognition to accommodate a variety of use scenarios, from banking and payments to IoT applications.

-

AI-Powered Biometrics and Document Verification: Uses advanced algorithms and AI models to authenticate users and detect identity fraud through facial recognition, liveness detection, and document verification technologies. These tools are essential for industries like banking, e-commerce, and healthcare to ensure the individual's identity is authentic.

-

Fraud Intelligence and Credit Insight: Employs big data and machine learning to detect and prevent fraudulent activities. The system analyses a wide range of data to provide fraud intelligence and credit scoring, which assist in areas such as customer management, risk assessment, and debt collection.

Industries Served:

-

Banking and Financial Services: ADVANCE.AI's solutions help financial institutions enhance customer experiences and ensure compliance with KYC/AML requirements through innovative identity verification and fraud prevention.

-

Payment Services: Protect payment transactions with risk management systems that effectively tackle fraud issues like account theft and compliance with cashless transaction standards.

-

Healthcare: Utilizes identity verification to protect sensitive medical data and prevent fraud in insurance claims and prescription management.

-

Travel and Hospitality: Assists in quickly verifying traveller identities, reducing fraud, and expediting processes such as hotel check-ins and airport procedures.

-

Sharing Economy and E-commerce: Builds user trust and platform security by ensuring the verification of identities in peer-to-peer rental services, online marketplaces, and other shared resource environments.

Technology and Innovation:

-

AI and Machine Learning: Central to ADVANCE.AI's offering, helping businesses mitigate fraud risks and optimize operations by leveraging predictive analytics, data mining, and advanced natural language processing.

-

Liveness Detection and Face Comparison: Ensures the person presenting the ID is the actual owner through real-time validation of facial movements and comparison with stored images.

-

ID Forgery Detection: Able to identify altered or forged documents using machine learning models, addressing typical forgery patterns and inaccuracies.

-

Joint Modelling and Credit Insight: Enhances decision-making with real-time fraud scores and risk evaluations, designed for multi-dimensional credit analysis and management.

Support and Customization:

-

ADVANCE.AI provides a configurable API and SDK support for integrating their solutions into existing business workflows, ensuring localized, tailored solutions for diverse markets in Asia and beyond.

-

Customer Support and Collaboration: Services include 24/7 support for inquiries, with a focus on understanding business-specific needs to ensure optimal deployment and performance of ADVANCE.AI's solutions.

With these offerings, ADVANCE.AI aims to guide multiple industries towards more secure, efficient, and innovative business operations by using cutting-edge technology to solve complex identity and verification challenges.

Spatial.ai

Spatial.ai is an AI-powered segmentation platform for retail marketers, offering insights into consumer spending and behavior, which allows businesses to identify and reach their best customers, strategize brand positioning, and craft tailored marketing campaigns.

Spatial.ai specializes in creating data-driven solutions that assist businesses in consumer segmentation and geographic insights. The focus is on leveraging a variety of datasets to understand consumer behaviors, enabling companies to make informed decisions in marketing, site selection, and more. Below are some key offerings and tools highlighted in the company-authored content:

Key Products

-

PersonaLive: This is a real-time segmentation platform that categorizes consumers based on social, mobile, and web behaviors. It divides U.S. households into 17 high-level groups and 80 behavioral segments, enhancing customer understanding by integrating demographic, movement, and spending data. The platform improves retail behavior prediction by 17% and enhances campaign performance by up to 50%.

-

Proximity: Aims to segment neighborhoods based on social media behaviors to provide insights into social characteristics of various areas. This product uses data from platforms like Instagram, Twitter, and Facebook to reveal community behaviors that can influence business decisions.

-

FollowGraph: This dataset helps businesses understand consumer interests by analyzing who they follow on social media. It combines social, mobile, and demographic data to offer insights into consumer preferences for brands and activities at geographic levels.

Applications by Industry

-

Retail & Restaurant: The solutions enhance site selection, validate sales projections, and optimize marketing by understanding consumer behavior beyond traditional demographic data.

-

Marketing & Advertising: Offers real-time data to inform campaign strategies and facilitate the deployment of custom audiences across various digital channels.

-

Commercial Real Estate: Provides insights into property value through consumer behavior and assists in identifying ideal tenants and optimizing property marketing strategies.

-

Residential Real Estate: Enables homebuyers to assess neighborhoods through local social media activity, improving the property search and personalizing recommendations.

-

Financial Services: Utilizes customer segmentation to personalize offers and optimize marketing campaigns, enhancing decision-making for banks, insurance companies, and credit card providers.

-

CPG (Consumer Packaged Goods): Assists companies in understanding customer segments to optimize product distribution and personalize marketing campaigns for driving sales.

Data and Insights

-

Spatial.ai's data relies on permissioned, anonymized, and aggregated sources, ensuring that personal privacy is respected while providing actionable insights. These include credit card transactions, demographic data, and social media activity.

-

By harnessing comprehensive behavioral data, businesses can determine market share, identify high-potential audiences, and make strategic decisions in location and marketing.

Pricing

- The pricing model is based on the number of contacts and locations. It offers various plans, such as The Analyst, The Media Buyer, and The Strategist, tailored to different business needs from segmentation to campaign strategy.

Resources and Community

- Spatial.ai provides various resources, including case studies, webinars, tutorials, and guides to help customers understand and effectively utilize their data solutions.

For businesses interested in understanding their customers beyond traditional demographics, Spatial.ai offers data-driven solutions that provide deep insights into consumer behaviors, aiding in strategic business decisions across various industries.

Scienaptic AI

Scienaptic AI offers adaptive AI-powered credit underwriting, fraud detection, and investment analytics tools to enhance decision-making for banks and institutional investors.

Scienaptic AI offers advanced AI-driven credit decision technology designed to improve credit accessibility by automating underwriting and providing intelligent risk predictions. The platform is utilized by over 150 lenders and facilitates faster credit decisions while maintaining compliance with regulatory standards.

Key Features:

-

AI Technology: Scienaptic’s AI models are built on 200 years of combined credit risk expertise and are trained on over 400 million records. They provide significantly higher risk differentiation compared to traditional bureau-based scores. The technology promises increased automation, higher approval rates, and reduced default risks.

-

Integration and Partnerships: Scienaptic seamlessly integrates with existing Loan Origination Systems (LOS) and partners with various data, bureau, and league partners to enhance decision-making capabilities. This integration aims to ensure a disruption-free deployment and more efficient credit decision processes.

-

Regulatory Compliance: The platform assists clients in passing regulatory audits and integrates thorough disparate impact analysis to ensure unbiased model design. Comprehensive documentation and explainable AI models provide transparency and compliance with fair lending guidelines.

-

Focus on Inclusivity: Scienaptic emphasizes fair and equitable lending practices. Over 1.3 million underserved applicants are approved each month, and the platform is capable of scoring over 95% of applications without a traditional credit score. This includes a higher rate of approvals for protected classes and new-to-credit segments like Gen-Z.

Client and Partner Experiences:

- Client Testimonials: Numerous credit unions, such as the Credit Union of Colorado and Southwest Louisiana Credit Union, report improved approval rates, enhanced decision-making processes, and a higher return on investment after adopting Scienaptic’s solutions.

- Partner Collaborations: Partners like Kentucky Credit Unions and Magiloop highlight the value of AI in improving membership growth, risk management, and service delivery, particularly for underserved populations.

Company Overview:

- Foundation and Mission: Founded in 2014, Scienaptic AI's mission is to drive financial inclusion on a large scale through its AI-powered credit decisioning platform. The company integrates data from various sources, leveraging advanced machine learning algorithms to enhance lending practices.

- Leadership and Culture: The leadership team comprises experienced professionals with deep credit risk management expertise. The company provides a flexible work culture, promotes cross-functional learning, and invests in technological advancements to maintain a competitive edge.

- Career Opportunities: Scienaptic is expanding its workforce, seeking talented individuals for roles such as Chief Growth Officer and Vice President of Strategic Partnerships, to further drive its growth in the financial technology sector.

Thought Leadership and Educational Resources:

- Webinars and Podcasts: Scienaptic regularly hosts webinars and releases podcasts that cover topics on AI's role in lending, economic uncertainty strategies using AI, and credit union growth opportunities. These sessions feature industry leaders discussing practical applications of AI in credit decisioning.

- Case Studies and Insights: They offer detailed case studies showcasing the transformative impact of their AI technology on various lending institutions. Additionally, blogs and whitepapers provide insights into AI adoption and its implications for financial services.

In summary, Scienaptic AI positions itself as a company addressing the limitations of traditional credit systems through innovative AI solutions, enhancing fair lending practices, regulatory compliance, and overall efficiency in credit decisioning for financial institutions.

Zest AI

Zest AI enhances underwriting by utilizing AI to assess borrowers with limited credit history, providing data-driven insights to improve lender risk management and decision-making.

Zest AI is a technology company specializing in AI-powered lending solutions aimed at improving the efficiency, transparency, and accessibility of credit decision-making. It provides a range of AI-driven products and services tailored for different types of lending institutions, including credit unions, banks, and specialty lenders. Here's a summary of the key offerings and recent updates from Zest AI:

Key Offerings:

-

AI-Automated Underwriting: Zest AI offers AI-automated underwriting solutions designed to improve lending decisions by considering a wider array of data points than traditional models. This helps institutions make more accurate predictions about an applicant's credit risk and ensures consistency in decision-making.

-

Fraud Detection: The company's fraud detection solutions use advanced AI to protect against various types of application fraud. These systems leverage a wide range of data to detect both first-party and third-party fraud and enable lenders to make confident lending decisions.

-

Lending Intelligence: Zest AI's lending intelligence tools provide actionable insights and metrics to help institutions optimize their lending strategies. This includes performance data across all lending stages from marketing to portfolio management, aiding lenders in making more informed decisions.

Industry Impacts:

-

Zest AI is notable for its commitment to fair lending practices. Its technology aims to increase access to credit for underserved groups, effectively removing biases present in traditional credit scoring systems.

-

The company has developed various strategic partnerships to enhance its service delivery, including integrations that aid in seamless implementation within financial institutions' existing systems.

Recent Developments:

-

Funding: Zest AI recently secured a $200 million growth investment from Insight Partners, which will be used to advance product innovation, particularly in fraud protection and generative AI, as well as pursue M&A opportunities.

-

Awards and Recognition: The firm has been recognized as one of North America's fastest-growing tech companies by Deloitte Technology Fast 500 for 2024, underscoring its significant market impact and growth trajectory.

-

Product Innovation: Zest AI unveiled the first generative AI lending intelligence companion named LuLu, enhancing financial institutions' ability to glean insights via intuitive, natural language prompts.

-

Compliance and Risk Management: The company emphasizes compliance, with technology aligning with legal standards such as the Fair Credit Reporting Act and the Equal Credit Opportunity Act. Zest AI's solutions are crafted to meet and exceed these regulatory expectations, offering robust documentation and reporting for model risk management.

Customer and Market Engagement:

-

Zest AI supports over 500 active AI models in the lending ecosystem, covering a broad spectrum of credit union members and financial assets.

-

Customer feedback from entities like credit unions and banks highlight the transformative impact of Zest AI’s technology in terms of reduced delinquency rates, increased automation, and expanded credit access.

Educational and Supportive Initiatives:

-

The company provides educational resources such as a "Lender's Guide to Implementing AI", aimed at assisting financial institutions to understand and integrate AI tools effectively.

-

Zest AI emphasizes continuous customer support, offering dedicated expert teams to assist clients in optimizing their lending processes.

Overall, Zest AI is positioning itself as a catalyst in the lending industry, advocating for equitable lending practices and leveraging the power of AI to transform traditional underwriting and fraud detection methodologies for better economic equity.

Alpha Intelligence Capital (AIC)

Alpha Intelligence Capital is a venture capital firm based in Luxembourg, focusing on deep AI and machine learning investments, typically in the series A to E rounds.

Alpha Intelligence Capital (AIC) is a global venture capital firm specializing in early to mid-stage investments in artificial intelligence and machine learning technology companies. With a focus on transforming industries through AI-driven innovation, AIC's strategy includes partnering with technically adept teams to drive the advent of AI advancements that solve real-world business problems.

Main Areas of Focus:

-

Investment Scope: AIC invests in startups from Seed to Series B stages. The firm has a portfolio of AI/ML companies that span various industries, including healthcare, robotics, and enterprise software.

-

Deep Learning and AI Technologies: At the core of AIC's investment thesis is a focus on deep learning—utilizing artificial neural networks to create products capable of executing tasks traditionally performed by humans. This also includes advanced AI technologies like confidential computing for data security and privacy.

Team and Advisors:

- Leadership and Expertise: AIC's team consists of industry veterans and experts with backgrounds in leading technology corporations like Apple, Meta, Google, and others. The advisory board includes notable figures such as Yann LeCun, AI scientists, academics, and entrepreneurs, who provide guidance and support for portfolio companies.

Portfolio Highlights:

-

Active and Acquired Companies: The firm showcases a portfolio featuring companies at the cutting edge of AI technology. Examples include Advanced Navigation, a leader in AI robotics and navigation, and Aidoc, specializing in AI-enabled medical imaging.

-

Recent Acquisitions: Some of their portfolio companies have been acquired, such as AI Music and Drishti, demonstrating AIC's success in nurturing companies to a mature stage.

Notable Investments:

-

DeepOpinion: A company focused on automating complex cognitive tasks using AI technology, specifically for processing unstructured data across various sectors like insurance and financial services. DeepOpinion employs a cloud-native platform that integrates advanced AI to create scalable, intelligent workflows, setting it apart from traditional automation tools.

-

Anjuna Security: Anjuna provides platforms that ensure digital sovereignty and data privacy in AI collaborations, crucial for managing sensitive data without needing significant infrastructure changes.

-

Ovom Care: This investment in the fertility space involves the application of AI to enhance reproductive health care by improving predictive accuracy and data collection in fertility treatments. Ovom Care combines digital-first clinics with AI solutions to navigate existing challenges in the industry.

Industry Impact and Perspectives:

-

AIC's commitment extends beyond mere investment to actively shaping the future through strategic guidance and support, assisting in the societal and economic transformation led by AI technologies.

-

The firm acknowledges the challenges and opportunities presented by AI, emphasizing the need for robust data protection and the potential of AI to redefine traditional industries.

Global Presence:

- AIC maintains a global presence with offices in San Francisco, Paris, Luxembourg, and Singapore, indicating its international scope in identifying and fostering AI innovation.

Contact and Legal Notice:

- AIC is focused on professional clients and provides the necessary disclaimers on its website, ensuring users are informed that the content does not constitute investment advice.

This comprehensive approach positions AIC as a substantive player in the venture capital landscape, focusing not only on financial returns but also on fostering technological innovation to address tangible problems across multiple sectors.

Artivatic.ai

Artivatic Data Labs provides an end-to-end AI infrastructure platform, leveraging deep-tech and ML technologies for intelligent product and solution development.

Artivatic is a technology company focused on providing Artificial Intelligence (AI) and machine learning solutions tailored for the insurance and healthcare industries. Through its platform, the company seeks to enhance efficiency, decision-making, and customer engagement for businesses operating in these sectors.

Key Offerings:

-

Insurance Solutions:

- Artivatic offers a range of products designed to streamline various insurance operations, including underwriting, claims management, and fraud detection. These solutions use AI-driven automation to improve processing times and accuracy.

- The platform provides tools for risk assessment and prediction, leveraging data analytics to inform insurers about potential risks and enabling them to tailor products accordingly.

-

Healthcare Solutions:

- In the healthcare domain, Artivatic’s offerings focus on patient diagnosis, treatment planning, and personalized healthcare management. AI algorithms analyze medical data to aid healthcare providers in delivering more accurate and personalized care.

- The platform also supports telemedicine services and remote patient monitoring, enhancing access to healthcare services and improving patient outcomes.

Technology and Innovation:

- The company emphasizes the integration of machine learning models that can adapt to an array of data inputs, allowing businesses to customize AI applications to their specific needs.

- They provide APIs and SDKs for clients to implement the solutions seamlessly into existing systems, ensuring that businesses can scale their operations efficiently.

- Artivatic also prioritizes data security and privacy, implementing measures to protect sensitive information while delivering AI services.

Business Impact:

- For insurers, the use of AI reduces operational costs, enhances customer satisfaction through more accurate predictions and personalized policies, and decreases the likelihood of fraud.

- In healthcare, the tools aim to improve patient care quality, optimize resource allocation, and promote preventive healthcare practices with predictive analytics.

Additional Aspects:

- Artivatic positions itself as not only a technology provider but also a partner in digital transformation, enabling users to adapt to changing industry demands with agility.

- The platform is designed to be user-friendly, allowing users without technical expertise to harness the benefits of complex AI models simply and efficiently.

Through its suite of AI-powered solutions, Artivatic aims to assist companies in modernizing their operations and embracing digital tools to meet the evolving needs of their industries. The emphasis on automation and analytics supports their clients in making data-driven decisions that can both reduce risks and capitalize on opportunities in competitive markets.

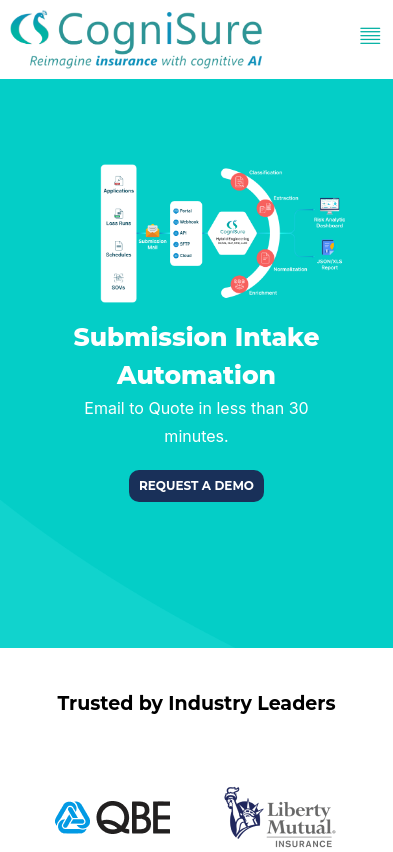

CogniSure

CogniSure is a company focused on transforming the future of insurance by providing smart and efficient underwriting solutions.

CogniSure AI is a company focused on utilizing artificial intelligence to address challenges in the insurance industry, particularly dealing with unstructured data. The company offers specialized solutions aimed at enhancing underwriting efficiency, risk management, and financial reporting for insurance stakeholders. Here's a consolidated overview of their offerings and approach:

Solutions Offered:

-

Submission Insights: Aimed at optimizing the underwriting process by reducing the time and resources needed to transition from submission to quote. The platform automates document ingestion and decision-making, helping reduce inefficiencies and cycle times.

-

Loss Run Insights: Facilitates data extraction from unstructured insurance documents, providing insights into trends, patterns, and potential risks quickly. This solution allows insurance brokers and underwriters to better manage and analyze loss run data across various carriers.

-

Benefit Insights: Designed for employers managing benefit plans, this platform streamlines financial reporting by automating data processing from multiple vendors. It delivers analytics capable of identifying cost drivers and coverage gaps, thereby facilitating better decision-making.

Platform Features:

CogniSure employs a mixed approach of non-symbolic AI (like machine learning and deep learning) and symbolic AI (embedding human intelligence) to add value through data enrichment. The platform includes various elements, such as:

- MailExtract: Automates the extraction of relevant data from emails.

- SplitAny and ClassifyAny: Divides large documents into sections for easier processing and uses algorithms to identify types and origins of documents.

- ExtractAny and InterpretAny: Facilitates detailed data extraction according to user needs and deciphers textual insights using natural language processing.

- Any2Any and SearchAny: Converts data into standard formats for better compatibility and retrieves particular insights from large data sets.

Technological Infrastructure and Security:

CogniSure uses a cloud-hosted, scalable infrastructure on platforms like AWS to ensure data security and availability. The platform is designed to meet stringent security standards, with features like encryption, access control, and regular security audits to protect sensitive information.

Partnerships and Client Testimonials:

CogniSure has strategic partnerships with companies like Duck Creek Technologies and Federato, and collaborates with organizations to integrate its solutions into broader insurance processes. Testimonials highlight the platform’s effectiveness in transforming complex data into useful insights, reducing operational costs, and enabling smarter risk management decisions.

Strategic Vision:

CogniSure focuses on innovation to reshape how the insurance industry handles unstructured data. Their AI-powered platform aims to increase productivity, reduce manual processes, and enhance data-driven decision-making for better risk evaluation and underwriting strategies.

This approach positions CogniSure as an influential player in the InsurTech space, aiming to drive digital transformation within the insurance sector. Their solutions are tailored to make the processing of previously untapped or underutilized data a manageable and insightful task.

AMBIENT.AI

Uses computer vision intelligence to proactively prevent security incidents.

Ambient.ai focuses on transforming physical security using artificial intelligence (AI) and computer vision intelligence. It offers a comprehensive suite of software solutions designed to enhance security and response systems across various sectors.

Key Offerings:

-

Platform Overview: The core platform integrates several AI-driven security features with the prime objective of improving real-time threat detection and response.

-

Threat Detection & Response: This feature is pivotal in identifying and mitigating potential threats promptly. It includes an emphasis on signals intelligence, which provides warnings based on data analysis, and gun detection, enhancing security measures against armed threats.

-

Forensics and Investigation: AI-powered forensics helps in conducting swift and exhaustive investigations following security incidents, providing actionable insights and facilitating evidence gathering.

-

Occupancy Insights: Monitors and analyzes the movement and presence of people in a given space to provide insights that could preemptively mitigate potential security threats.

Featured Use Cases:

-

Customer Stories: The solutions cover diverse environments such as educational institutes, corporate campuses, and retail. For instance, the Harker School benefits from 24/7 proactive threat detection to safeguard K-12 settings, while notable enterprises like VMware and SentinelOne utilize the platform to enhance their operational security efficiency.

-

Case Studies: Clients such as Fortune 500 companies and e-commerce giants streamline their security operations, achieving milestones like a 100% alert resolution rate and drastically improving post-incident investigation speeds.

Resources and Learning:

Ambient.ai provides a resource hub that includes educational materials and customer stories to guide organizations in optimizing their security strategies. The offerings are rich with:

-

Webinars and Guides: These cover strategic themes in AI implementation, discussing topics ranging from active shooter incident management to the future of autonomous security operations.

-

Whitepapers and Videos: These resources delve into AI’s impact on physical security, providing analytical insights and industry-specific intelligence.

Professional Integration and Partnerships:

-

Collaborations and Partnerships: The company works closely with technology partners such as Brivo and Axis Communications to enhance its security solutions. It integrates seamlessly with existing security infrastructures to improve access control and incident response capabilities.

-

Achievements and Recognitions: Recognized for its innovative approach, the company has received certifications and accolades such as SOC 2 Type II certification and featuring on lists of noteworthy advancements in technology.

-

Investment and Growth: Recent financial investments demonstrate ongoing growth, aiding in the expansion of AI-powered security technologies globally, as seen with the strategic growth investment from Allegion Ventures.

Company Infrastructure:

Ambient.ai operates from multiple locations, including offices in San Jose, California, and Bengaluru, India, reflecting its global operational reach. It maintains a user-friendly online platform to engage with clients and offer demonstrations of its technologies.

Privacy and Legal:

The company provides clear policies on privacy and terms of use, ensuring transparency and regulatory compliance in its operations.

In summary, Ambient.ai aims to enhance physical security through sophisticated AI and computer vision technologies, offering tailored solutions that cater to diverse sectoral needs and empowering customers with actionable intelligence to preempt and respond to security challenges effectively.

Arya AI

Arya AI provides advanced AI solutions to streamline and automate credit risk assessment and various aspects of financial operations, enhancing precision and speed.

Arya.ai is a technology platform offering a range of AI-driven solutions, primarily aimed at improving financial operations for banks, insurance companies, and other financial institutions. Here's a breakdown of their main offerings and solutions:

Product Lineup:

-

Apex: An AI-powered API library designed to streamline workflows through over 100+ AI APIs. These APIs facilitate automating tasks such as customer verification, document fraud detection, invoice extraction, KYC data processing, and more. It offers a low code solution for easy integration into existing systems.

-

Nexus: A secure and scalable API gateway that optimizes, secures, and governs APIs with high performance and ease. The gateway provides sophisticated traffic management, reliability, and compliance measures for managing APIs efficiently. Nexus aims to streamline large-scale integrations.

-

AryaXAI: A machine learning observability platform that assists in explaining, observing, and aligning mission-critical AI applications. This platform ensures AI models are performing in line with business needs and regulatory requirements.

Key Solutions:

-

AI Cashflow Forecasting: Automates cashflow forecasting, reducing manual labor and improving accuracy by consolidating vast sets of financial data and optimizing predictive models.

-

Intelligent Document Processing (IDP): Uses AI, OCR, and NLP to process documents more efficiently and accurately, significantly reducing manual work and errors associated with document management.

-

AI Onboarding: Streamlines onboarding processes by automating identity verification, fraud detection, and compliance checks, resulting in reduced drop-off rates and improved customer experience.

Applications in Finance:

-

Banking: From cash flow analysis to transaction anomaly detection, Arya.ai leverages AI to enhance security, streamline operations, and improve customer experiences in the banking sector.

-

Insurance: Arya’s technology supports automation in underwriting, claims processing, risk assessments, and fraud management, thereby enhancing process efficiency and service offerings in the insurance sector.

-

Lending: AI models assess risk, detect fraud, and help personalize loan offerings, which can help streamline lending processes and enhance credit assessments.

Customer Experiences:

- Companies like Tata AIG, ICICI Lombard, and Axis Bank have utilized Arya’s API solutions to streamline operations such as KYC processes, onboarding, document classification, and fraud reduction. Users have reportedly experienced heightened process efficiency and significant reductions in operational costs and time.

Compliance and Security:

- Arya.ai emphasizes compliance with global regulations such as GDPR and ISO 27001. Their systems are designed to handle sensitive data securely with end-to-end encryption and robust privacy controls.

AI in Practice:

-

AI Agents: Arya’s AI agents perform a wide variety of tasks ranging from operational to strategic decisions using large language models and other advanced AI techniques to mimic complex human decision-making processes.

-

Real-time Services: Arya provides insights and analytics in real-time through various APIs, aiding in quick decision-making and fraud prevention.

The emphasis across Arya.ai's product line is on enhancing efficiency, reducing manual errors, and providing robust security, particularly aimed at financial institutions looking to leverage AI for better operational results and customer service.

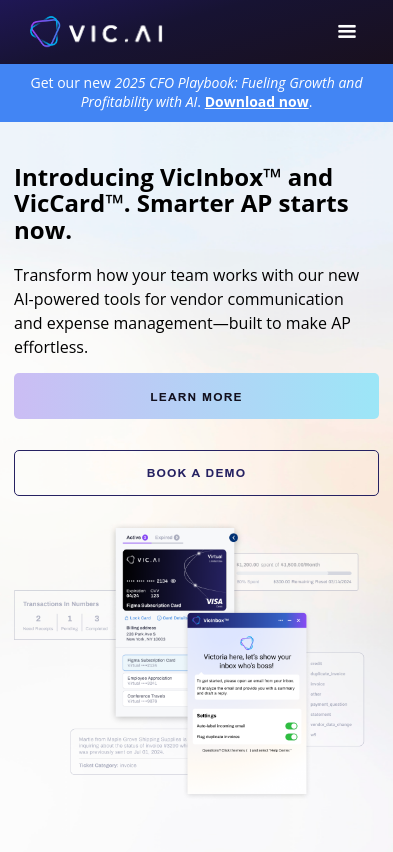

Vic.ai

Vic.ai focuses on autonomous invoice processing, leveraging AI for real-time insights and seamless approval workflows.

Vic.ai provides an Autonomous Finance Platform designed to digitize and transform various accounts payable (AP) processes using artificial intelligence (AI). The company offers several AI-powered tools and platforms that aim to enhance the efficiency and accuracy of these processes while minimizing human intervention. Here are some key products and features:

Products and Features:

-

Autonomous Invoice Processing:

- Uses AI to process invoices faster and more accurately than traditional methods.

- Offers 97-99% accuracy in data extraction and coding of invoices without template setup.

- Vic.ai’s system can maintain a high no-touch rate, promoting a hands-free approach to AP.

-

PO (Purchase Order) Matching:

- AI supports 2-, 3-, and 4-way PO matching.

- The platform can match invoices with associated POs even when identifiers are not readily available.

- Streamlines AP processes by automatically resolving discrepancies and managing workflow efficiently.

-

Approval Flows:

- Automates invoice approvals, routing them correctly based on predefined rules.

- Mobile and desktop notifications facilitate real-time approvals.

- Autopilot feature can be used for complete hands-free approvals once the AI is sufficiently trained.

-

B2B Payments:

- Manages the full spectrum of business payments without transaction fees within the U.S.

- Provides fraud protection and early payment discounts.

- Handles multiple payment formats, including check, ACH, and virtual card options.

-

Analytics and Insights:

- Offers real-time metrics to monitor AP performance and workflow efficiency.

- Customizable dashboards show metrics like accuracy rates, invoice processing speed, and team performance.

- Advanced analytics packages address specific business needs for enhanced decision-making support.

-

VicInbox™:

- Uses AI to automate email sorting and generate responses for vendor communications.

- Seamlessly processes invoices that arrive via email, detecting duplicates and supporting various file formats.

-

VicCard™:

- AI-driven tool for expense management, simplifying corporate spend approvals.

- Automatically classifies expenses and detects fraud using real-time analytics.

- Consolidates and tracks corporate spending to enhance visibility and security.

Integration and Functionality:

- Vic.ai provides plug-and-play integrations with leading ERP systems through its flexible API.

- The platform supports various document types and languages to ensure broad compatibility across different organizational infrastructures.

Customer Success and Deployment:

- Vic.ai is adopted by over 10,000 firms globally, highlighting the software's efficacy and value in complex AP environments.

- Case studies showcase how organizations achieve significant time savings, increased accuracy, and reduced errors by using Vic.ai’s solutions.

- The company positions itself not only as an AP automation tool but as a comprehensive AI autonomy solution, promising reductions in payback periods and marked improvements in processing efficiency.

Overall, Vic.ai aims to revolutionize finance functions through its AI-powered tools, offering substantial enhancements in the speed and accuracy of AP operations.

Crediflow

Crediflow is a company that automates SMB credit risk assessment and due diligence using AI Credit Agents. It serves banks, non-bank lenders, private credits, and fintechs by turning financial documents into customized credit memos with full financial analysis, trend analysis, risk and ratio analysis to aid decision-making.

Crediflow AI offers solutions for automating credit risk assessment and underwriting for SMBs, banks, non-bank lenders, private credits, and fintech companies. The platform leverages AI and machine learning (ML) to transform financial documents into custom credit memos, providing comprehensive financial, trend, risk, and ratio analyses.

Main Features and Offerings:

-

AI-Powered Credit Analysis: Crediflow uses AI to parse financial statements into IFRS standards, conducting risk, ratio, and trend analyses in its credit memos without manual input. This is achieved through advanced language models that enhance accuracy and reduce decision-making time.

-

Custom Credit Solutions and Tools: It provides a no-code platform for building custom credit scorecards and application flows, enabling users to define their scoring methodologies. This allows for the automation of credit analysis and monitoring of portfolios, which can improve efficiency and accuracy in lending operations.

-

Automated Due Diligence and Compliance: The platform includes KYB (Know Your Business) and AML (Anti-Money Laundering) screenings to help users comply with regulatory standards and mitigate fraud risks. This reduces the manual workload associated with due diligence practices.

-

Scalable and Efficient Operations: The AI tools offered by Crediflow aim to help businesses scale operations by automating traditional credit assessment processes from origination to decision-making. This facilitates faster processing of credit applications without needing to increase staffing or resources.

-

Portfolio Monitoring and Risk Management: Crediflow automates annual reviews and monitors client portfolios for risks. The platform can be integrated with existing systems through a single API, making real-time portfolio alerts available and allowing institutions to focus more on high-risk customers.

-

Integration and Customization: Crediflow allows integration with enterprise systems like CRMs, loan software, and credit bureaus through a single API connection. This feature also supports the creation of custom credit products and dynamic decision rules through pre-defined variables.

-

Generative AI for Business Lending: The firm leverages generative AI to assess complex credit risk scenarios, allowing the automation of comprehensive reviews of financial statements and management accounts, which traditionally required extensive manual effort. This enhances consistency, accuracy, and scalability in the credit decision-making process.

Strategic Advantages for Clients:

-

Efficiency and Cost-Effectiveness: Crediflow's AI platform enhances operational efficiency by reducing the time and labor needed for credit assessment and underwriting processes. Businesses can handle more credit applications without additional human resources.

-

Enhanced Decision-Making: By providing thorough data analyses and insights into both current and potential customer risks, Crediflow enables businesses to make faster, more informed credit decisions.

-

Adaptable and Reliable Technology: The use of AI enables real-time analysis of business and market data, supporting a flexible approach to credit risk management and offering solutions that can be customized based on a company's specific credit risk appetite.

Crediflow AI strives to revolutionize credit analysis and assessment with its end-to-end automated solutions designed to empower financial institutions by leveraging advanced AI technologies tailored for streamlined and efficient credit operations.

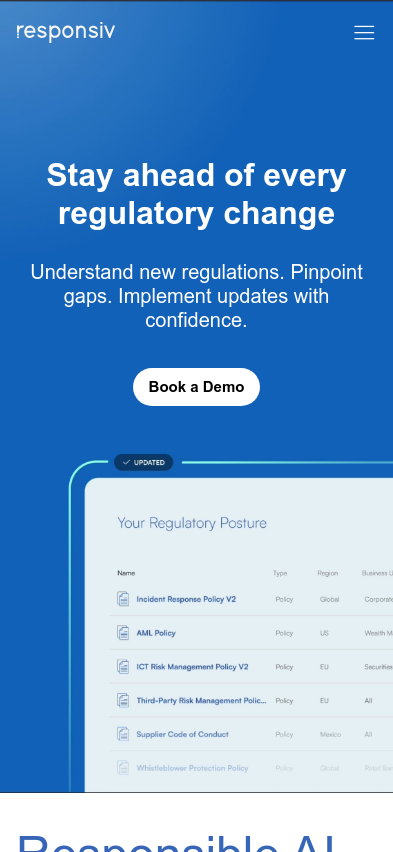

Responsiv

Provides AI assistants for in-house legal teams, focusing on contract execution and generalist legal knowledge support.

Responsiv AI Overview

1. Key Focus Area:

Responsiv AI specializes in compliance automation using artificial intelligence. Their primary platform is geared toward enabling businesses to stay ahead of regulatory changes in various industries such as finance, health, and tech. They provide tools that help organizations keep track of legal and regulatory requirements, pinpoint compliance gaps, and implement updates efficiently.

2. Unique Value Proposition and Strategic Advantage:

-

Tailored AI Models: Responsiv offers customized AI solutions that deliver precise, industry-specific information, accommodating sectors like finance, health, and tech. This specificity helps organizations better manage compliance risks pertinent to their industry.

-

Data Security and Privacy: The company emphasizes full data privacy by ensuring customer data remains exclusively theirs, never leveraging it for AI training. They utilize de-identification techniques to remove sensitive information from documents while performing sophisticated analyses, maintaining a high level of security.

-

Effortless Compliance Management: Responsiv stands out with its capability to suggest policy changes and draft new versions, assisting businesses to remain consistent with evolving regulations efficiently.

3. Delivery on Value Proposition:

Responsiv delivers its value proposition through a streamlined four-step process integrated within its AI-powered platform:

-

Analyzing Regulatory Issues: Users can pose any legal or compliance questions using natural language to receive actionable insights backed by authoritative sources.

-

Gap Analysis: The platform identifies necessary regulatory updates in organizational documents to ensure compliance is maintained throughout the organization.

-

Implementation of Updates: The system provides AI-driven suggestions for updates tailored to the specific operational context and risks of the business, ensuring that document revisions align with the latest legal frameworks.

-

Documentation Centralization: All updates are stored in a secure and centralized repository. This allows each business unit to access the most current versions, ensuring regulatory compliance across different jurisdictions.

Additional Features:

-

Regulatory Database: Responsiv offers a comprehensive regulatory database mapped to business needs, providing access to primary and secondary legal sources.

-

Centralized Repository and Audit Process: The platform ensures a centralized library for all legal and compliance documentation, supported by an integrated audit process to catch any regulatory oversights.

-

Interactive Tool Development: Plans include the launch of an interactive document drafter and editor, improving efficiency in creating, editing, and aligning documents with regulatory requirements.

Company Values and Culture

Responsiv AI embraces a culture focused on efficiency and accountability, with values such as speed over perfection, extreme ownership, and impactful work. They champion resourcefulness and advocate for innovation within their team to continuously enhance their service offerings.

Conclusion

In summary, Responsiv AI provides AI-driven compliance solutions tailored to industry-specific needs with a strong emphasis on security and efficiency. Their unique approach to automating compliance processes offers significant benefits in operational efficiency and cost reduction, positioning them strategically in the legal tech landscape.

Docenty.ai

Offers a SaaS to auto-generate AI chatbots for websites.

Docenty operates in the realm of AI solutions with a primary focus on delivering industry-specific business automation. Their aim is to enhance operational efficiency and productivity by providing AI technologies that are tailored to the needs of specific sectors like construction, e-commerce, finance, and law. Docenty capitalizes on its wealth of experience acquired through strategic collaborations with both SMEs and large enterprises, as well as government institutions.

Unique Value Proposition and Strategic Advantage

-

Customizable AI Solutions: Docenty's core strength lies in its ability to customize AI solutions to meet the needs of specific industries. Through leveraging proprietary data processing technology, they can transform internal data into effective solutions for document automation, data search, and processing.

-

Integration and Convenience: The company offers one-click chatbots for ease and enterprise-grade chatbots for performance, making implementation quick and seamless. This adaptability ensures that businesses of varying sizes and sectors can find a suitable AI solution aligned with their needs.

-

Data Utilization: With the ability to process large language models (LLMs) and proprietary data effectively, Docenty enables organizations to harness their own data more efficiently, creating bespoke solutions that leverage historical data.

Delivery on Value Proposition

-

Diverse AI Offerings: Docenty provides an array of AI services. This includes e-commerce AI solutions with features such as real-time shipping updates, automated customer service responses on order-related inquiries, personalized product recommendations, and management of undelivered items. Additionally, they utilize YouTube and Instagram Reels’ subtitle data to integrate social media insights into customer interactions.

-

Platform Integration: Their solutions integrate with prevalent communication platforms such as Cafe24, Kakao, and Naver, simplifying interactions through automated AI responses in business channels, enhancing customer engagement efficiency.

-

Task Automation: Internally, Docenty AI supports enterprise document management by sorting, tagging, and creating downloadable documents. This task automation extends into creating natural sentence responses and report generation, improving productivity within organizations.

-

Flexible Pricing Models: Offering varied pricing plans, ranging from basic to enterprise solutions, Docenty ensures that their product is accessible to diverse business needs. The basic plans are designed for affordability, while the enterprise plans focus on customization and advanced consulting, including AI expert teams for bespoke solution creation.

Docenty promotes its AI solutions as cost-reducing and innovative, encouraging businesses to trial their services with a 14-day free event. They present themselves as a bridge for enterprises looking to maximize efficiency and productivity through tailored AI-enabled automation, striving to stay at the forefront by actively participating in tech exhibitions like CES 2025.

Senso

Toronto-based FinTech startup building an AI-powered knowledge base for customer support, marketing, and sales teams.

Senso.ai Overview

1) Key Focus Area: Senso.ai focuses on improving operational efficiency, member experience, and data-driven decision-making for the financial services and credit union sector. Their platform leverages artificial intelligence (AI) to streamline processes such as document retrieval, member interactions, and workflow management.

2) Unique Value Proposition and Strategic Advantage: Senso distinguishes itself by providing AI-enabled solutions tailored to the specific needs of credit unions:

- Generative AI Collaboration: Through their CUCopilot Network, Senso facilitates a collaborative environment where credit unions can share insights and standardize practices, resulting in enhanced operational efficiencies.

- AI-Driven Knowledge Engine: The platform transforms unstructured data into actionable insights, helping organizations refine strategies, improve member experiences, and streamline operations.

- Endorsement by Notable Entities: Their partnership with Filene Research Institute and integration with CU 2.0 creates a framework for industry-wide learning and innovation.

3) Delivery on their Value Proposition: Senso employs several strategies and tools to deliver on its promise of improving efficiency and efficacy for credit unions:

- AI-Powered Agents like Agent Echo and Agent Fetch:

- Agent Echo automates call tagging and utilizes AI to improve conversation outcomes for call centers and voice agents.

- Agent Fetch helps identify content gaps within organizational documents, enhancing the quality of responses and processing efficiency.

- CUCopilot Network:

- Provides a platform for credit unions to collaborate on AI-driven initiatives.

- Facilitates real-time updates and uniformity across credit unions, enhancing the flow of industry knowledge.

- Offers continuous learning and shared best practices among credit union members.

- Focus on Practical Execution:

- Senso emphasizes "real-world application" of AI strategies, assisting credit unions in implementing AI initiatives practically rather than theoretically.

- The platform's design reduces member wait times and call volumes by streamlining procedural documentation and service interactions.

Conclusion: Senso.ai’s core strategy is to harness AI technology to create a more intuitive and efficient operating environment for credit unions. Their unique position lies in blending cutting-edge AI functionalities with a collaborative framework that enables industry-wide transformation in operational efficiencies, member engagement, and resource management. Through its platform, Senso supports credit unions in transitioning to AI-centric operating models, thereby future-proofing their operations and aligning them with modern technological advances.

Insight AI

Insight AI is a fintech company offering AI-powered solutions like AI underwriting and cash flow forecasting to enhance financial decision-making.

-

Key Focus Area: Insight AI concentrates on the development and deployment of AI-driven solutions, specifically focusing on AI chatbots and automation for businesses. Their services cater to organizations looking to incorporate artificial intelligence into their processes to enhance efficiency, streamline operations, and provide data-driven insights.

-

Unique Value Proposition and Strategic Advantage: Insight AI leverages custom AI chatbots and automated workflows adapted to a company's specific informational context. The strategic advantage is their methodology of using organization-specific data, enabling seamless integration into existing business operations. This tailored approach allows businesses to optimize internal processes by providing precise interactions and automations grounded in their proprietary data.

- Customization and Specificity: Insight AI’s leverage of company-specific training ensures solutions align closely with existing data systems, such as internal wiki pages and document repositories.

- Privacy and Security: Through data cleansing processes, they ensure sensitive information is protected, bolstering client trust in AI implementations.

- No-Code and Low-Code Solution Flexibility: By using platforms like Stack-AI, RelevanceAI, and Python, they accommodate both rapid development needs and the customization depth for complex tasks.

-

Delivering on Their Value Proposition: Insight AI implements its value proposition through several key methods and technological strategies:

-

AI Chatbots: Custom chatbots facilitate employee and customer interactions, drawing from a company’s specific data to provide prompt replies. This is critical in industries where quick and factual responses are necessary for operations or customer service improvements.

-

Automation Pipelines: Businesses can automate routine tasks, such as report generations and test evaluations, thus reducing manual labor and human error. For instance, automated reporting processes use pre-defined templates and sequential prompts to generate detailed reports.

-

AI Knowledge Bots and Tools: For example, tools are created for use in specialized sectors such as ERP providers and financial consulting, ensuring the AI is relevant and valuable to a company's unique needs.

-

Advanced Technology Stack: Utilizing advanced large language models (LLMs) like GPT-4o and GPT-4 Turbo, Insight AI is able to ensure robust and scalable AI solutions that are adaptable to various business scenarios.

-

In sum, Insight AI's approach combines the harnessing of custom AI technologies with an emphasis on practical applicability, privacy, and technology integration. They strive to enable businesses to better utilize their proprietary data, enhancing productivity and decision-making processes across different verticals.

Abacus.AI

Abacus.AI enables businesses to implement AI without needing expert developers by offering pre-trained models for tasks like customer service and forecasting. Abacus.AI offers pre-trained models for business tasks like customer service, simplifying AI implementation without expert developers.

News | About | About | About | About | About | About | About | About | About | About | About | About | About | Vision/Values | About | Vision/Values | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About | About

-

Company's Key Focus Area: Abacus.AI is primarily focused on providing AI-driven solutions tailored for both individual professionals and large enterprises. Their main goal is to automate and enhance business processes through the use of AI technology. This includes a broad range of applications, such as predictive modeling, personalization, anomaly detection, and AI-based decision-making tools. They offer platforms and tools to build AI agents and chatbots, optimize resources through discrete optimization, and utilize vision AI for modeling tasks.

-

Unique Value Proposition and Strategic Advantage: Abacus.AI positions itself as an AI super-assistant that leverages generative AI technology to automate various business processes. Their strategic edge lies in their state-of-the-art AI capabilities, including structured machine learning, vision AI, and personalized solutions, along with a commitment to open-source generative AI models. They claim that their AI systems can enhance productivity and efficiency by automating complex tasks and reducing human intervention.

-

Delivery on Their Value Proposition: To deliver on its value proposition, Abacus.AI employs:

-

AI Super Assistants: Tools like ChatLLM and CodeLLM are designed to integrate AI capabilities across platforms, providing services like web search, image generation, and code editing.

-

Comprehensive AI Platform: For larger organizations, they offer a platform capable of building enterprise-scale AI systems, using AI to create and manage other AI agents and processes. This platform aims to automate tasks such as fraud detection, contract analysis, and personalized marketing.

-

Structured ML and Predictive Modeling: Abacus.AI provides tools to create machine learning models tailored to specific data inputs, ensuring accurate business predictions and process optimizations.

-

Vision AI and Optimization: These services offer advanced solutions for image analysis and optimizing business processes under given constraints, aimed at reducing costs and increasing efficiency.

-

Integration and Customization: The company offers integration with existing data systems, allowing for customization and personalized setups that fit specific business needs and enable contextual AI interactions.

-

Consultation and Support: They provide consultations to help enterprises tailor the AI solutions to their specific requirements and offer support throughout the implementation process.

-

Overall, their approach focuses on using cutting-edge AI models and deep learning techniques to build custom solutions that improve business process efficiency and decision-making.

zypl.ai

zypl.ai provides GenAI SaaS to optimize risk management with macro-resilient zGAN for the financial sector.

Executive Summary of Zypl.ai

-

Key Focus Area: Zypl.ai is concentrated on pioneering innovations in synthetic data generation and artificial intelligence to optimize credit scoring. Their mission encompasses the advancement of AI technologies within the financial sector, particularly concerning credit scoring and lending models. The firm targets regions with emerging economies, focusing on improving credit availability and financial inclusivity through smarter, AI-driven solutions.

-

Unique Value Proposition and Strategic Advantage: The company offers a unique value proposition through its proprietary AI tools that leverage synthetic data to complement traditional credit scoring models. This approach allows financial institutions to account for outlier conditions, often not captured in typical lending evaluations. The strategic advantage lies in their ability to provide adaptive and convincing credit scoring solutions that can be customized to varying levels of risk appetite. By utilizing machine learning techniques to handle ‘black swan’ events, they enhance the stability and resilience of financial institutions’ credit portfolios.

-

Delivery on Value Proposition:

-

Generative AI Software (Zypl.score): The flagship product is ‘zypl.score,’ a software offering AI-as-a-service capabilities that support banks and financial institutions in adopting a macro-resilient decision-making framework. By using synthetic data-driven AI algorithms, zypl.score helps in providing a more robust credit evaluation process that is privacy-secure and customizable.

-

Partnerships: Zypl.ai collaborates with over 35 banks across 12 markets, which includes leading financial institutions in Eurasia, MENA, and Southeast Asia, effectively demonstrating the product's applicability and scalability across different geographies.

-

Strategic Collaborations: They maintain significant partnerships with global entities and leverage influential networks which enable the firm to access cutting-edge resources and insights. The collaboration with institutions like Commercial Bank International further solidifies its credibility in fintech innovation.

-

Market Expansion: Beyond its origins, zypl.ai has embraced a broad geographical expansion strategy, often highlighted by their move from a Tajik startup to establishing headquarters in Dubai’s International Financial Center and participating in international accelerators such as Hub71 and the Silkway Accelerator.

-

Technological and Market Innovation: Besides credit scoring, the company is venturing into underwriting insurance models and exploring other finance-related AI applications, thus broadening its impact and adaptation of its AI tools.

Zypl.ai’s strategic focus and technological advancements align with their ambition to be the first unicorn from Central Asia and their commitment to transforming the regional financial landscape. This is supported by their continual drive for innovation in AI-driven financial services.

nSure.ai

nSure.ai provides customers with their own AI/Machine learning model that specializes in combating fraud for high-risk digital transactions.

nSure.ai Summary

Key Focus Area: nSure.ai specializes in delivering payment fraud prevention solutions targeted at industries such as Crypto, Gaming, Prepaid, and Gift Cards. Their main objective is to mitigate the risk associated with digital transactions by employing sophisticated AI technology. They aim to ensure high transaction approval rates while assuming full liability for fraud-related chargebacks, positioning themselves as a zero-risk partner in the digital payments ecosystem.

Unique Value Proposition and Strategic Advantage: nSure.ai's unique value proposition centers around utilizing Adaptive AI technology to deliver highly accurate fraud prevention solutions specifically customized for each client. They stand out by guaranteeing high approval rates—up to 98%—and taking full liability for fraud- and service-related chargebacks. This approach significantly reduces the risk for businesses while increasing the profitability of digital transactions, thus making payment fraud a potential profit center rather than just a cost or risk.

Strategic Advantages Include:

- Adaptive AI and Custom Models: nSure.ai develops a dedicated model for each client, trained on their specific data. This individualized approach allows for superior accuracy in the detection and prevention of fraudulent activities.

- Rapid and Real-time Decision-Making: Their system processes fraud decisions in under 500 milliseconds, enabling quick approvals and fewer interruptions to the purchasing process.

- Liability Assumption: The company not only protects businesses from fraud but also shoulders the financial liability tied to chargebacks, positioning it as a valuable partner for online merchants.

Delivery on Value Proposition: nSure.ai operationalizes its value proposition through several robust processes and technologies:

- Adaptive AI: By tailoring fraud prevention models to each customer's data and transaction patterns, nSure.ai ensures a high level of accuracy and efficiency in rejecting fraudulent attempts while approving legitimate transactions without delay.

- SoftApproval® and StingBack® Protocols: These mechanisms differentiate between suspicious and genuine customer transactions, using a behavioral approach to further test flagged transactions. StingBack® deceives fraudsters into believing their transaction was successful, thus disrupting fraudulent operations without affecting legitimate customers.

- Minimized Verification Processes: The company recommends reducing unnecessary KYC procedures, which are often mistaken for anti-fraud measures, to lower false-positive decline rates and improve customer acquisition and retention.

- Comprehensive Support and Integration: Clients benefit from seamless integration experiences with nSure.ai's infrastructure and dedicated support, ensuring their system is quickly adapted and operational within their existing tech environments. The company offers specialized guidance to enhance fraud strategies tailored to each segment of a client's business.

In conclusion, nSure.ai positions itself as a strategic partner in digital payment sectors, mitigating risks while enhancing profitability through adaptive and tailored fraud prevention solutions.

Sherpa.ai

Sherpa is a predictive and conversational AI digital assistant for consumer products.

Sherpa.ai focuses on advancing Privacy-Preserving Artificial Intelligence (AI). Their platform is designed to facilitate the development and deployment of AI applications across various industries while maintaining stringent privacy and compliance standards.

Key Focus Area: The company's central theme is the creation and implementation of privacy-preserving AI solutions. It serves diverse sectors, including financial services, healthcare, life sciences, Industry 4.0, and internal data collaboration, by allowing organizations to harness the power of AI without compromising data privacy.

Unique Value Proposition and Strategic Advantage: Sherpa.ai’s unique offering lies in its Federated Learning (FL) platform. The platform enables collaborative AI model training while ensuring that data never leaves the owner's environment. This capability addresses significant pain points in data-driven initiatives, such as privacy concerns and regulatory obstacles. Their approach ensures that organizations can gain insights and make decisions using distributed datasets without the need for data sharing. This is particularly advantageous in heavily regulated sectors such as healthcare and financial services, where the privacy of sensitive information is paramount. Sherpa.ai is recognized for integrating Privacy Enhancing Technologies (PETs), which adds a two-layer system emphasizing data security and regulatory compliance.

How They Deliver on Their Value Proposition:

- Federated Learning Platform: Sherpa.ai’s platform is designed to be easily deployable, adaptable to a range of AI models and tuneable with data from multiple sources while maintaining privacy standards.

- Compliance with Regulations: The platform ensures compliance with global and regional data protection regulations such as GDPR and HIPAA, reducing the risk of data breaches and associated penalties.

- Plug-and-Play Deployment: Designed for rapid deployment, the platform allows businesses to connect their data sources, select models, and begin training without delay, thereby accelerating time-to-value.

- Seamless Integration: The platform’s flexible architecture integrates with various data lakes and frameworks like TensorFlow and Keras, allowing organizations to leverage their existing data infrastructure.

- Privacy and Security Features: Through its implementation of Federated Learning, differential privacy, and cryptographic measures like Secure Multi-party Computation and Homomorphic Encryption, Sherpa.ai provides a secure data collaboration environment. The data remains within its original environment while aggregated model updates are shared securely.

- Collaborative Ecosystem: Sherpa.ai collaborates with major industry players such as KPMG and Telefónica to extend the benefits of federated learning, enabling organizations to optimize business outcomes through shared innovation without data exchange.

Through these mechanisms, Sherpa.ai positions itself as a strategic partner for businesses looking to integrate AI into their operations while safeguarding their informational assets. This approach not only alleviates privacy concerns but also capitalizes on the rapidly expanding capabilities of AI, fostering an environment for cross-organizational partnerships and innovation.

Datrics

Datrics offers AI-driven credit scoring solutions that enhance risk assessments and lending decisions through accurate predictions, reduced bias, and customized data science applications.

Datrics offers an AI-driven analytics platform designed to enhance business operations through advanced data processing, artificial intelligence (AI) analytics, and automation solutions. Here’s an overview of the key features and offerings based on the information provided:

Platform Features:

- Full Stack Data Processing: The platform allows users to manage data from ingestion to insight delivery, featuring an intelligent data ingestion engine and automated data processing workflows.

- No-Code Visual Interface: Enables users to prepare data, create models, and analyze information without requiring coding skills, making analytics accessible to business users.

- AI Analyst: Offers a natural language interface that provides instant analysis by engaging users in conversational interactions. This can be embedded into existing workflows to provide continuous insights.

Use Cases and Benefits:

- Customized Solutions: The platform tailors AI and machine learning (ML) models to meet specific business needs across various sectors including software development, recruitment, sales and marketing, and financial services.

- Recruitment & HR: Improves hiring processes by 25% using AI for candidate matching to enhance hiring speed and success prediction.

- Sales & Marketing: Provides tools for real-time pipeline analysis, pricing optimization, lead scoring, and customer behavior analysis.

- Financial Services: Features automated financial analysis, real-time risk assessment, and compliance monitoring.

Security & Compliance:

- The platform employs strong encryption protocols (TLS 1.2+ and AES-256) to protect sensitive data during transmission and storage.

- It supports role-based access controls (RBAC) along with multi-factor authentication (MFA) to ensure secure access management.

- On-premise installation options are available, enabling enterprises to integrate within their own data infrastructure to meet compliance and privacy standards.

Success Stories:

- Bear Claw's BC-Agent: By integrating Datrics' AI, Bear Claw enhanced its recruitment platform, resulting in faster hiring and match accuracy.

- European Financial Institution: Datrics assisted in transforming business intelligence, enabling better strategic decisions through comprehensive and integrated analytics solutions.

Updates & Innovations:

- Continuous improvements and updates, including features like enhanced data pipeline safety and Excel automation, provide users with up-to-date tools and capabilities.

Technology and Accessibility:

- Rapid Deployment: The platform claims to achieve a 40% ROI within the first 6 months by optimizing processes.

- Innovation in User Interfaces: The deployment of chat-based interfaces and no-code data mining tools aims to reduce the dependence on data teams.

Company Vision:

- Datrics aims to democratize data analytics and empower business users by simplifying complex data processing tasks. It combines industry expertise with cutting-edge software development to deliver data-driven solutions that support improved decision-making across businesses.

In summary, Datrics provides a robust AI-driven platform that supports data processing, analysis, and integration, enabling businesses to leverage technology to streamline their operations and enhance decision-making processes with an emphasis on security and ease of use.